Answered step by step

Verified Expert Solution

Question

1 Approved Answer

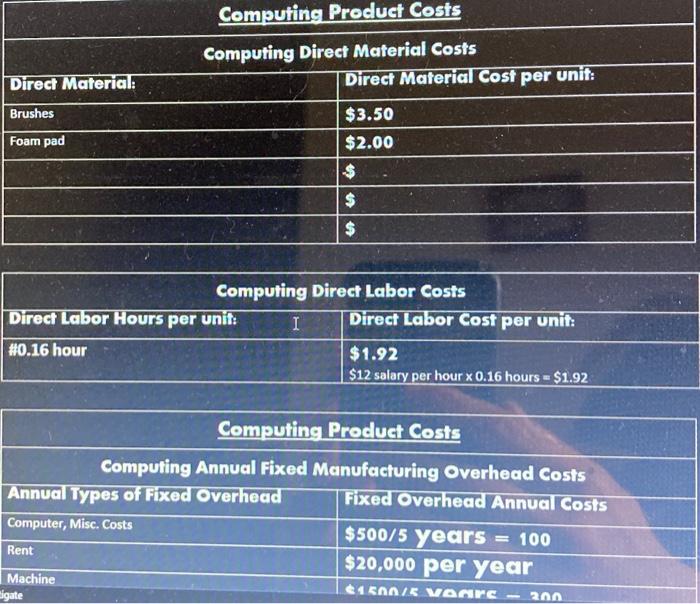

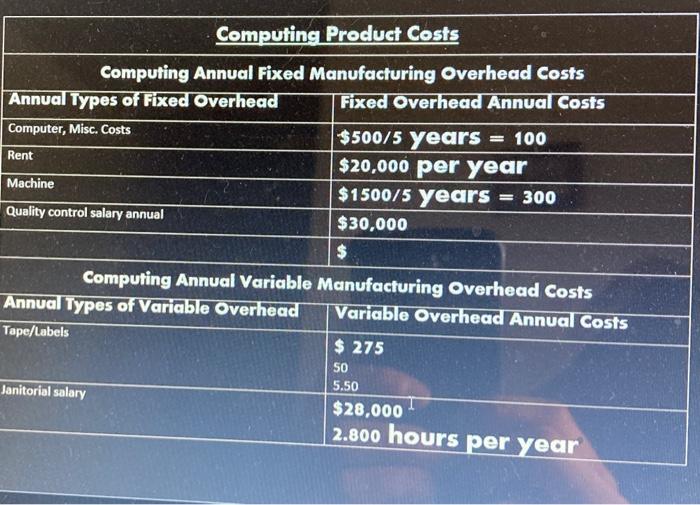

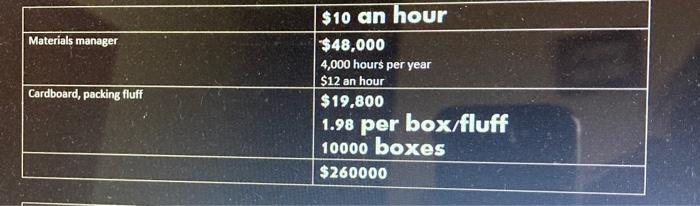

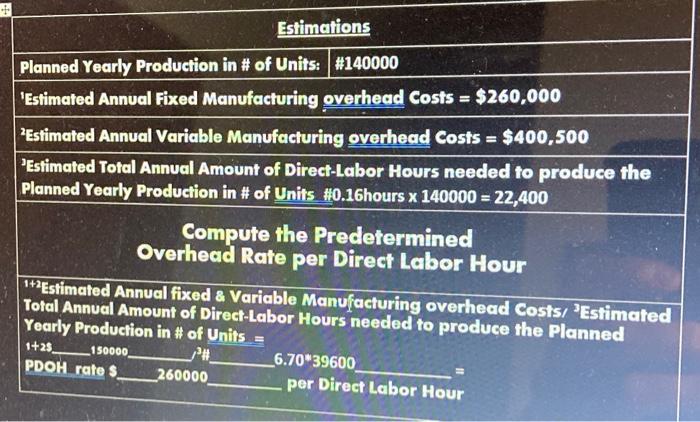

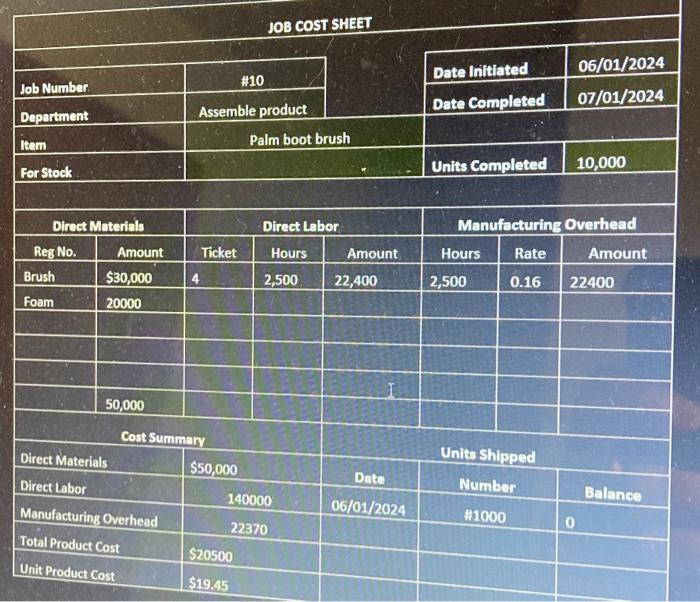

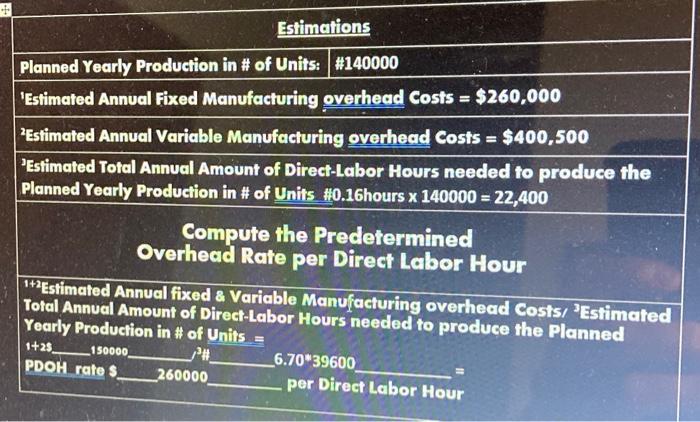

