New City uses the full accrual method to prepare journal entries for its Government-Wide financial statements. Prepare the journal entries to record each transaction

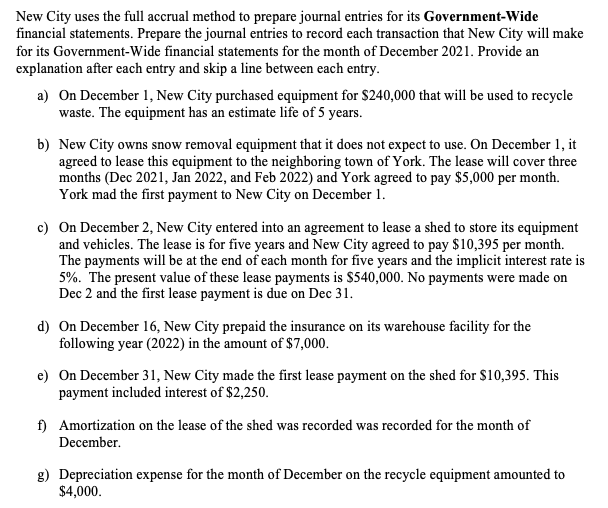

New City uses the full accrual method to prepare journal entries for its Government-Wide financial statements. Prepare the journal entries to record each transaction that New City will make for its Government-Wide financial statements for the month of December 2021. Provide an explanation after each entry and skip a line between each entry. a) On December 1, New City purchased equipment for $240,000 that will be used to recycle waste. The equipment has an estimate life of 5 years. b) New City owns snow removal equipment that it does not expect to use. On December 1, it agreed to lease this equipment to the neighboring town of York. The lease will cover three months (Dec 2021, Jan 2022, and Feb 2022) and York agreed to pay $5,000 per month. York mad the first payment to New City on December 1. c) On December 2, New City entered into an agreement to lease a shed to store its equipment and vehicles. The lease is for five years and New City agreed to pay $10,395 per month. The payments will be at the end of each month for five years and the implicit interest rate is 5%. The present value of these lease payments is $540,000. No payments were made on Dec 2 and the first lease payment is due on Dec 31. d) On December 16, New City prepaid the insurance on its warehouse facility for the following year (2022) in the amount of $7,000. e) On December 31, New City made the first lease payment on the shed for $10,395. This payment included interest of $2,250. f) Amortization on the lease of the shed was recorded was recorded for the month of December. g) Depreciation expense for the month of December on the recycle equipment amounted to $4,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution Journal Entries in the books of New city for the month of December 2021 Date Particular ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started