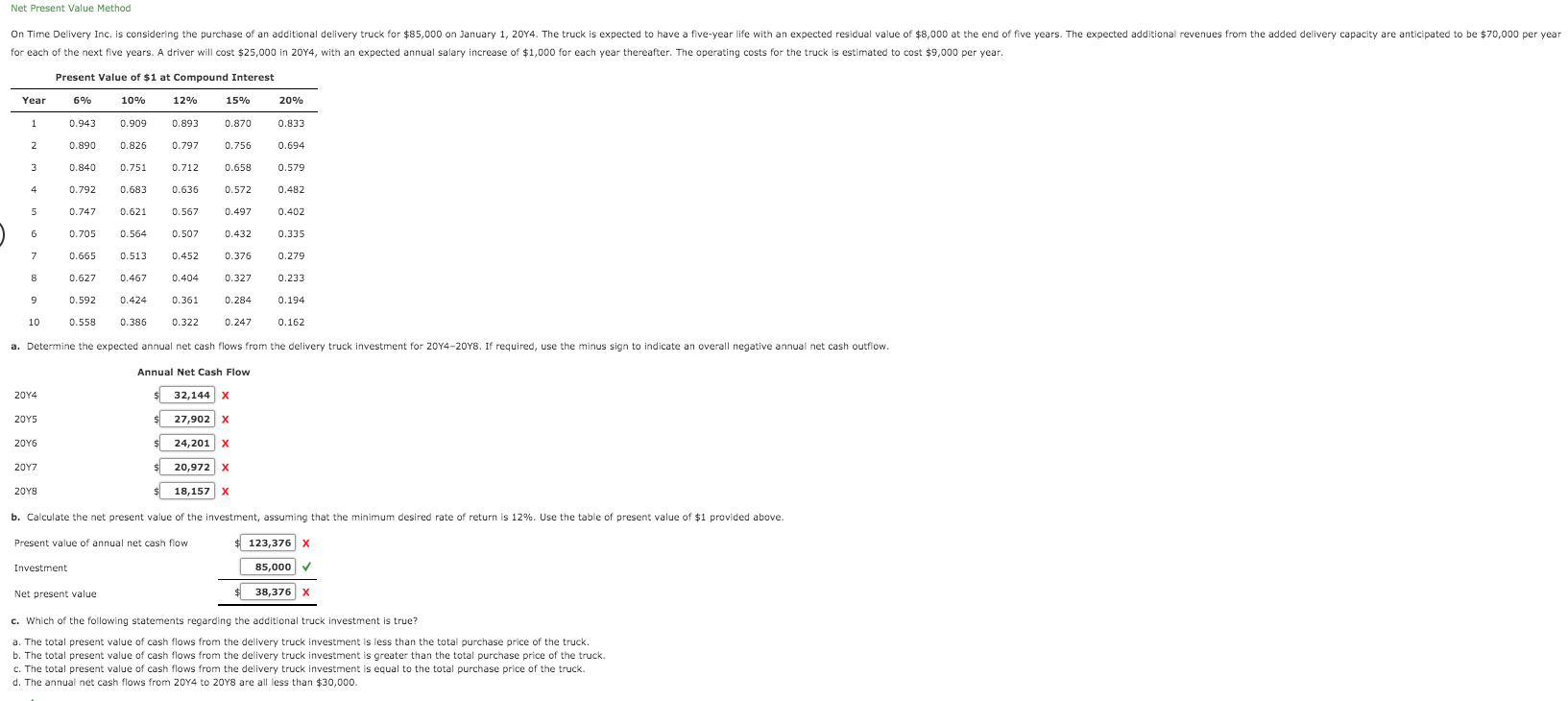

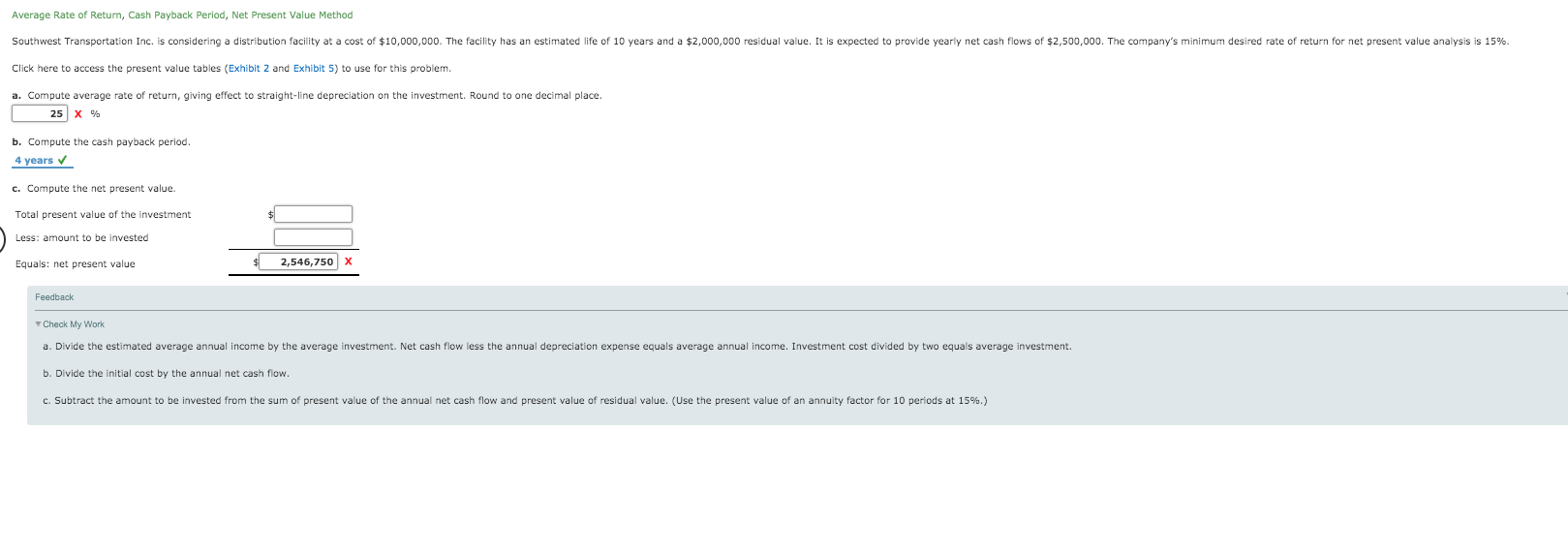

Net Present Value Method On Time Delivery Inc. is considering the purchase of an additional delivery truck for $85,000 on January 1, 2014. The truck is expected to have a five-year life with an expected residual value of $8,000 at the end of five years. The expected additional revenues from the added delivery capacity are anticipated to be $70,000 per year for each of the next five years. A driver will cost $25,000 in 2014, with an expected annual salary increase of $1,000 for each year thereafter. The operating costs for the truck is estimated to cost $9,000 per year. Present Value of $1 at Compound Interest Year 20% 6% 0.943 0.890 10% 0.909 12% 0.893 15% 0.870 0.826 0.756 0.658 0.840 0.751 0.683 0.833 0.694 0.579 0.482 0.402 0.335 0.797 0.712 0.636 0.567 0.507 0.792 0.747 0.621 0.564 0.572 0.497 0.432 0.705 0.665 0.513 0.452 8 0.627 .592 0.558 9 0.376 0.327 0.284 0.247 0.467 0.424 0.386 0 0.279 0.233 0.194 0.162 0.404 0.361 0.322 10 a. Determine the expected annual net cash flows from the delivery truck investment for 20Y4-2018. If required, use the minus sign to indicate an overall negative annual net cash outflow. Annual Net Cash Flow 2014 2045 $ $ $ $ 32,144 x 27,902 X 24,201 x 20,972 x 2046 2017 2048 $ 18,157 X b. Calculate the net present value of the investment, assuming that the minimum desired rate of return is 12%. Use the table of present value of $1 provided above. Present value of annual net cash flow $123,376 x 85,000 Investment Net present value $ 38,376 x c. Which of the following statements regarding the additional truck investment is true? a. The total present value of cash flows