Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Neer Company sells 2,000 units of its product for $500 each. The selling price includes a one-year warranty on parts. It is expected that

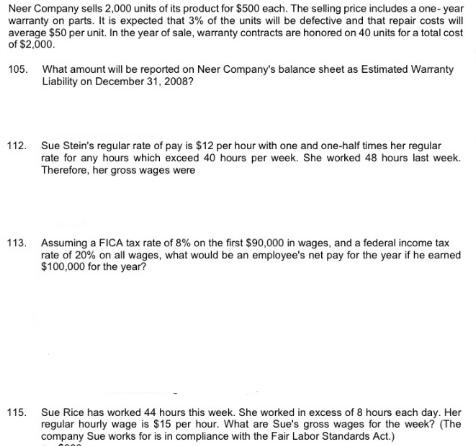

Neer Company sells 2,000 units of its product for $500 each. The selling price includes a one-year warranty on parts. It is expected that 3% of the units will be defective and that repair costs will average $50 per unit. In the year of sale, warranty contracts are honored on 40 units for a total cost of $2,000. 105. What amount will be reported on Neer Company's balance sheet as Estimated Warranty Liability on December 31, 2008? 112. Sue Stein's regular rate of pay is $12 per hour with one and one-half times her regular rate for any hours which exceed 40 hours per week. She worked 48 hours last week. Therefore, her gross wages were 113. Assuming a FICA tax rate of 8% on the first $90,000 in wages, and a federal income tax rate of 20% on all wages, what would be an employee's net pay for the year if he earned $100,000 for the year? 115. Sue Rice has worked 44 hours this week. She worked in excess of 8 hours each day. Her regular hourly wage is $15 per hour. What are Sue's gross wages for the week? (The company Sue works for is in compliance with the Fair Labor Standards Act.)

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

105 To calculate the estimated warranty liability on December 31 we need to consider the expected number of defective units and the average repair cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started