Answered step by step

Verified Expert Solution

Question

1 Approved Answer

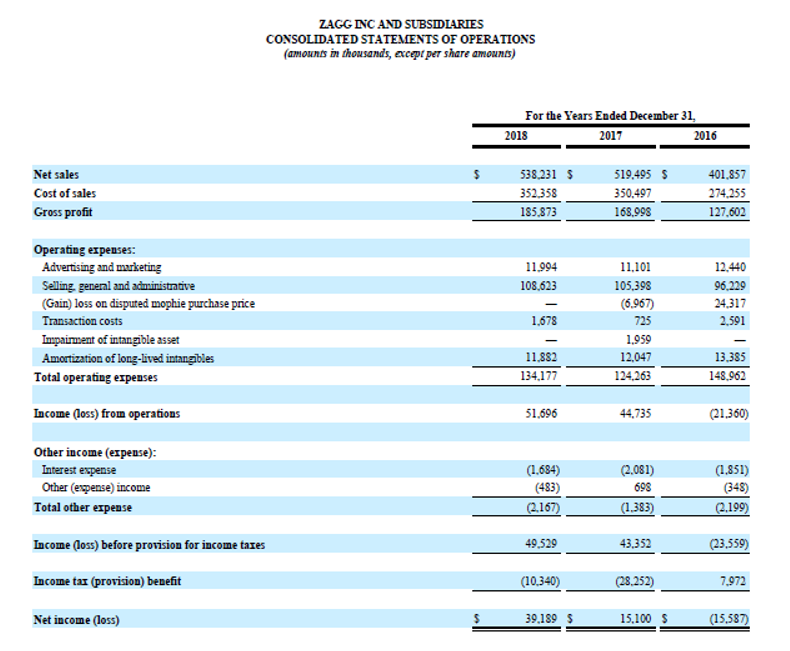

Net sales Cost of sales Gross profit Operating expenses: ZAGG INC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except per share amounts)

