Answered step by step

Verified Expert Solution

Question

1 Approved Answer

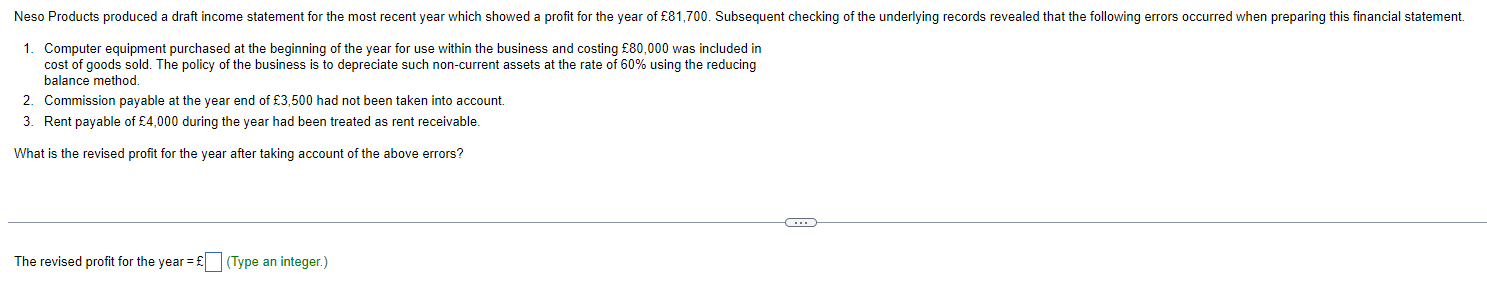

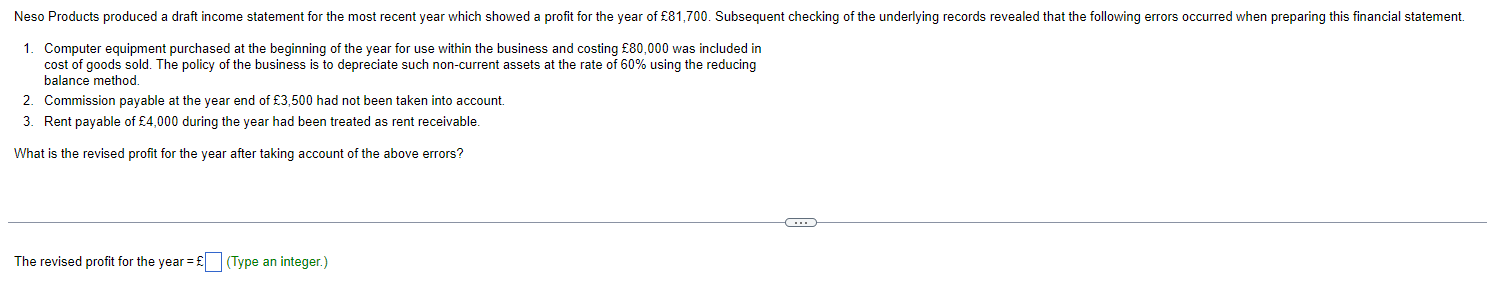

Neso Products produced a draft income statement for the most recent year which showed a profit for the year of81,700. Subsequent checking of the underlying

Neso Products produced a draft income statement for the most recent year which showed a profit for the year of81,700.

Subsequent checking of the underlying records revealed that the following errors occurred when preparing this financial statement.

| 1. | Computer equipment purchased at the beginning of the year for use within the business and costing80,000 was included in cost of goods sold. The policy of the business is to depreciate such non-current assets at the rate of 60% using the reducing balance method. |

| 2. | Commission payable at the year end of 3,500 had not been taken into account. |

| 3. | Rent payable of 4,000  during the year had been treated as rent receivable. during the year had been treated as rent receivable. |

What is the revised profit for the year after taking account of the above errors?

1. Computer equipment purchased at the beginning of the year for use within the business and costing 80,000 was included in cost of goods sold. The policy of the business is to depreciate such non-current assets at the rate of 60% using the reducing balance method. 2. Commission payable at the year end of 3,500 had not been taken into account. 3. Rent payable of 4,000 during the year had been treated as rent receivable. What is the revised profit for the year after taking account of the above errors? The revised profit for the year = (Type an integer.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started