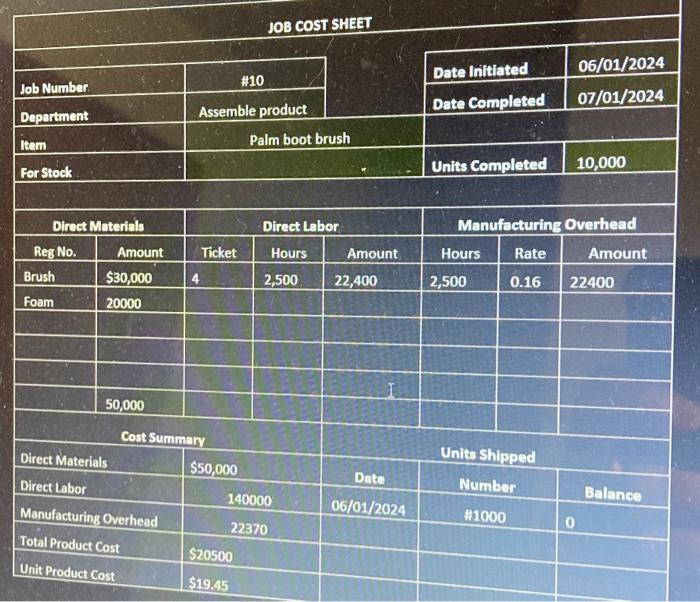

Needing assistance correcting my calculations for this project. first part of calulations. sorry for the long post. thanks for any help. the first few photos,

Needing assistance correcting my calculations for this project.

first part of calulations.

sorry for the long post. thanks for any help.

