Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Needing problem 3 & 4 please. Problem 3 Your local bank will pay you a rate of 5% on savings account. You view your savings

Needing problem 3 & 4 please.

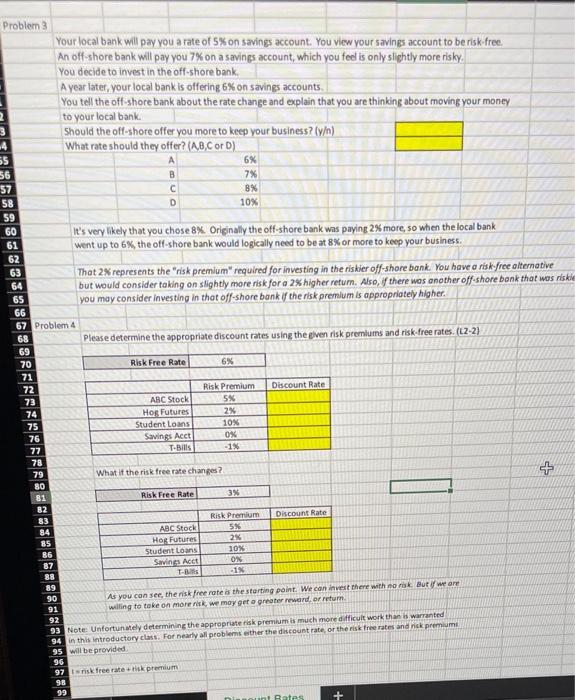

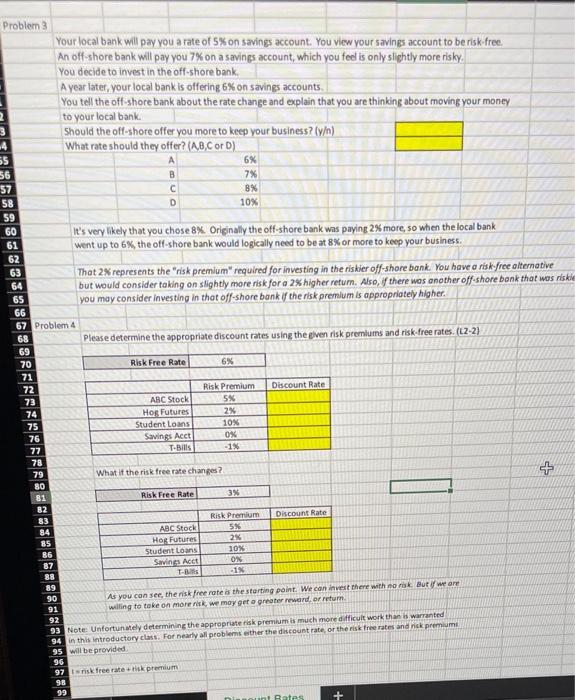

Problem 3 Your local bank will pay you a rate of 5% on savings account. You view your savings account to be risk-free An off-shore bank will pay you 7% on a savings account, which you feel is only slightly more risky You decide to invest in the off-shore bank. A year later, your local bank is offering 6% on savings accounts You tell the off-shore bank about the rate change and explain that you are thinking about moving your money to your local bank. Should the off-shore offer you more to keep your business? [y) .4 What rate should they offer? (A,B,C or D) 55 6% 56 B 7% 57 8% 58 D 10% 59 60 It's very likely that you chose 8% Originally the off-shore bank was paying 2% more, so when the local bank 61 went up to 6% the off-shore bank would logically need to be at 8% or more to keep your business. 62 63 Thot 2% represents the "risk premium" required for investing in the riskier off-shore bank. You have a risk-free alternative 64 but would consider taking on slightly more risk for a 2% higher return. Also, if there was another off-shore bank that was riskie 65 you may consider investing in that off-shore bank if the risk premium is appropriately higher. 66 67 Problem 4 68 Please determine the appropriate discount rates using the given riskpremiums and risk-free rates. (L2-2) 69 70 Risk Free Rate 6% 71 72 Risk Premium 73 ABC Stock 5% 74 Hos Futures 2% 75 Student Loans 10% 76 Savings Acet 0% 77 T-Bills 78 79 What if the risk free rate changes? SO 3% 82 83 Risk Premium Discount Rate 84 ABC Stock 5% 85 Hog Futures 2% 86 Student Loans 10% 87 Savings Act ON -15 38 89 90 As you can see the risk free rate is the starting point. We can invest there with no rok but we are 91 willing to take on more, we may get a greater word or return 92 93 Note: Unfortunately determining the appropriate risk premium is much more difficult work than is warranted 94 in this introductory class. For nearly all problems other the discount rate, or the risk free rates and risk premium 95 will be provided 96 97 tisk free ratek premium 98 99 niunt Rates + Discount Rate - 1% + Risk Free Rate T

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started