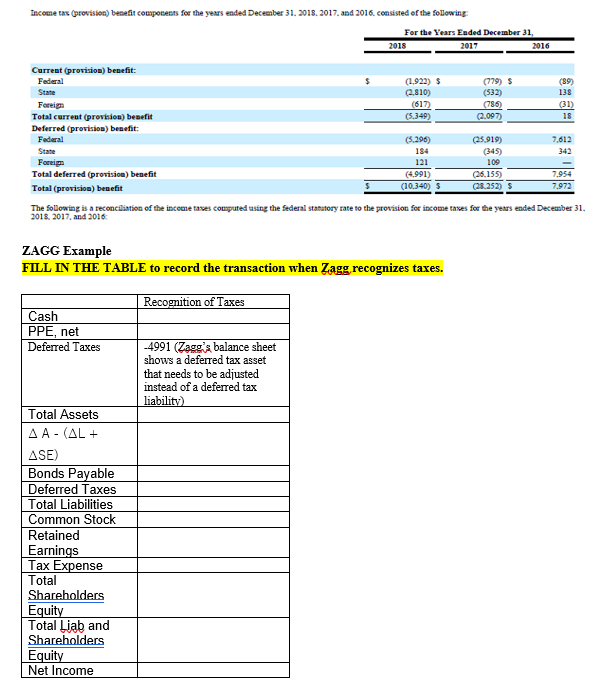

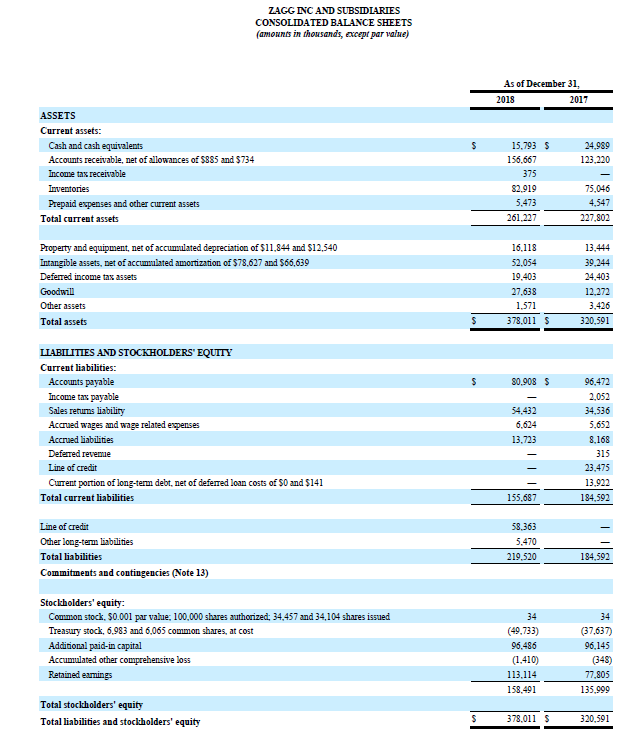

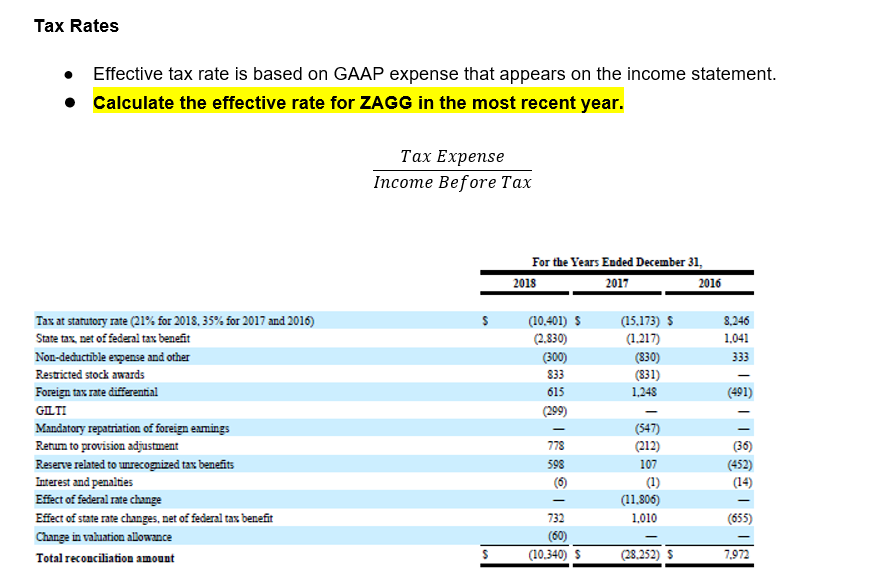

Net sales Cost of sales Gross profit Operating expenses: ZAGG INC AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (amounts in thousands, except per share amounts) For the Years Ended December 31, 2018 2017 2016 $ 538,231 $ 519,495 $ 401,857 352,358 350,497 274,255 185,873 168,998 127,602 Advertising and marketing 11,994 11,101 12,440 Selling, general and administrative 108,623 105,398 96,229 (Gain) loss on disputed mophie purchase price (6.967) 24,317 Transaction costs 1,678 725 2,591 Impairment of intangible asset 1,959 Amortization of long-lived intangibles 11,882 12,047 13,385 Total operating expenses 134,177 124,263 148,962 Income (loss) from operations 51,696 44,735 (21,360) Other income (expense): Interest expense (1.684) (2.081) Other (expense) income (483) 698 (1.851) (348) Total other expense (2.167) (1.383) (2.199) Income (loss) before provision for income taxes 49,529 43,352 (23,559) Income tax (provision) benefit (10,340) (28,252) 7.972 Net income (loss) 39,189 $ 15,100 $ (15,587) Income tax (provision) benefit components for the years ended December 31, 2018. 2017, and 2016, consisted of the following: For the Years Ended December 31, 2018 2017 2016 Current (provision) benefit: Federal State Foreign Total current (provision) benefit Deferred (provision) benefit: Federal State Foreign Total deferred (provision) benefit Total (provision) benefit (1.922) $ (2.810) (779) $ (89) (532) 138 (617) (786) (31) (5.349) (2.097) 18 (5.296) 184 (25,919) (345) 7,612 342 121 109 (4.991) (26.155) (10.340) (28.252) $ 7,954 7.972 The following is a reconciliation of the income taxes computed using the federal statutory rate to the provision for income taxes for the years ended December 31. 2018, 2017, and 2016: ZAGG Example FILL IN THE TABLE to record the transaction when Zagg recognizes taxes. Recognition of Taxes Cash PPE, net Deferred Taxes Total Assets AA - (AL + ASE) Bonds Payable Deferred Taxes Total Liabilities Common Stock Retained -4991 (Zagg's balance sheet shows a deferred tax asset that needs to be adjusted instead of a deferred tax liability) Earnings Tax Expense Total Shareholders Equity Total Liab and Shareholders Equity Net Income ASSETS ZAGG INC AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (amounts in thousands, except par value) As of December 31, 2018 2017 Current assets: Cash and cash equivalents Accounts receivable, net of allowances of $885 and $734 Income tax receivable $ 15,793 $ 156,667 375 24,989 123,220 Inventories Prepaid expenses and other current assets Total current assets 82,919 75,046 5,473 4,547 261,227 227,802 Property and equipment, net of accumulated depreciation of $11,844 and $12,540 16.118 13,444 Intangible assets, net of accumulated amortization of $78,627 and $66,639 52,054 39,244 Deferred income tax assets 19,403 24,403 Goodwill Other assets Total assets 27,638 12,272 1,571 3,426 378,011 $ 320,591 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Income tax payable S 80,908 $ 96,472 2,052 Sales returns liability 54,432 34,536 Accrued wages and wage related expenses 6,624 5,652 Accrued liabilities 13,723 8,168 Deferred revenue 315 Line of credit 23,475 Current portion of long-term debt, net of deferred loan costs of $0 and $141 13,922 Total current liabilities 155,687 184,592 Line of credit Other long-term liabilities Total liabilities 58,363 5,470 219,520 184,592 Commitments and contingencies (Note 13) Stockholders' equity: Common stock, $0.001 par value; 100,000 shares authorized; 34,457 and 34,104 shares issued 34 34 Treasury stock, 6,983 and 6,065 common shares, at cost (49,733) (37,637) Additional paid-in capital 96,486 96,145 Accumulated other comprehensive loss (1,410) (348) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 113,114 77,805 158,491 135,999 S 378,011 $ 320,591 Tax Rates Effective tax rate is based on GAAP expense that appears on the income statement. Calculate the effective rate for ZAGG in the most recent year. Tax Expense Income Before Tax Tax at statutory rate (21% for 2018, 35% for 2017 and 2016) State tax, net of federal tax benefit Non-deductible expense and other Restricted stock awards Foreign tax rate differential GILTI Mandatory repatriation of foreign earnings Return to provision adjustment Reserve related to unrecognized tax benefits Interest and penalties Effect of federal rate change Effect of state rate changes, net of federal tax benefit Change in valuation allowance Total reconciliation amount 2018 For the Years Ended December 31, 2017 2016 (10,401) $ (15.173) $ 8,246 (2.830) (1.217) 1,041 (300) (830) 333 833 (831) 615 1,248 (491) (299) - (547) 778 (212) 598 107 (452) (6) (1) (11.806) 732 1,010 (655) (60) g (14) $ (10.340) $ (28.252) $ 7,972

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information here are the missing amounts for ZAGG INC and Subsidiaries Consolidated Statements of Operations For the Year Ended ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started