Answered step by step

Verified Expert Solution

Question

1 Approved Answer

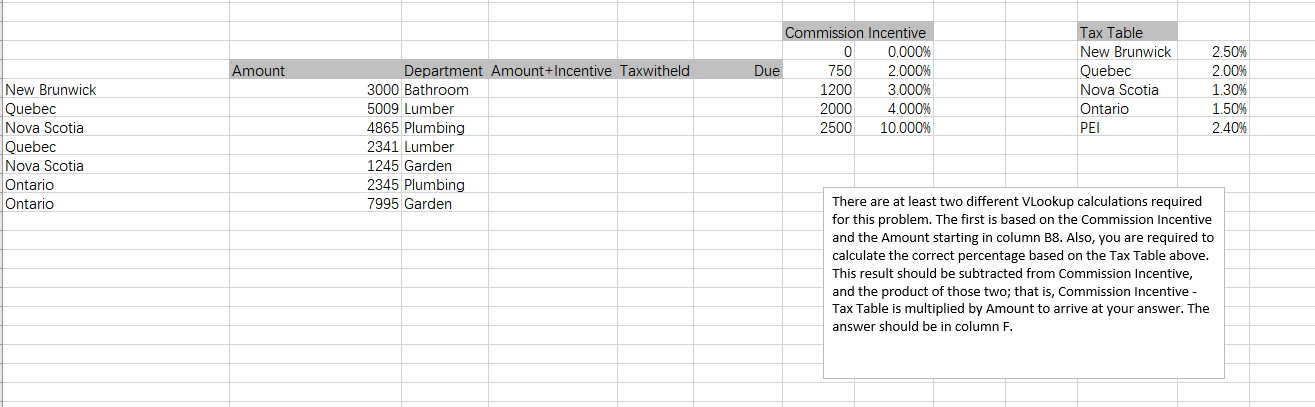

New Brunwick Quebec Nova Scotia Quebec Nova Scotia Ontario Ontario Commission Incentive Tax Table 0 0.000% New Brunwick 2.50% Amount Department Amount+Incentive Taxwitheld Due

New Brunwick Quebec Nova Scotia Quebec Nova Scotia Ontario Ontario Commission Incentive Tax Table 0 0.000% New Brunwick 2.50% Amount Department Amount+Incentive Taxwitheld Due 750 2.000% Quebec 2.00% 3000 Bathroom 1200 3.000% Nova Scotia 1.30% 5009 Lumber 2000 4.000% 2500 10.000% Ontario 1.50% 2.40% 4865 Plumbing 2341 Lumber 1245 Garden 2345 Plumbing 7995 Garden There are at least two different Vlookup calculations required for this problem. The first is based on the Commission Incentive and the Amount starting in column B8. Also, you are required to calculate the correct percentage based on the Tax Table above. This result should be subtracted from Commission Incentive, and the product of those two; that is, Commission Incentive - Tax Table is multiplied by Amount to arrive at your answer. The answer should be in column F.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started