Answered step by step

Verified Expert Solution

Question

1 Approved Answer

needs answer to this one Problem 3-1B Preparing adjusting entries (annual) prepaid expenses (14 marks) Camillo's Cleaning Services is gathering information for its year-end, April

needs answer to this one

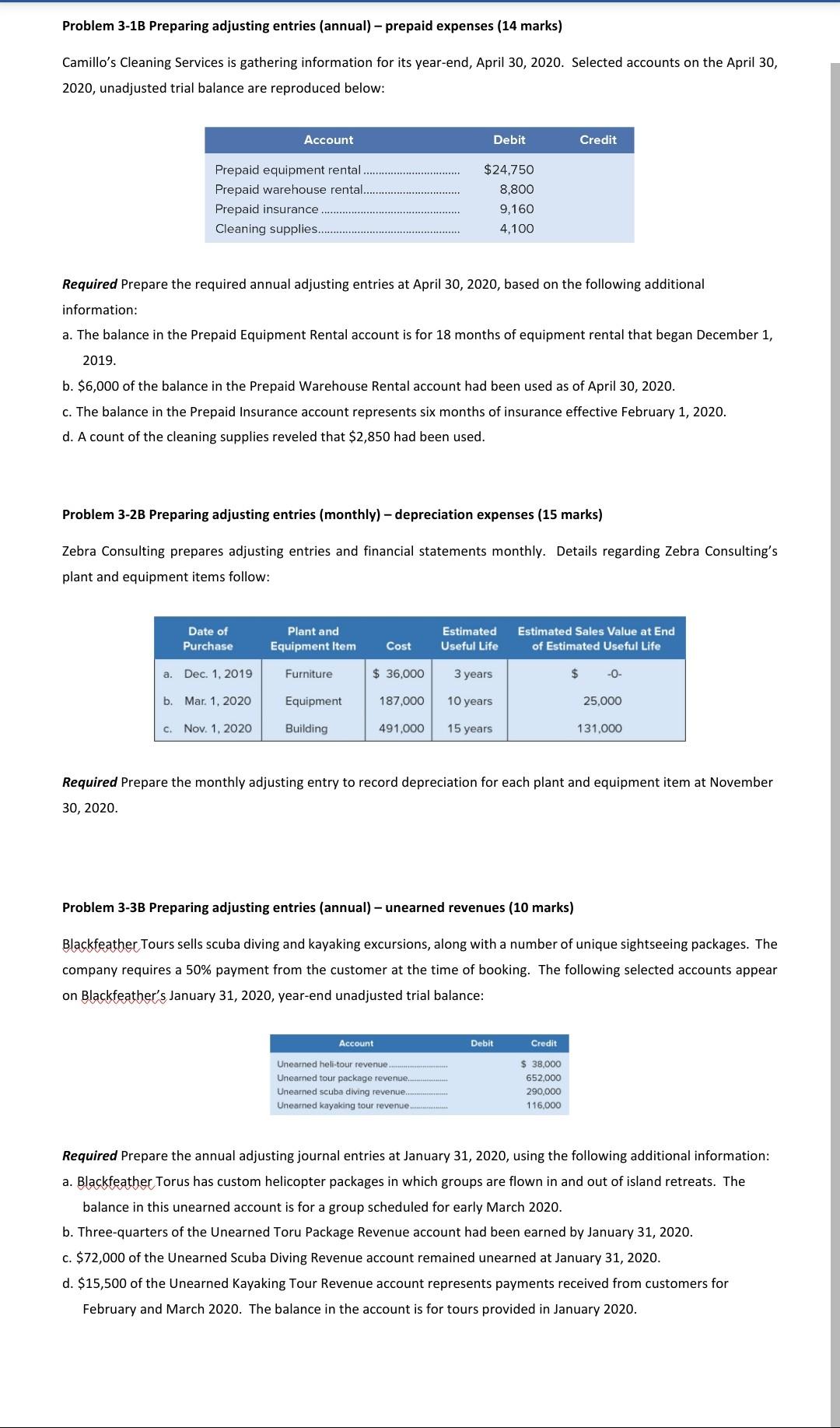

Problem 3-1B Preparing adjusting entries (annual) prepaid expenses (14 marks) Camillo's Cleaning Services is gathering information for its year-end, April 30, 2020. Selected accounts on the April 30, 2020, unadjusted trial balance are reproduced below: Account Debit Credit Prepaid equipment rental. Prepaid warehouse rental. Prepaid insurance Cleaning supplies. $24.750 8,800 9.160 4,100 Required Prepare the required annual adjusting entries at April 30, 2020, based on the following additional information: a. The balance in the Prepaid Equipment Rental account is for 18 months of equipment rental that began December 1, 2019. b. $6,000 of the balance in the Prepaid Warehouse Rental account had been used as of April 30, 2020. c. The balance in the Prepaid Insurance account represents six months of insurance effective February 1, 2020. d. A count of the cleaning supplies reveled that $2,850 had been used. Problem 3-2B Preparing adjusting entries (monthly) - depreciation expenses (15 marks) Zebra Consulting prepares adjusting entries and financial statements monthly. Details regarding Zebra Consulting's plant and equipment items follow: Date of Purchase Plant and Equipment Item Estimated Useful Life Estimated Sales Value at End of Estimated Useful Life Cost a. Dec. 1, 2019 Furniture $ 36,000 3 years -0- b. Mar. 1. 2020 Equipment 187,000 10 years 25,000 Nov. 1, 2020 Building 491,000 15 years 131,000 Required Prepare the monthly adjusting entry to record depreciation for each plant and equipment item at November 30, 2020. Problem 3-3B Preparing adjusting entries (annual) - unearned revenues (10 marks) Blackfeather Tours sells scuba diving and kayaking excursions, along with a number of unique sightseeing packages. The company requires a 50% payment from the customer at the time of booking. The following selected accounts appear on Blackfeather's January 31, 2020, year-end unadjusted trial balance: Account Debit Credit Unearned heli-tour revenue. Unearned tour package revenue Unearned scuba diving revenue. Unearned kayaking tour revenue....... $ 38,000 652,000 290,000 116,000 Required Prepare the annual adjusting journal entries at January 31, 2020, using the following additional information: a. Blackfeather Torus has custom helicopter packages in which groups are flown in and out of island retreats. The balance in this unearned account is for a group scheduled for early March 2020. b. Three-quarters of the Unearned Toru Package Revenue account had been earned by January 31, 2020. c. $72,000 of the Unearned Scuba Diving Revenue account remained unearned at January 31, 2020. d. $15,500 of the Unearned Kayaking Tour Revenue account represents payments received from customers for February and March 2020. The balance in the account is for tours provided in January 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started