Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Calculate the Payback Period of each project. Explain what argument Tim should make to show that the Payback Period is not appropriate in

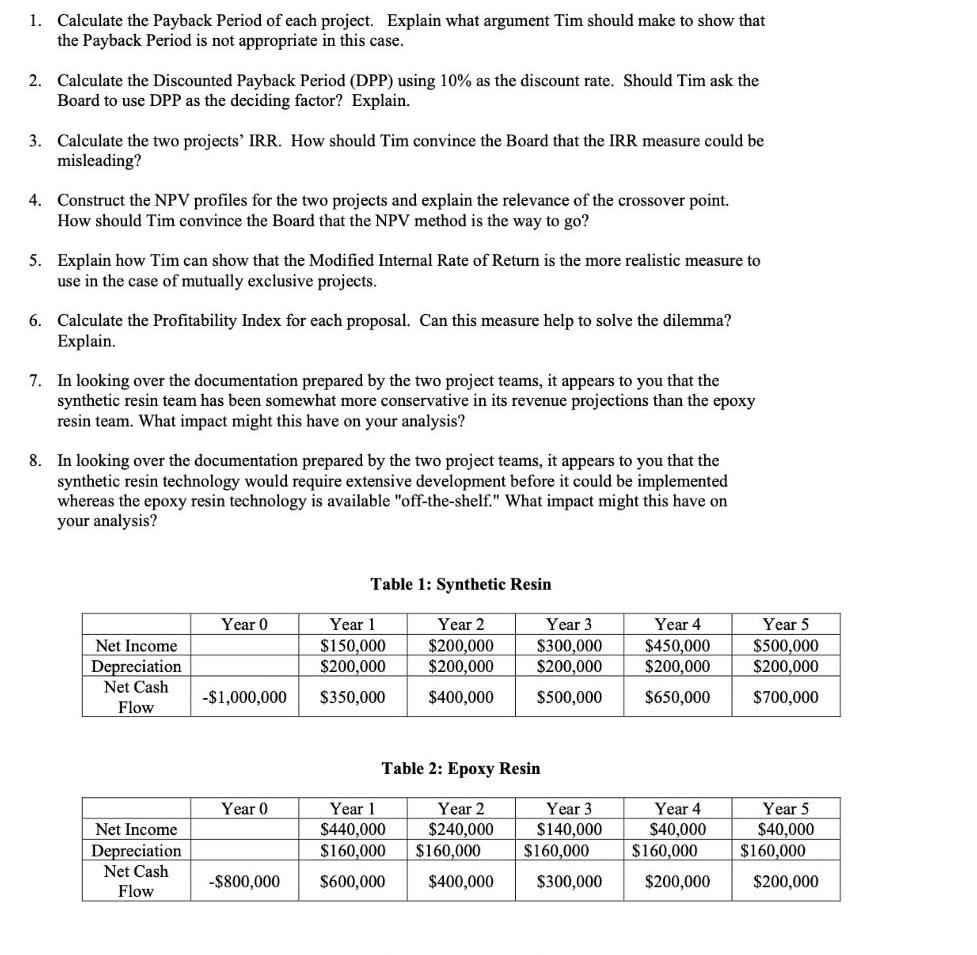

1. Calculate the Payback Period of each project. Explain what argument Tim should make to show that the Payback Period is not appropriate in this case. 2. Calculate the Discounted Payback Period (DPP) using 10% as the discount rate. Should Tim ask the Board to use DPP as the deciding factor? Explain. 3. Calculate the two projects' IRR. How should Tim convince the Board that the IRR measure could be misleading? 4. Construct the NPV profiles for the two projects and explain the relevance of the crossover point. How should Tim convince the Board that the NPV method is the way to go? 5. Explain how Tim can show that the Modified Internal Rate of Return is the more realistic measure to use in the case of mutually exclusive projects. 6. Calculate the Profitability Index for each proposal. Can this measure help to solve the dilemma? Explain. 7. In looking over the documentation prepared by the two project teams, it appears to you that the synthetic resin team has been somewhat more conservative in its revenue projections than the epoxy resin team. What impact might this have on your analysis? 8. In looking over the documentation prepared by the two proje teams, it appears to you that the synthetic resin technology would require extensive development before it could be implemented whereas the epoxy resin technology is available "off-the-shelf." What impact might this have on your analysis? Net Income Depreciation Net Cash Flow Net Income Depreciation Net Cash Flow Year 0 -$1,000,000 Year 0 -$800,000 Table 1: Synthetic Resin Year 1 $150,000 $200,000 $350,000 Year 2 $200,000 $200,000 $400,000 Year 1 $440,000 $160,000 $600,000 Table 2: Epoxy Resin Year 2 $240,000 $160,000 Year 3 $300,000 $200,000 $500,000 $400,000 Year 3 $140,000 $160,000 $300,000 Year 4 $450,000 $200,000 $650,000 Year 4 $40,000 $160,000 $200,000 Year 5 $500,000 $200,000 $700,000 Year 5 $40,000 $160,000 $200,000

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer Lets address each question one by one 1 Payback Period Project with Synthetic Resin Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started