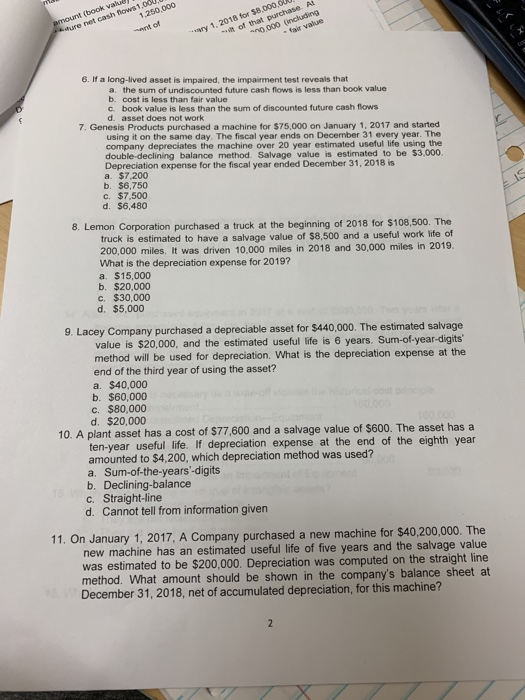

net cash fiows1,000 ant of of that purchase. At n0,000 (ncluding - fair value 1.250,000 y 1,2018 for $8,000,00 6. If a long-lived asset is impaired, the impairment test reveals that a. the sum of undiscounted future cash flows is less than book value b. cost is less than fair value c. book value is less than the sum of discounted future cash flows d. asset does not work 7. Genesis Products purchased a machine for $75,000 on January 1,2017 and started using it on the same day. The fiscal year ends on December 31 every year. The company depreciates the machine over 20 year estimated useful life using the double-declining balance method. Salvage value is estimated to be $3,000. Depreciation expense for the fiscal year ended December 31, 2018 is a. $7,200 b. S6.750 C. $7,500 d. $6,480 8. Lemon Corporation purchased a truck at the beginning of 2018 for $108,500. The truck is estimated to have a salvage value of $8,500 and a useful work life of 200,000 miles. It was driven 10,000 miles in 2018 and 30,000 miles in 2019. What is the depreciation expense for 2019? a. $15,000 b. $20,000 C. $30,000 d. $5,000 9. Lacey Company purchased a depreciable asset for $440,000. The estimated salvage value is $20,000, and the estimated useful life is 6 years. Sum-of-year-digits method will be used for depreciation. What is the depreciation expense at the end of the third year of using the asset? a. $40,000 b. $60,000 c. $80,000 d. $20,000 10. A plant asset has a cost of $77,600 and a salvage value of $600. The asset has a ten-year useful life. If depreciation expense at the end of the eighth year amounted to $4,200, which depreciation method was used? a. Sum-of-the-years'-digits b. Declining-balance c. Straight-line d. Cannot tell from information given 11. On January 1, 2017, A Company purchased a new machine for $40.200,000. The new machine has an estimated useful life of five years and the salvage value was estimated to be $200,000. Depreciation was computed on the straight line method. What amount should be shown in the company's balance sheet at December 31, 2018, net of accumulated depreciation, for this machine