from the delivery truck investment is less than the total purchase price of the truck. b. The total present value of cash flows from the delivery truck investment is greater than the total purchase price of the truck. c. The total present value of cash flows from the delivery truck investment is equal to the total purchase price of the truck d. The annual net cash flows from 2004 to 2048 are all less than $30,000. Average Rate of Retum, Cash Payback Period, Net Present Value Method Southwest Transportation Inc. is considering a distribution facility at a cost of $10,000,000. The facility has an estimated life of 10 years and a $2,000,000 residual value. It is expected to provide yearly net cash flows of $2,500,000. The company's minimum desired rate of return for net present value analysis is 15%. Click here to access the present value tables (Exhibit 2 and Exhibit 5) to use for this problem. a. Compute average rate of return, giving effect to straight-line depreciation on the investment. Round to one decimal place. 25 x % b. Compute the cash payback period. 4 years c. Compute the net present value. Total present value of the investment Less: amount to be invested Equals: net present value $ 2,546,750 x Feedback Check My Work a. Divide the estimated average annual income by the average investment. Net cash flow less the annual depreciation expense equals average annual income. Investment cost divided by two equals average investment. b. Divide the initial cost by the annual net cash flow. c. Subtract the amount to be invested from the sum of present value of the annual net cash flow and present value of residual value. (Use the present value of an annuity factor for 10 periods at 15%.)