Answered step by step

Verified Expert Solution

Question

1 Approved Answer

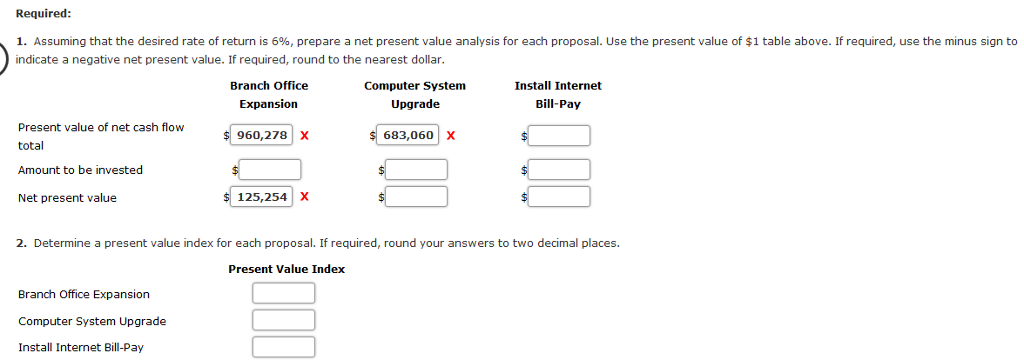

Net Present Value Method, Present Value Index, and Analysis United Bankshores, Inc. wishes to evaluate three capital investment proposals by using the net present value

Net Present Value Method, Present Value Index, and Analysis

United Bankshores, Inc. wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:

| Branch Office Expansion | Computer System Upgrade | Install Internet Bill-Pay | |||||

| Amount to be invested | $527,952 | $397,512 | $206,060 | ||||

| Annual net cash flows: | |||||||

| Year 1 | 251,000 | 186,000 | 103,000 | ||||

| Year 2 | 233,000 | 167,000 | 71,000 | ||||

| Year 3 | 213,000 | 149,000 | 52,000 | ||||

| Present Value of $1 at Compound Interest | |||||

| Year | 6% | 10% | 12% | 15% | 20% |

| 1 | 0.943 | 0.909 | 0.893 | 0.870 | 0.833 |

| 2 | 0.890 | 0.826 | 0.797 | 0.756 | 0.694 |

| 3 | 0.840 | 0.751 | 0.712 | 0.658 | 0.579 |

| 4 | 0.792 | 0.683 | 0.636 | 0.572 | 0.482 |

| 5 | 0.747 | 0.621 | 0.567 | 0.497 | 0.402 |

| 6 | 0.705 | 0.564 | 0.507 | 0.432 | 0.335 |

| 7 | 0.665 | 0.513 | 0.452 | 0.376 | 0.279 |

| 8 | 0.627 | 0.467 | 0.404 | 0.327 | 0.233 |

| 9 | 0.592 | 0.424 | 0.361 | 0.284 | 0.194 |

| 10 | 0.558 | 0.386 | 0.322 | 0.247 | 0.162 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started