Answered step by step

Verified Expert Solution

Question

1 Approved Answer

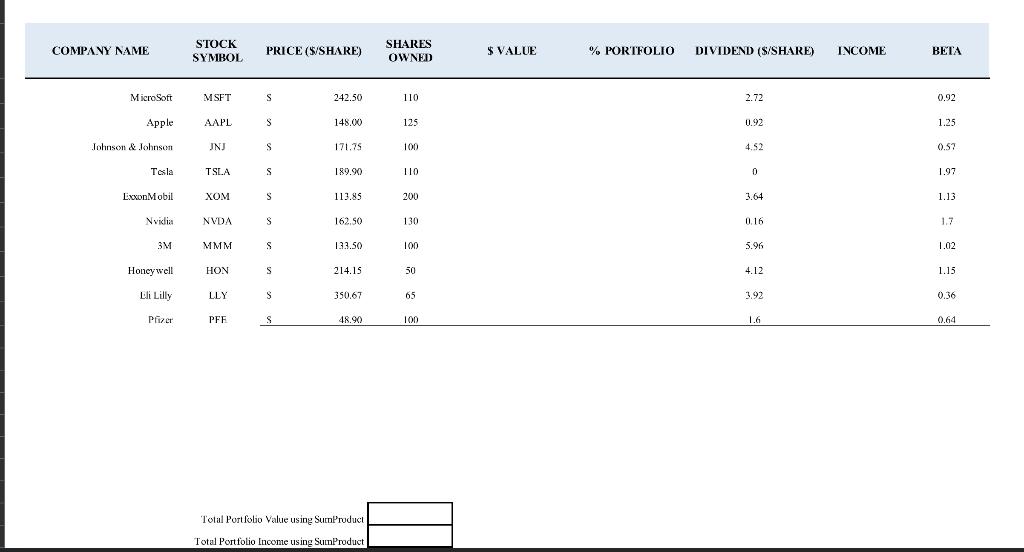

COMPANY NAME Microsoft Apple Johnson & Johnson Tesla ExxonMobil Nvidia 3M Honeywell Eli Lilly Pfizer STOCK SYMBOL MSFT AAPL JNJ TSLA XOM NVDA MMM

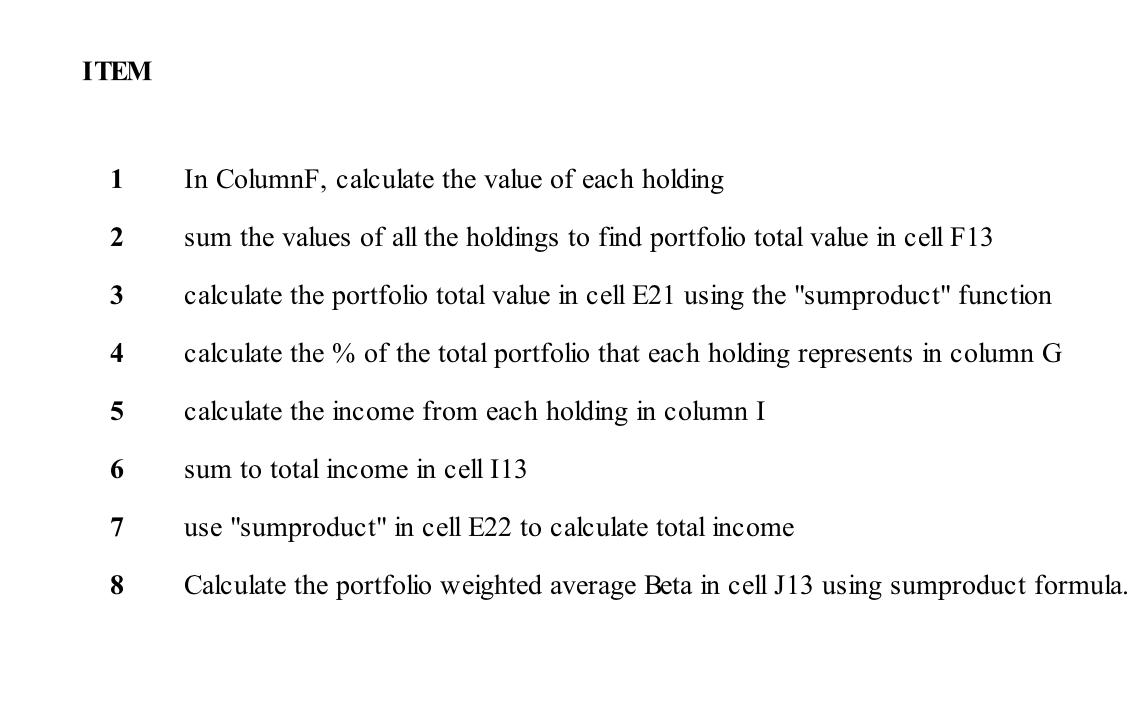

COMPANY NAME Microsoft Apple Johnson & Johnson Tesla ExxonMobil Nvidia 3M Honeywell Eli Lilly Pfizer STOCK SYMBOL MSFT AAPL JNJ TSLA XOM NVDA MMM HON LLY PFF PRICE (S/SHARE) S S S S S S S S S S 242.50 148.00 171.75 189.90 113.85 162.50 133.50 214.15 350.67 48.90 Total Portfolio Value using SumProduct Total Portfolio Income using SumProduct SHARES OWNED 110 125 100 110 200 130 100 50 65 100 $VALUE % PORTFOLIO DIVIDEND (S/SHARE) 2.72 0.92 4.52 0 3.64 0.16 5.96 4.12 3.92 1.6 INCOME BETA 0.92 1.25 0.57 1.97 1.13 1.7 1.02 1.15 0.36 0.64 ITEM 1 2 3 4 5 6 7 8 In ColumnF, calculate the value of each holding sum the values of all the holdings to find portfolio total value in cell F13 calculate the portfolio total value in cell E21 using the "sumproduct" function calculate the % of the total portfolio that each holding represents in column G calculate the income from each holding in column I sum to total income in cell I13 use "sumproduct" in cell E22 to calculate total income Calculate the portfolio weighted average Beta in cell J13 using sumproduct formula.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

We will tackle each of the tasks outlined in the second image step by step using the information provided in the first image Here is how to complete e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started