needed

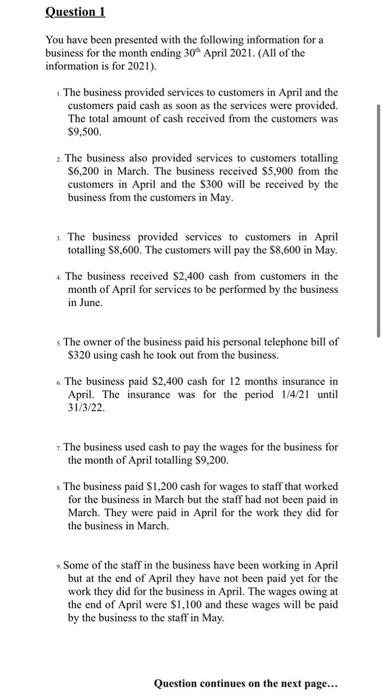

Question 1 You have been presented with the following information for a business for the month ending 30 April 2021. (All of the information is for 2021). The business provided services to customers in April and the customers paid cash as soon as the services were provided. The total amount of cash received from the customers was $9,500 The business also provided services to customers totalling $6,200 in March. The business received $5,900 from the customers in April and the $300 will be received by the business from the customers in May. The business provided services to customers in April totalling 88,600. The customers will pay the $8,600 in May. The business received $2,400 cash from customers in the month of April for services to be performed by the business in June. * The owner of the business paid his personal telephone bill of $320 using cash he took out from the business. The business paid $2,400 cash for 12 months insurance in April. The insurance was for the period 1/4/21 until 31/3/22 The business used cash to pay the wages for the business for the month of April totalling $9.200. The business paid $1,200 cash for wages to staff that worked for the business in March but the staff had not been paid in March. They were paid in April for the work they did for the business in March. Some of the staff in the business have been working in April but at the end of April they have not been paid yet for the work they did for the business in April. The wages owing at the end of April were $1,100 and these wages will be paid by the business to the staff in May. Question continues on the next page... The electricity expense for the business for the month of April was $600. The $600 was paid using cash by the business in the month of April. 1. The bill for the water used by the business for the month of April was $380. The bill will not be paid by the business until May. 12. The telephone bill for the business for March was still owing at the start of April and was paid in April. The telephone bill was $280. 1x The business has a long-term loan with the bank of S20,000. The interest owing on the loan for the month of April was $70. The interest owing for the loan has not been paid by the business yet. # The business paid $1.200 for 4 months rent on the 1" of April. The rent was for the period 1" April - 31 July is the business purchased supplies to be used by the business. The business paid $700 cash for the supplies. At the end of April, the business checked how much supplies were still not used. At the end of April, S90 of the supplies had not been used and would be used in May. The rest of the supplies had been used in April. The business has $7,500 cash in the bank. The cash has earned interest income of $30 for the month of April . The $30 has been received by the business from the bank in the month of April. 17. The total depreciation of the assets used by the business during the month of April was $2.400. General expenses for the business for the month of April were $380 in total and this was paid by the business using cash in April. Required: Prepare an income statement for the month of April using the information from above. Please make sure that your income statement has a title and shows that it is for one month ending 30/4/21. Please go to the next page to prepare the income statement. YOU ARE NOT REQUIRED TO DO ANY JOURNAL ENTRIES IN YOUR