Answered step by step

Verified Expert Solution

Question

1 Approved Answer

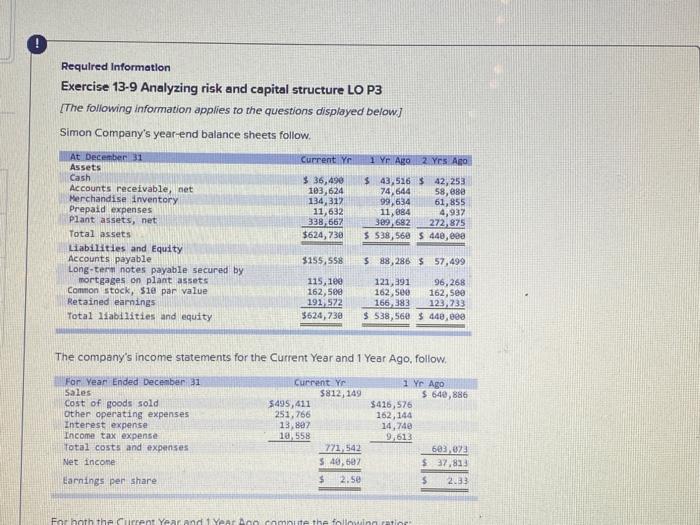

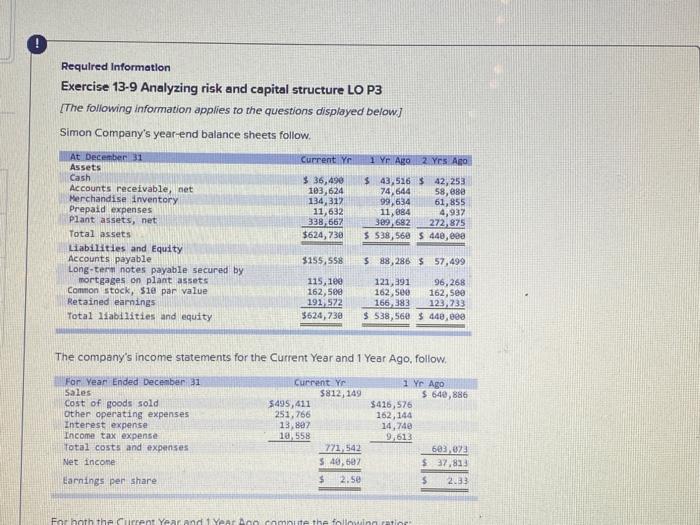

neeeeed Required Information Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below) Simon Company's year end

neeeeed

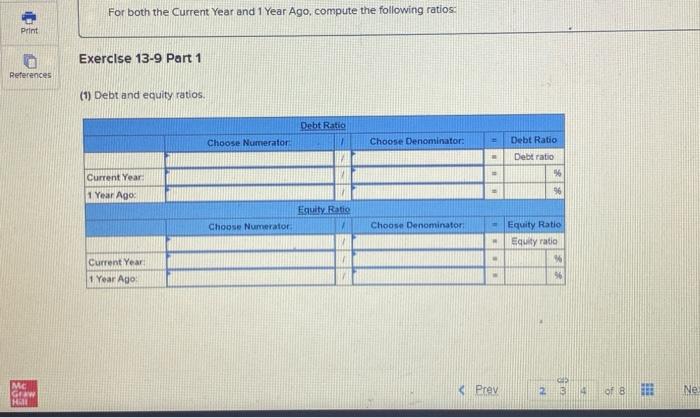

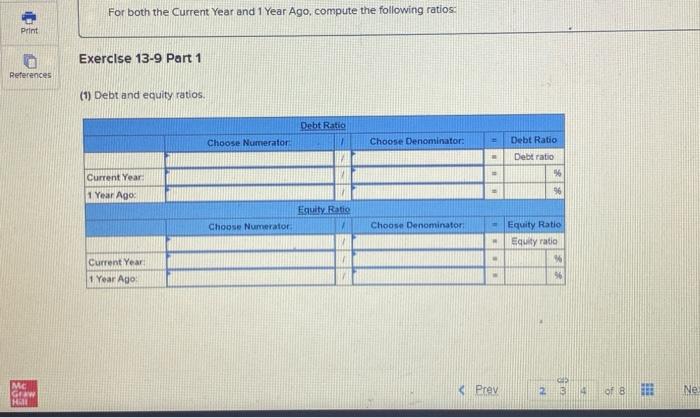

Required Information Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below) Simon Company's year end balance sheets follow Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 36,490 103,624 134, 312 11,632 338,667 $624,730 $ 43,516 $ 42,253 74,644 58,888 99,634 61,855 11,884 4,932 309,682 272 875 $ 538, 568 S 440,000 $155,558 588,286 $ 57,499 115,100 162,500 191 522 5624,738 121,391 96,268 162,500 162,500 166,383 123,233 $ 538,560 $ 440,000 The company's income statements for the current Year and 1 Year Ago, follow, For Year Ended December 31 Sales cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $812,149 5495,411 251,766 13,807 10 558 771, 542 $ 40,60 $ 2.50 1 Yr Ago $ 640,886 $416,576 162,144 14,740 9,61 683,073 $ 37,823 $ 2283 Earnings per share For both the current Year and Ar an camnite the following ration For both the Current Year and 1 Year Ago, compute the following ratios. Print Exercise 13-9 Part 1 References (1) Debt and equity ratios. Debt Ratio Choose Numerator Choose Denominator: Debt Ratio Debt ratio 76 Current Year 1 Year Ago: 96 Equity Ratio Choose Numerator Choose Denominator Equity Ratio Equity ratio Current Year 1 Year Ago 36 IME GEW HO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started