Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nessa Corporation is a major international company with its head office in the Zambia, wanting to raise K150 million to establish a new production

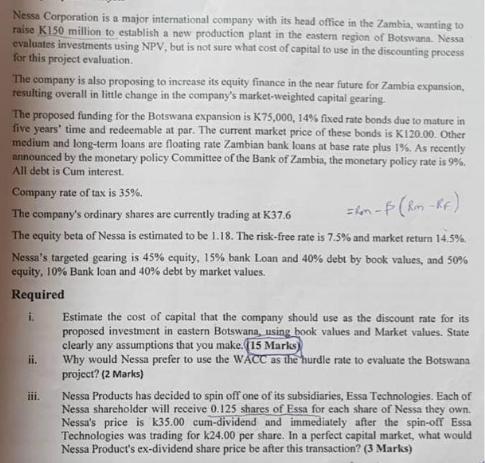

Nessa Corporation is a major international company with its head office in the Zambia, wanting to raise K150 million to establish a new production plant in the eastern region of Botswana. Nessa evaluates investments using NPV, but is not sure what cost of capital to use in the discounting process for this project evaluation. The company is also proposing to increase its equity finance in the near future for Zambia expansion, resulting overall in little change in the company's market-weighted capital gearing. The proposed funding for the Botswana expansion is K75,000, 14% fixed rate bonds due to mature in five years' time and redeemable at par. The current market price of these bonds is K120.00. Other medium and long-term loans are floating rate Zambian bank loans at base rate plus 1%. As recently announced by the monetary policy Committee of the Bank of Zambia, the monetary policy rate is 9%. All debt is Cum interest. Company rate of tax is 35%. The company's ordinary shares are currently trading at K37.6 The equity beta of Nessa is estimated to be 1.18. The risk-free rate is 7.5% and market return 14.5%. Nessa's targeted gearing is 45% equity, 15% bank Loan and 40% debt by book values, and 50% equity, 10% Bank loan and 40% debt by market values. Required i. ii. Estimate the cost of capital that the company should use as the discount rate for its proposed investment in eastern Botswana, using book values and Market values. State clearly any assumptions that you make. (15 Marks Why would Nessa prefer to use the WACC as the hurdle rate to evaluate the Botswana project? (2 Marks) Nessa Products has decided to spin off one of its subsidiaries, Essa Technologies. Each of Nessa shareholder will receive 0.125 shares of Essa for each share of Nessa they own. Nessa's price is k35.00 cum-dividend and immediately after the spin-off Essa Technologies was trading for k24.00 per share. In a perfect capital market, what would Nessa Product's ex-dividend share price be after this transaction? (3 Marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i Book Value The cost of capital for Nessa Corporation using book values can be estimated using the weighted average cost of capital WACC formula The WACC formula is WACC Equity Component x Equity Bet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started