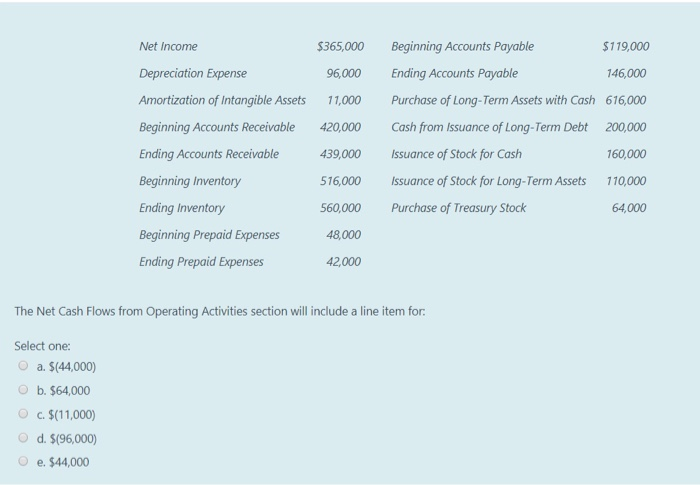

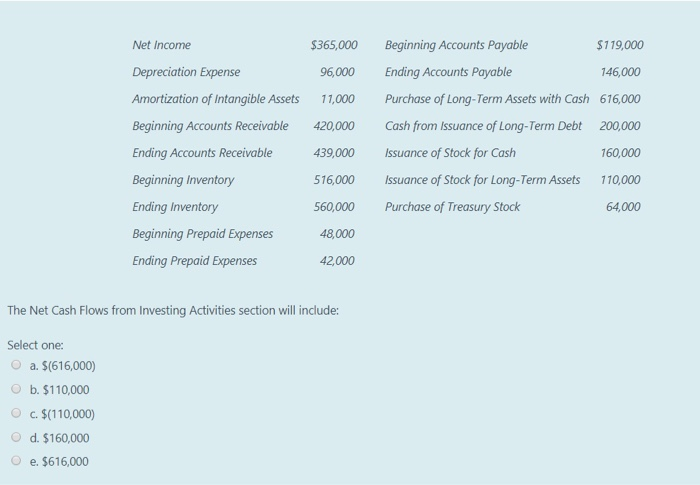

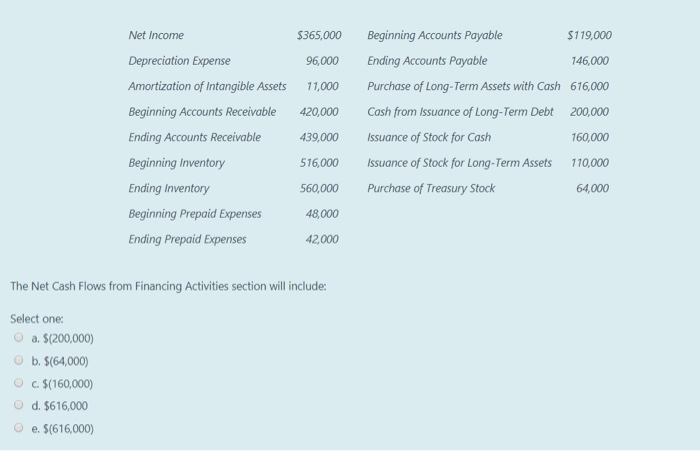

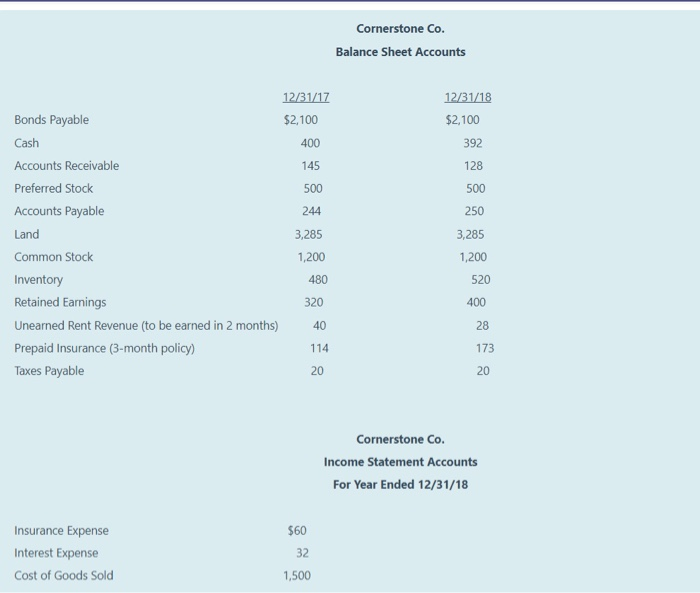

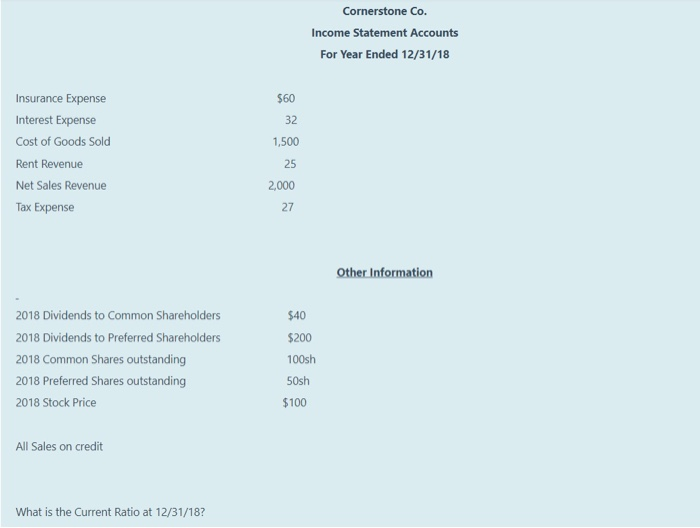

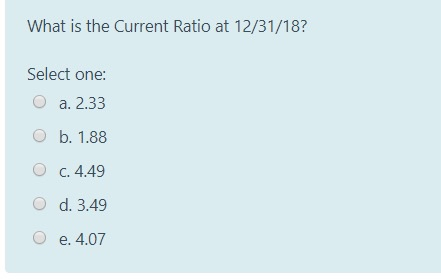

Net Income $365,000 96,000 11,000 420,000 Beginning Accounts Payable $119,000 Ending Accounts Payable 146,000 Purchase of Long-Term Assets with Cash 616,000 Cash from Issuance of Long-Term Debt 200,000 Issuance of Stock for Cash 160,000 Issuance of Stock for Long-Term Assets 110,000 Purchase of Treasury Stock 64,000 Depreciation Expense Amortization of Intangible Assets Beginning Accounts Receivable Ending Accounts Receivable Beginning inventory Ending Inventory Beginning Prepaid Expenses Ending Prepaid Expenses 439,000 516,000 560,000 48,000 42,000 The Net Cash Flows from Operating Activities section will include a line item for. Select one: a. $(44,000) b. $64,000 O c. $(11,000) d. $196,000) e. $44,000 Net Income $365,000 96,000 11,000 420,000 Beginning Accounts Payable $119,000 Ending Accounts Payable 146,000 Purchase of Long-Term Assets with Cash 616,000 Cash from Issuance of Long-Term Debt 200,000 Issuance of Stock for Cash 160,000 Issuance of Stock for Long-Term Assets 110,000 Purchase of Treasury Stock 64,000 Depreciation Expense Amortization of Intangible Assets Beginning Accounts Receivable Ending Accounts Receivable Beginning inventory Ending Inventory Beginning Prepaid Expenses Ending Prepaid Expenses 439,000 516,000 560,000 48,000 42,000 The Net Cash Flows from Investing Activities section will include: Select one: a. $(616,000) b. $110,000 c. $(110,000) d. $160,000 e. $616,000 Net Income $365,000 Depreciation Expense Amortization