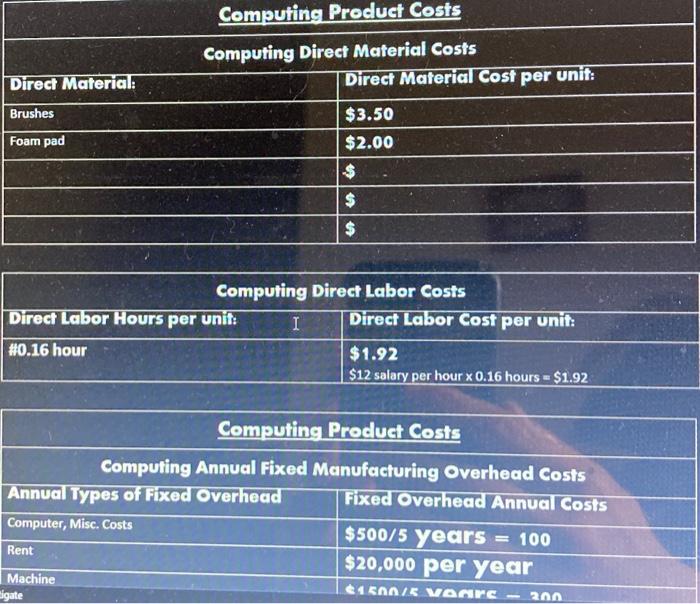

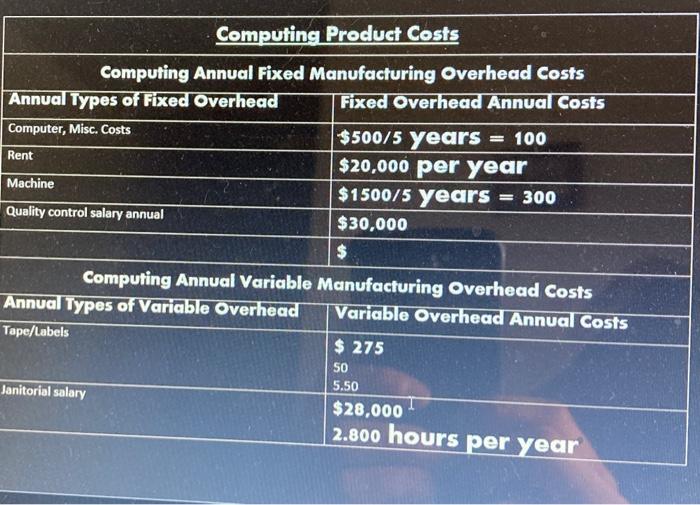

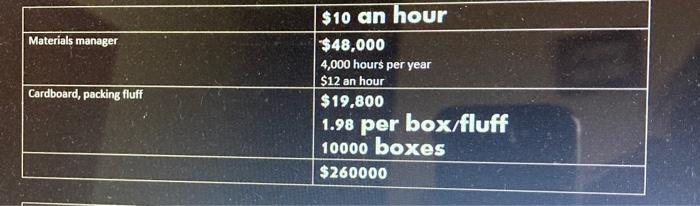

the first few photos, with black background, are my added values, they can be changed or altered as needed. There are no given values, the values come from us for this exercise.

