Question

Never Give Up Workshops Selling the dream The owners of Never Give Up have decided to retire and embark on new life adventures. Assume they

Never Give Up Workshops

Selling the dream

The owners of Never Give Up have decided to retire and embark on new life adventures. Assume they own all the common shares of the business and are looking to sell those shares to the right person or team who can continue to build upon the sterling reputation of the business. Youre going to switch sides and your team is considering purchasing 100% of the shares of this business.

Based on the information provided on the next page, answer the following:

- Restate the balance sheetto more accurately reflect the market value and performance of the business.

- Utilizing the Asset Valuation Approach, estimate the cost or purchase price of the business.

- Using a discount rate of 11% (cost of capital), what is the NPV of the investment? Does it suggest we purchase this business?

- There is inherent risk to this business model being that it operates in the ever-changing workshop/education/training industry, so we would like to set a hurdle rate. If our hurdle rate is 15%, should we still buy the business? At this rate, what purchase price should we offer?

- What is the internal rate of return?

Never Give Up Information

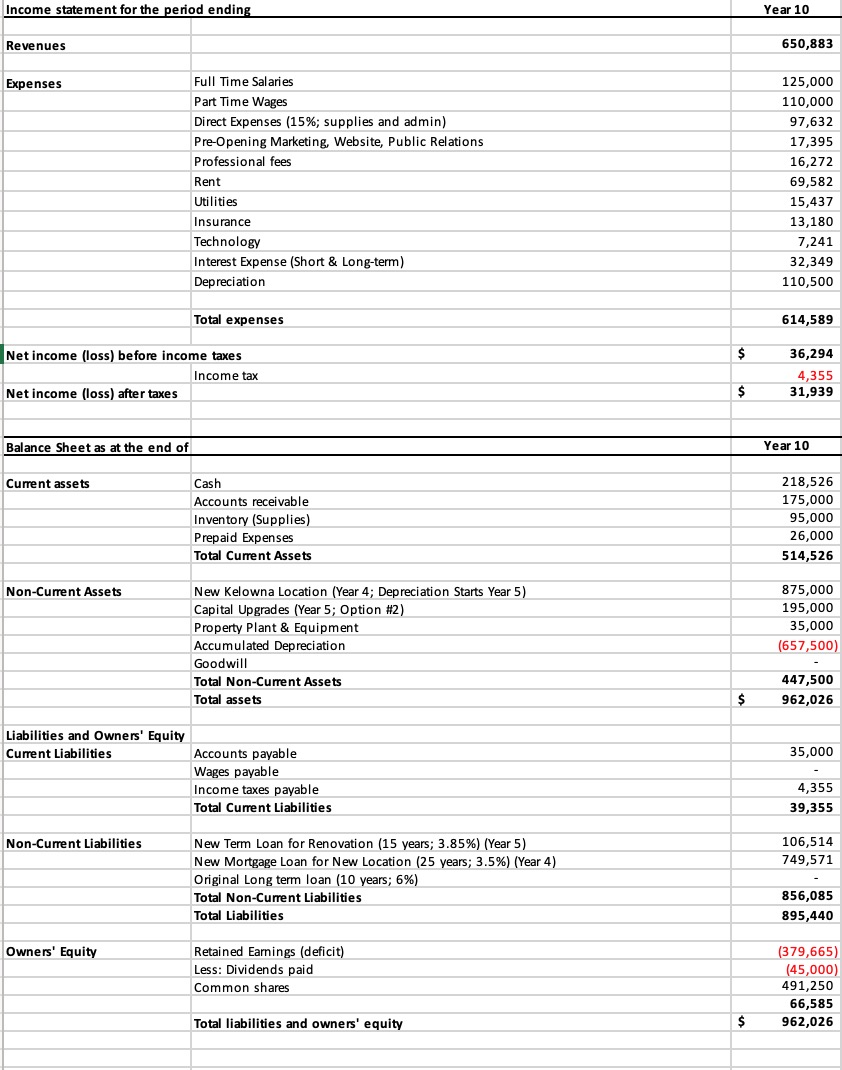

- The company is concluding Year 10 of operations.

- The original loan to start the business will be paid off in Year 10 (Challenge 1).

- In Year 4, Never Give Up added a new location in Kelowna (Challenge 4).

- In Year 5, Never Give up renovated and expanded the Kamloops location (Option 2 from Challenge 5).

- Despite a retained earnings deficit lasting through its life, Never Give Up paid a flat rate dividend of $45k annually since Year 5.

- For the last four years the company has been recognized as a trusted brand and innovative workshop company that provides significant online and in-person learning opportunities.

Valuation Elements (Restating the Balance Sheet)

- The market value of the capital assets has been estimated to be $1.5 million, an increase of about 235% over the book value of the sellers non-current assets ($447,500).

- As the buyers, we are interested in purchasing all the assets of the business including goodwill, which is estimated to be $1 million for the name and the business.

- Prepaid Expenses and Cash accounts show their actual balances and can be carried forward.

- Based on a detailed audit of the companys inventories and A/R, they have each been reduced by 45%.

- All current liabilities are brought forward to the restated balance sheet.

- The buyers will borrow $2 million to purchase some of the assets of the business (new amount for non-current liabilities).

- An amount of $853,671 would be invested in the business by the buyers (this share capital replaces sellers owners equity on the restated balance sheet).

Valuation Elements (Discounting Cash Flows)

- As the buyers, we are planning on keeping the business for 10 years then exiting. The estimated sale price at that time is $6 million.

- Estimated annual cash inflows are determined by adding depreciation expense to Net Income in Year 10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started