of Intangible Assets Beginning Accounts Receivable Ending Accounts Receivable Beginning inventory Ending Inventory Beginning Prepaid Expenses Ending Prepaid Expenses 96,000 11,000 420,000 439,000 516,000 Beginning Accounts Payable $119,000 Ending Accounts Payable 146,000 Purchase of Long-Term Assets with Cash 616,000 Cash from Issuance of Long-Term Debt 200,000 Issuance of Stock for Cash 160,000 Issuance of Stock for Long-Term Assets 110,000 Purchase of Treasury Stock 64,000 560,000 48,000 42,000 The Net Cash Flows from Financing Activities section will include: Select one: a. $(200,000) b. $(64,000) C. $(160,000) d. $616,000 e. $(616,000) Cornerstone Co. Balance Sheet Accounts 12/31/18 $2,100 400 392 145 128 500 500 244 250 12/31/17 Bonds Payable $2,100 Cash Accounts Receivable Preferred Stock Accounts Payable Land 3,285 Common Stock 1,200 Inventory Retained Earnings 320 Unearned Rent Revenue (to be earned in 2 months) Prepaid Insurance (3-month policy) Taxes Payable 20 3,285 1,200 480 520 400 40 28 114 173 20 Cornerstone Co. Income Statement Accounts For Year Ended 12/31/18 $60 Insurance Expense Interest Expense Cost of Goods Sold 32 1,500 Cornerstone Co. Income Statement Accounts For Year Ended 12/31/18 $60 32 Insurance Expense Interest Expense Cost of Goods Sold Rent Revenue Net Sales Revenue Tax Expense 1,500 25 2,000 27 Other Information 2018 Dividends to Common Shareholders 2018 Dividends to Preferred Shareholders 2018 Common Shares outstanding 2018 Preferred Shares outstanding 2018 Stock Price $40 $200 100sh 50sh $100 All Sales on credit What is the Current Ratio at 12/31/18? What is the Current Ratio at 12/31/18? Select one: O a. 2.33 O b. 1.88 O C. 4.49 O d. 3.49 e. 4.07