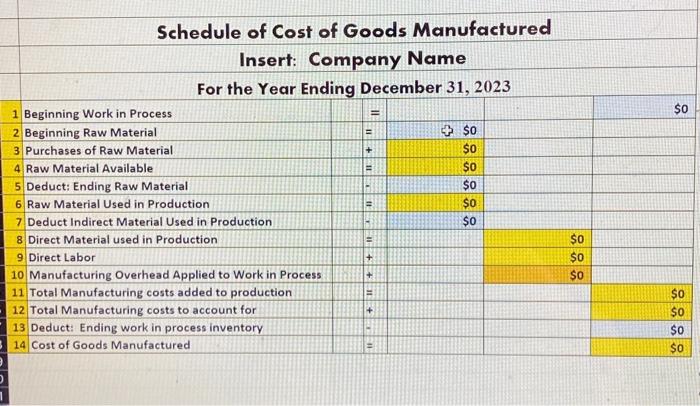

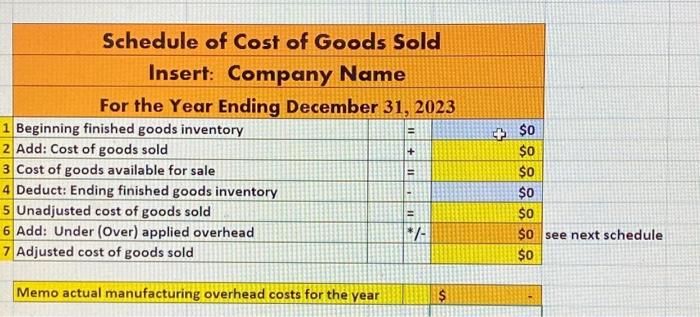

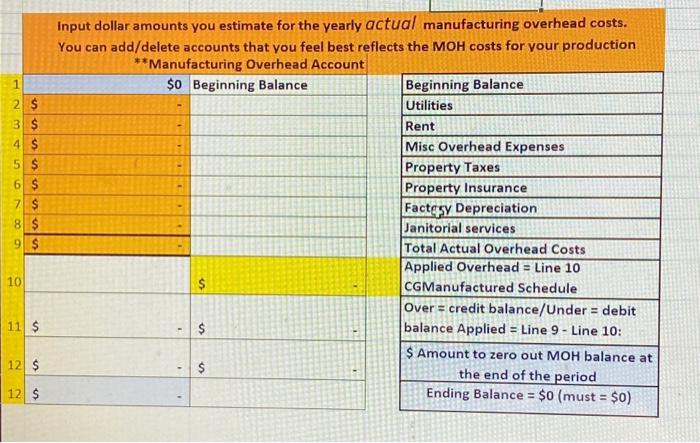

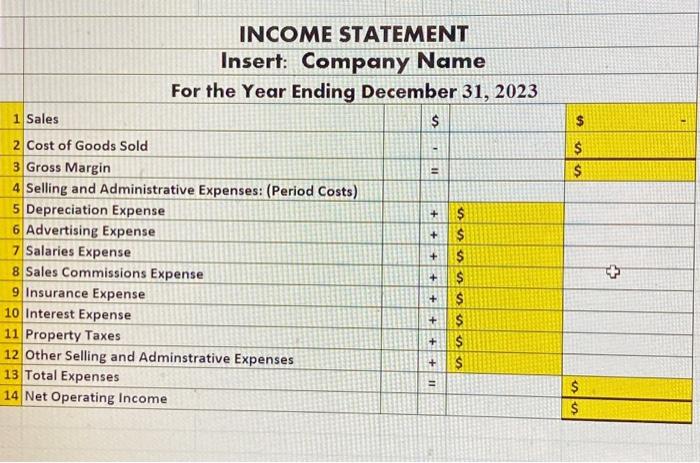

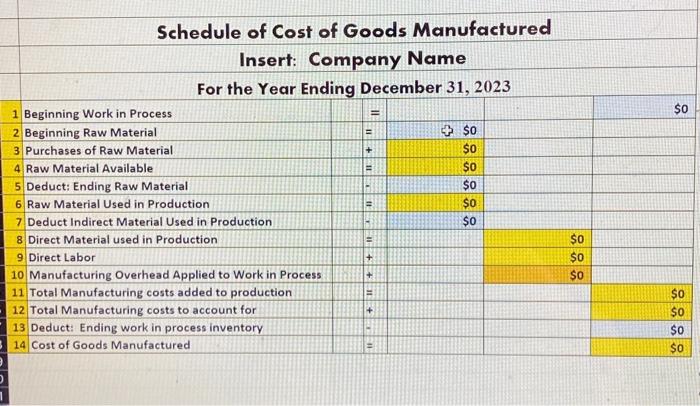

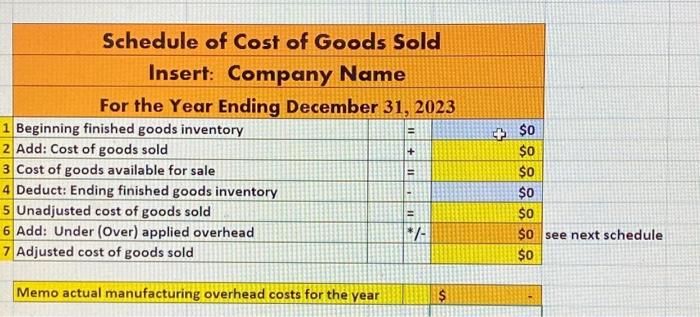

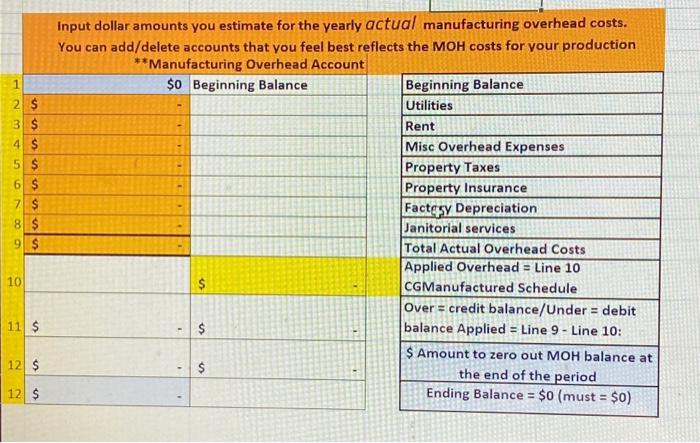

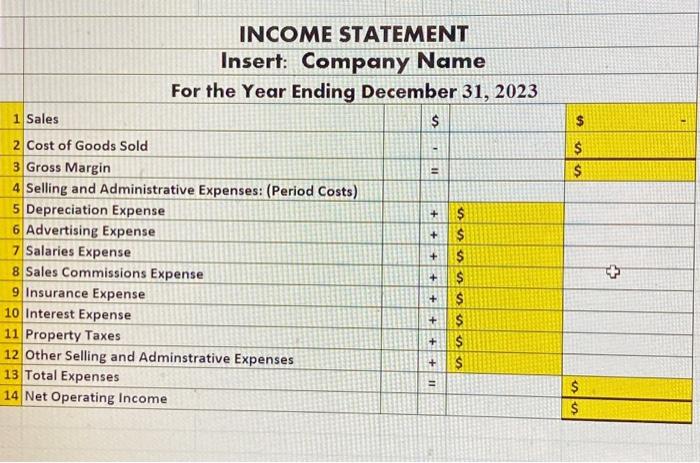

Computing Procluct Costs Computing Direct Material Costs \begin{tabular}{|l|l|} \hline Direct Materich: & Direct Materici cost per unt: \\ \hline Brushes & $3.50 \\ \hline Foam pad & $2.00 \\ \hline & $ \\ \hline & $ \\ \hline & $ \\ \hline \end{tabular} Computing Direct Labor Costs Computing Product Costs Computing Annual Fixed Manufacturing Overhead Costs \begin{tabular}{|l|l|} \hline Annud Types of Fkxed Pverhead & Fixed Overhead Annud Costs \\ \hline Computer, Misc. Costs & $500/5 Yecrs = 100 \\ \hline Rent & $20,000 per Yecr \\ \hline Machine & Esenn/e wanre - \\ \hline \end{tabular} Computing Product Costs Computing Annual Fixed Manufacturing Overhead Costs \begin{tabular}{|l|l|} \hline & $10cm hour \\ \hline Materials manager & $48,000 \\ & 4,000 hours per year \\ & $12 an hour \\ \hline Cardboard, packing fluff & $19,800 \\ & 1.98 per box/fluf \\ & 10000 boxes \\ \hline & $260000 \\ \hline \end{tabular} Estimations Planned Yearly Production in \# of Units: #140000 VEstimated Annual Fixed Manufacturing overhead Costs =$260,000 'Estimated Annual Variable Manufacturing overhead Costs =$400,500 'Estimated Total Annual Amount of Direct-Labor Hours needed to produce the Planned Yearly Production in \# of Units \#0.16hours 140000=22,400 Compute the Predetermined Overhead Rate per Direct Lobor Hour 1+2Estimated Annual fixed \& Variable Manufacturing overhead Costs/ 3 Estimated Total Annual Amount of Direct-Labor Hours needed to produce the Planned Yearly Production in \# of Units = 6.701+39600 PDOH rate 3_260000 6.7039600 per Direct Labor Hour Schedule of Cost of Goods Manufactured Insert: Company Name For the Year Ending December 31, 2023 Schedule of Cost of Goods Sold Insert: Company Name For the Year Ending December 