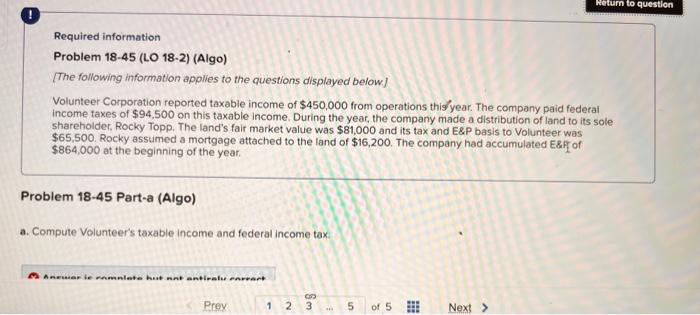

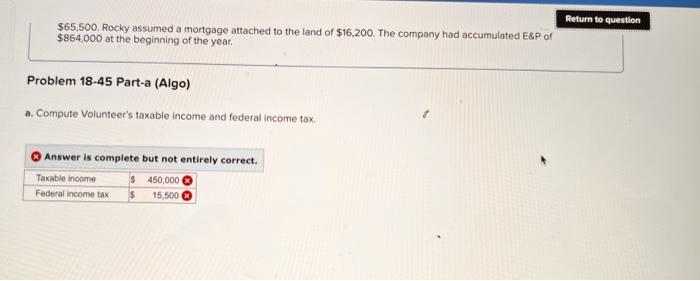

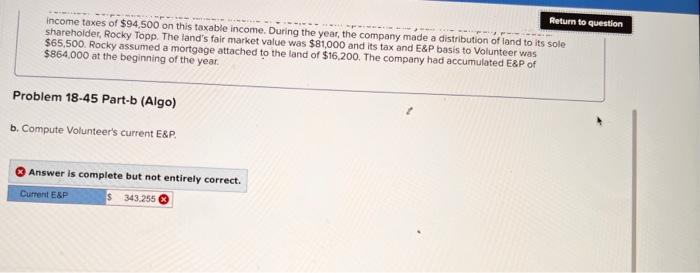

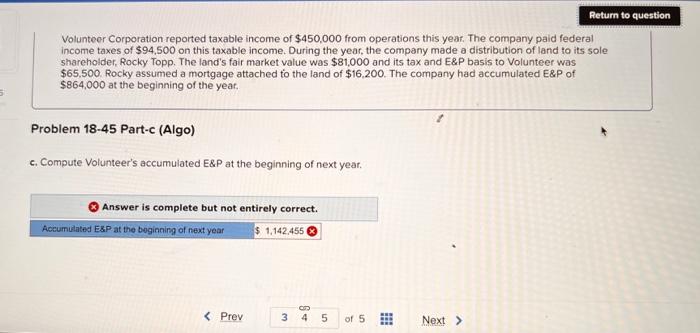

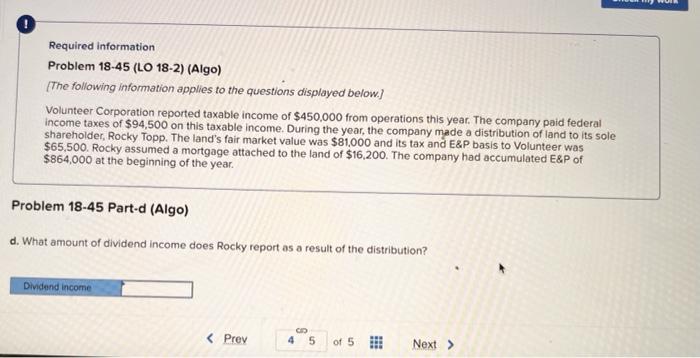

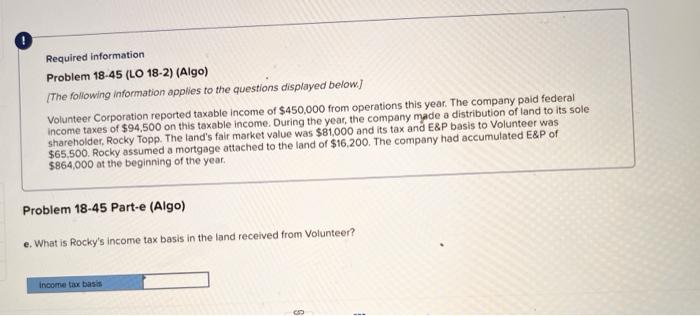

Neturn to question Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below) Volunteer Corporation reported taxable income of $450,000 from operations this year. The company paid federal income taxes of $94,500 on this taxable income. During the year, the company made a distribution of land to its sole shareholder. Rocky Topp. The land's fair market value was $81,000 and its tax and E&P basis to Volunteer was $65,500. Rocky assumed a mortgage attached to the land of $16,200. The company had accumulated E&F of $864,000 at the beginning of the year. Problem 18-45 Part-a (Algo) a. Compute Volunteer's taxable income and federal income tax Anwar le remate hunt antirourant Prey 1 2 Sm 5 of 5 Next > Return to question $65,500. Rocky assumed a mortgage attached to the land of $16,200. The company had accumulated E&P of $864,000 at the beginning of the year. Problem 18-45 Part-a (Algo) a. Compute Volunteer's taxable income and federal income tax. Answer is complete but not entirely correct. Taxable income $ 450,000 Federal income tax $ 15,500 Return to question Income taxes of $94.500 on this taxable income. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $81,000 and its tax and E&P basis to Volunteer was $65.500. Rocky assumed a mortgage attached to the land of $16.200. The company had accumulated E&P of $864,000 at the beginning of the year. Problem 18-45 Part-b (Algo) b. Compute Volunteer's current E&P. Answer is complete but not entirely correct. Current E&P $ 343.255 Return to question Volunteer Corporation reported taxable income of $450,000 from operations this year. The company paid federal income taxes of $94.500 on this taxable income. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $81,000 and its tax and E&P basis to Volunteer was $65,500 Rocky assumed a mortgage attached to the land of $16,200. The company had accumulated E&P of $864,000 at the beginning of the year. 5 Problem 18-45 Part-c (Algo) c. Compute Volunteer's accumulated E&P at the beginning of next year. Answer is complete but not entirely correct. Accumulated E&P at the beginning of next year $ 1,142.455 O Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $450,000 from operations this year. The company paid federal income taxes of $94,500 on this taxable income. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $81,000 and its tax and E&P basis to Volunteer was $65,500. Rocky assumed a mortgage attached to the land of $16,200. The company had accumulated E&P of $864,000 at the beginning of the year. Problem 18-45 Part-d (Algo) d. What amount of dividend income does Rocky report as a result of the distribution? Dividend income Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $450,000 from operations this year. The company paid federal income taxes of $94,500 on this taxable income. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $81,000 and its tax and E&P basis to Volunteer was $65.500. Rocky assumed a mortgage attached to the land of $16.200. The company had accumulated E&P of $864,000 at the beginning of the year Problem 18-45 Part-e (Algo) e. What is Rocky's income tax basis in the land received from Volunteer? income tax basis