Answered step by step

Verified Expert Solution

Question

1 Approved Answer

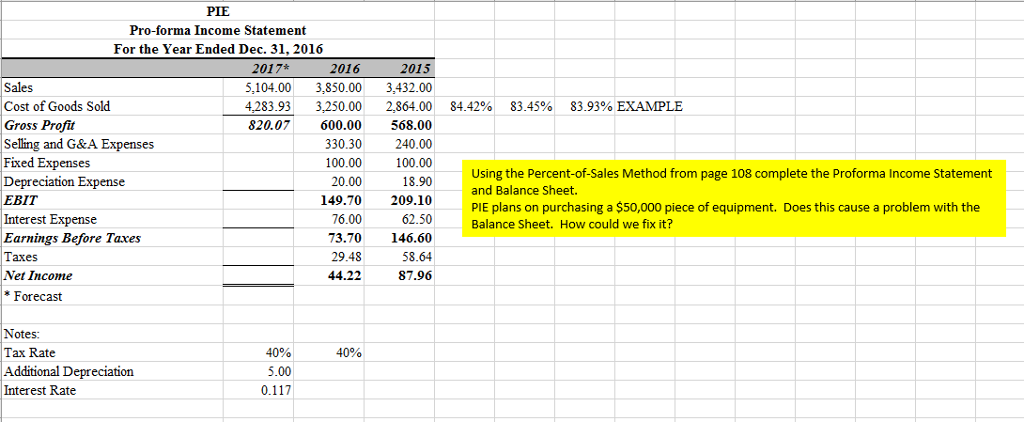

Net Addition to Plant & Equipment; 50.00 Life of New Equipment in Years: 10 New Depreciation (Straight Line): 5.00 PIE Pro-forma Income Statement For the

Net Addition to Plant & Equipment; 50.00

Life of New Equipment in Years: 10

New Depreciation (Straight Line): 5.00

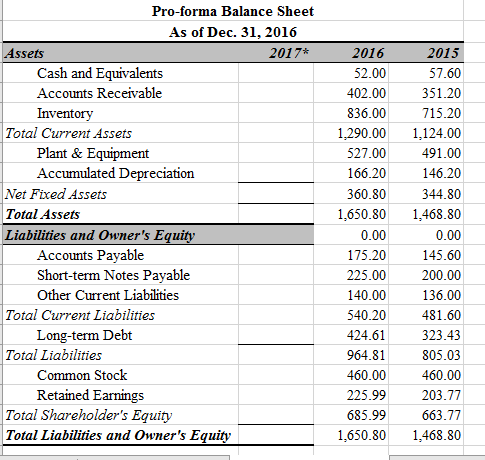

PIE Pro-forma Income Statement For the Year Ended Dec. 31, 2016 2017* 2016 2015 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income 5,104.003,850.00 3,432.00 4,283.93 3,250.00 2,864.00 84.42% 83.45% 83.93% EXAMPLE 820.07 600.00 568.00 330.30240.00 100.00 18.90 149.70 209.10 62.50 73.70 146.60 58.64 87.96 100.00 20.00 Using the Percent-of-Sales Method from page 108 complete the Proforma Income Statement and Balance Sheet PIE plans on purchasing a $50,000 piece of equipment. Does this cause a problem with the Balance Sheet. How could we fix it? 76.00 29.48 44.22 Forecast Notes: Tax Rate Additional Depreciation Interest Rate 40% 5.00 40% Pro-forma Balance Sheet As of Dec. 31, 2016 2015 57.60 402.00351.20 836.00715.20 1,290.001,124.00 527.00 491.00 146.20 60.80344.80 1,650.801,468.80 0.00 145.60 225.00200.00 136.00 540.20 481.60 323.43 805.03 460.00 225.99203.77 663.77 1,650.801,468.80 ssets 2017* 2016 Cash and Equivalents Accounts Receivable Invent 52.00 Total Current Assets Plant & Equipment Accumulated Depreciation 166.20 Net Fixed Assets Total Assets Liabilities and Owner's E 0.00 Accounts Payable Short-term Notes Payable Other Current Liabilities 175.20 140.00 Total Current Liabilities Long-term Debt 424.61 964.81 460.00 Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owner's Equity 685.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started