31, 2023 1 Beginning finished goods inventory 2 Add: Cost of goods sold 3 Cost of goods available for sale 4 Deduct: Ending finished goods inventory 5 Unadjusted cost of goods sold 6 Add: Under (Over) applied overhead 7 Adjusted cost of goods sold = + = = *1- see next schedule Memo actual manufacturing overhead costs for the year $ Input dollar amounts you estimate for the yearly actual manufacturing overhead costs. You can add/delete accounts that you feel best reflects the MOH costs for your production INCOME STATEMENT Insert: Company Name For the Year Ending December 31, 2023 \begin{tabular}{|l|r|r|l|} \hline Sales & $ & & \\ \hline 2 Cost of Goods Sold & & & \\ \hline Gross Margin & + & $ & \\ \hline 4 Selling and Administrative Expenses: (Period Costs) & + & \\ \hline 5 Depreciation Expense & +$ & \\ \hline 6 Advertising Expense & +$ & \\ \hline 7 Salaries Expense & + & \\ \hline 8 Sales Commissions Expense & + & \\ \hline 9 Insurance Expense & +$ & \\ \hline 10 Interest Expense & + & $ & \\ \hline 11 Property Taxes & = & $ \\ \hline 12 Other Selling and Adminstrative Expenses & & \\ \hline 13 Total Expenses & & \\ \hline 14 Net Operating Income & & \\ \hline \end{tabular} Computing Procluct Costs Computing Direct Material Costs \begin{tabular}{|l|l|} \hline Direct Materich: & Direct Materici cost per unt: \\ \hline Brushes & $3.50 \\ \hline Foam pad & $2.00 \\ \hline & $ \\ \hline & $ \\ \hline & $ \\ \hline \end{tabular} Computing Direct Labor Costs Computing Product Costs Computing Annual Fixed Manufacturing Overhead Costs \begin{tabular}{|l|l|} \hline Annud Types of Fkxed Pverhead & Fixed Overhead Annud Costs \\ \hline Computer, Misc. Costs & $500/5 Yecrs = 100 \\ \hline Rent & $20,000 per Yecr \\ \hline Machine & Esenn/e wanre - \\ \hline \end{tabular} Computing Product Costs Computing Annual Fixed Manufacturing Overhead Costs \begin{tabular}{|l|l|} \hline & $10cm hour \\ \hline Materials manager & $48,000 \\ & 4,000 hours per year \\ & $12 an hour \\ \hline Cardboard, packing fluff & $19,800 \\ & 1.98 per box/fluf \\ & 10000 boxes \\ \hline & $260000 \\ \hline \end{tabular} Estimations Planned Yearly Production in \# of Units: #140000 VEstimated Annual Fixed Manufacturing overhead Costs =$260,000 'Estimated Annual Variable Manufacturing overhead Costs =$400,500 'Estimated Total Annual Amount of Direct-Labor Hours needed to produce the Planned Yearly Production in \# of Units \#0.16hours 140000=22,400 Compute the Predetermined Overhead Rate per Direct Lobor Hour 1+2Estimated Annual fixed \& Variable Manufacturing overhead Costs/ 3 Estimated Total Annual Amount of Direct-Labor Hours needed to produce the Planned Yearly Production in \# of Units = 6.701+39600 PDOH rate 3_260000 6.7039600 per Direct Labor Hour Schedule of Cost of Goods Manufactured Insert: Company Name For the Year Ending December 31, 2023 Schedule of Cost of Goods Sold Insert: Company Name For the Year Ending December 31, 2023 1 Beginning finished goods inventory 2 Add: Cost of goods sold 3 Cost of goods available for sale 4 Deduct: Ending finished goods inventory 5 Unadjusted cost of goods sold 6 Add: Under (Over) applied overhead 7 Adjusted cost of goods sold = + = = *1- see next schedule Memo actual manufacturing overhead costs for the year $ Input dollar amounts you estimate for the yearly actual manufacturing overhead costs. You can add/delete accounts that you feel best reflects the MOH costs for your production INCOME STATEMENT Insert: Company Name For the Year Ending December 31, 2023 \begin{tabular}{|l|r|r|l|} \hline Sales & $ & & \\ \hline 2 Cost of Goods Sold & & & \\ \hline Gross Margin & + & $ & \\ \hline 4 Selling and Administrative Expenses: (Period Costs) & + & \\ \hline 5 Depreciation Expense & +$ & \\ \hline 6 Advertising Expense & +$ & \\ \hline 7 Salaries Expense & + & \\ \hline 8 Sales Commissions Expense & + & \\ \hline 9 Insurance Expense & +$ & \\ \hline 10 Interest Expense & + & $ & \\ \hline 11 Property Taxes & = & $ \\ \hline 12 Other Selling and Adminstrative Expenses & & \\ \hline 13 Total Expenses & & \\ \hline 14 Net Operating Income & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started