Question

Quality Pretzels Inc. makes chocolate-covered pretzels and other snacks in its Waco plant. Its products are sold in 5-pound metal containers, which are also manufactured

Quality Pretzels Inc. makes chocolate-covered pretzels and other snacks in its Waco plant. Its products are sold in 5-pound metal containers, which are also manufactured at the Waco plant. In June 2014, the plant manager, Sarah Cassidy, was approached by Texas Canister Company with an offer to supply the canisters at a price of $1 each. Quality Pretzels assigns the following direct costs to canister production, corresponding to a volume of 760,000 canisters:

Direct Material: $300,000

Direct Labor (12,000 hours at $15 per hour ) : $180,000

Both direct costs are considered variable. The company assigns variable overhead at $10 per direct labor hour and fixed manufacturing overhead at $45 per direct labor hour. Cassidy views this decision as a “long-term” decision because she expects that her fixed costs will decrease should she decide to accept the offer from Texas Canister Company. Assume that cost is the only consideration in her decision-making process (i.e., dimensions such as quality and delivery reliability are not relevant).

Required

- Based on the direct-labor-based product costing system in place, would Cassidy be inclined to accept the order?

- Never a fan of the direct-labor-based system, Cassidy performs her own analysis and determines that only $80,000 of supervisor salaries and $28,000 of machinery depreciation can be avoided from the fixed manufacturing overhead if she buys the canisters from Texas Canister Company. Based on this information, would Cassidy be inclined to accept the order? Show your computations.

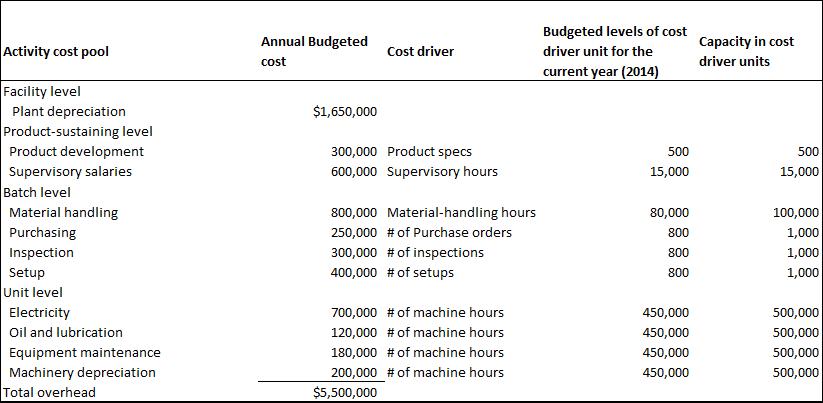

- Meanwhile, the controller of Quality Pretzels, Dave Paxon, had performed an activity-based costing analysis of Quality’s overall cost structure. His analysis is captured in the following exhibit:

Dave provides data both on capacity and on budgeted volume for 2014 because the volume in 2014 is unusually low, relative to a typical year in which capacity is used fully. Going forward, there is every expectation that capacity will be utilized fully. Assume now that Sarah consults Dave about the decision. Moreover, after further analysis, she concludes that the cost driver levels associated with canister production are as follows: 10 product specs, 2,000 supervisory hours, 6,000 material-handling hours, 30 inspections, 15 setups, 55 purchase orders, and 70,000 machine hours. Based on this information, would Sarah make or buy? How much would she save for the company with her decision? Show your computations.

- Many skeptics argue that activity-based costing is just a fancy way of allocating fixed costs. In your opinion, under what conditions would activity-based costing systems provide useful and appropriate cost bases for long-term product planning and capacity planning decisions?

Activity cost pool Facility level Plant depreciation Product-sustaining level Product development Supervisory salaries Batch level Material handling Purchasing Inspection Setup Unit level Electricity Oil and lubrication Equipment maintenance Machinery depreciation Total overhead Annual Budgeted cost $1,650,000 Cost driver 300,000 Product specs 600,000 Supervisory hours 800,000 Material-handling hours 250,000 # of Purchase orders 300,000 # of inspections 400,000 # of setups 700,000 # of machine hours. 120,000 # of machine hours 180,000 # of machine hours. 200,000 # of machine hours $5,500,000 Budgeted levels of cost driver unit for the current year (2014) 500 15,000 80,000 800 800 800 450,000 450,000 450,000 450,000 Capacity in cost driver units 500 15,000 100,000 1,000 1,000 1,000 500,000 500,000 500,000 500,000

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Direct Material Direct labor Variable overhead Fixed overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started