Needs to see formulas & calculations

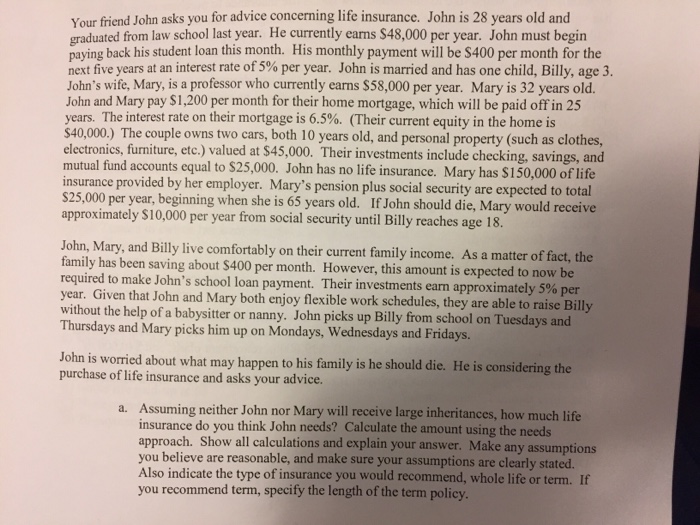

Your friend John asks you for advice concerning life insurance. John is 28 years old and graduated from law school last year. He currently earns $48,000 per year. John must begin paying back his student loan this month. His monthly payment will be $400 per month for the next fiveyears at an interest rate of5% per year. John is married and has one child, Billy, age 3 John's wife, Mary, is a professor who currently earns $58,000 per year. Mary is 32 years old John and Mary pay $1,200 per month for their home mortgage, which will be paid off in 25 years. The interest rate on their mortgage is 6.5% (Their current equity in the home is $40,000.) The couple owns two cars, both 10 years old, and personal property (such as clothes iture, etc.) valued at $45,000. Their investments include checking, savings, and mutual fund accounts equal to S25,000. John has no life insurance. Mary has $150,000 of life insurance provided by her employer. Mary's pension plus social security are expected to total S25,000 per year, beginning when she is 65 years old. If John should die, Mary would receive approximately $10,000 per year from social security until Billy reaches age 18 John, Mary, and Billy live comfortably on their current family income. As a matter of fact, th family has been saving about $400 per month. However, this amount is expected to now b required to make John's school loan payment. Their investments earn approximately 5% per year. Given that John and Mary both enjoy flexible work schedules, they are able to raise Billy without the help of a babysitter or nanny. John picks up Billy from school on Tuesdays and Thursdays and Mary picks him up on Mondays, Wednesdays and Fridays. John is worried about what may happen to his family is he should die. He is considering the purchase of life insurance and asks your advice. Assuming neither John nor Mary will receive large inheritances, how much lif insurance do you think John needs? Calculate the amount using the needs approach. Show all calculations and explain your answer. Make a. any assumptions u believe are reasonable, and make sure your assumptions are clearly stated. Also indicate the type of insurance you would recommend, whole life or term. If you recommend term, specify the length of the term policy