Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Net Operating Loss Carryovers. In 2018, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from

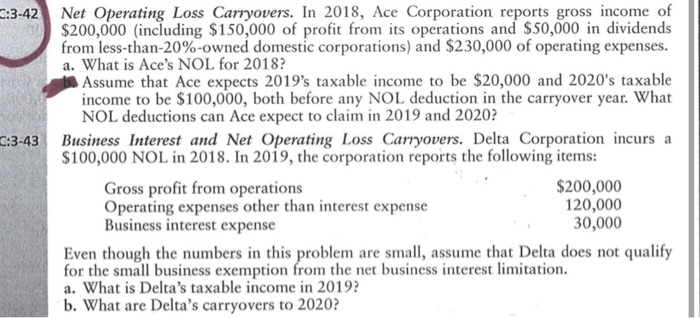

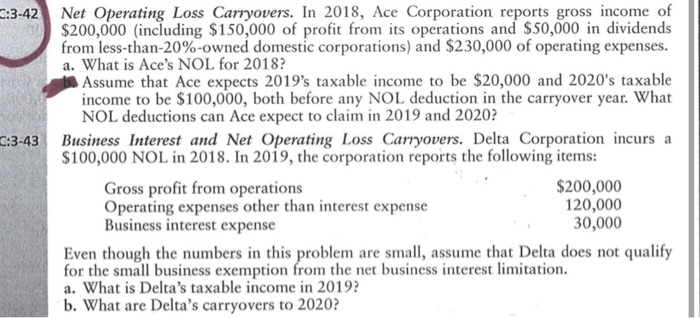

Net Operating Loss Carryovers. In 2018, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from less-than-20%-owned domestic corporations) and $230,000 of operating expenses. a. What is Ace's NOL for 2018? Assume that Ace expects 2019's taxable income to be $20,000 and 2020's taxable income to be $100,000, both before any NOL deduction in the carryover year. What NOL deductions can Ace expect to claim in 2019 and 2020? :3-42 6:3-43 Net Operating Loss Carryovers. In 2018, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from less-than-20%-owned domestic corporations) and $230,000 of operating expenses. a. What is Ace's NOL for 2018? Assume that Ace expects 2019's taxable income to be $20,000 and 2020's taxable income to be $100,000, both before any NOL deduction in the carryover year. What NOL deductions can Ace expect to claim in 2019 and 2020? Business Interest and Net Operating Loss Carryovers. Delta Corporation incurs a $100,000 NOL in 2018. In 2019, the corporation reports the following items: Gross profit from operations $200,000 Operating expenses other than interest expense 120,000 Business interest expense 30,000 Even though the numbers in this problem are small, assume that Delta does not qualify for the small business exemption from the net business interest limitation. a. What is Delta's taxable income in 2019? b. What are Delta's carryovers to 2020

Net Operating Loss Carryovers. In 2018, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from less-than-20%-owned domestic corporations) and $230,000 of operating expenses. a. What is Ace's NOL for 2018? Assume that Ace expects 2019's taxable income to be $20,000 and 2020's taxable income to be $100,000, both before any NOL deduction in the carryover year. What NOL deductions can Ace expect to claim in 2019 and 2020? :3-42 6:3-43 Net Operating Loss Carryovers. In 2018, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from less-than-20%-owned domestic corporations) and $230,000 of operating expenses. a. What is Ace's NOL for 2018? Assume that Ace expects 2019's taxable income to be $20,000 and 2020's taxable income to be $100,000, both before any NOL deduction in the carryover year. What NOL deductions can Ace expect to claim in 2019 and 2020? Business Interest and Net Operating Loss Carryovers. Delta Corporation incurs a $100,000 NOL in 2018. In 2019, the corporation reports the following items: Gross profit from operations $200,000 Operating expenses other than interest expense 120,000 Business interest expense 30,000 Even though the numbers in this problem are small, assume that Delta does not qualify for the small business exemption from the net business interest limitation. a. What is Delta's taxable income in 2019? b. What are Delta's carryovers to 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started