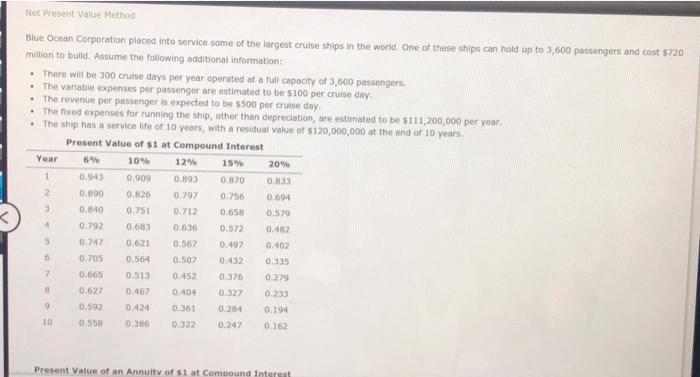

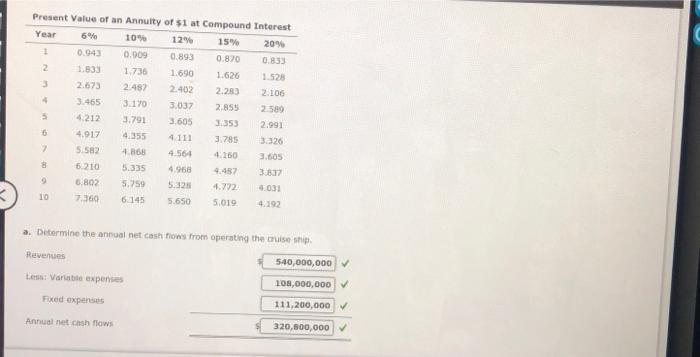

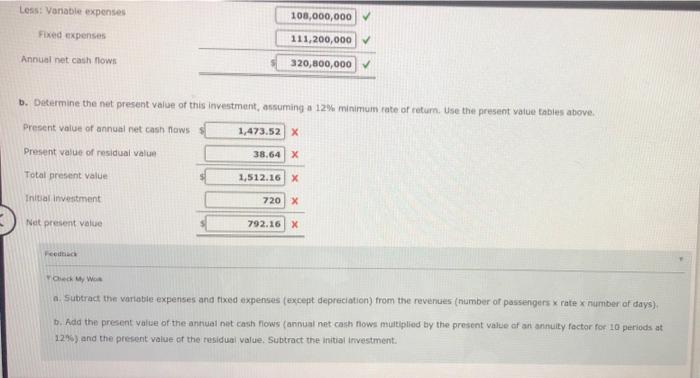

Net Present Value Method Blue Octan Corporation placed into service some of the largest cruise ships in the world, One of these ships can hold up to 3,600 passengers and cost $720 million to build Assume the following additional information: There will be 300 cruise days per year operated at a full capacity of 3,600 passengers The variable expenses per passenger are estimated to be $100 per cruise day, The revenue per passenger is expected to be 5500 per cruise day The fixed expenses for running the ship, other than depreciation, are estimated to be $111,200,000 per year: The ship has a service life of 10 years, with a residual value of $120,000,000 at the end of 10 years. Present Value of $1 at Compound Interest Year 6% 10% 12 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.570 0.792 0.63 0.636 0.572 0.482 5 0.74% 0.621 0.56% 0:49 0.402 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 3 0.627 0.46% 0.404 0.32% 0.233 9 0.592 0.24 0 361 0.284 0.194 TO 0.558 0.336 0.322 0:247 0.162 4 Present Value of an Annuity of si at Compound Interest 2.106 Present Value of an Annuity of sl at Compound Interest Year 6% 10 12% 15% 20 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.738 1.690 1.626 1.528 2.673 2.482 2.402 2.283 4 3.465 3.170 3.037 2.855 2.589 4.212 3.791 3.605 34353 2.991 4.917 4355 4. 111 3.785 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 3:37 6.802 5.759 5.32 4.772 4031 10 7360 6.145 5.650 5.019 4.192 3326 a. Determine the annual net cash flows from operating the cruise ship Revenues 540,000,000 Less: Variable expenses 108,000,000 Fixed expenses 111,200,000 Annual net cash flows 320,500,000 Less: Vanable expenses 108,000,000 Fixed expenses 111,200,000 Annual net cash Now 320,000,000 b. Determine the net present value of this investment, assuming a 12% minimum rote of return. Use the present value tables above. Present value of annual net cash flows 1,473.52 X 38.64 X Present value of residual value Total present value 1,512.16 X Initial investment 720 X Net present value 792.16X Feed Yok My We a Subtract the variable expenses and fixed expenses (except depreciation) from the revenues (number of passengers x rate x number of days) b. Add the present value of the annual net cash flows (annual net cash rows multiplied by the present value of an annuity factor for 10 periods at 12%) and the present value of the residual value. Subtract the initial investment