Answered step by step

Verified Expert Solution

Question

1 Approved Answer

New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $283,600. The ovens originally cost $378,000

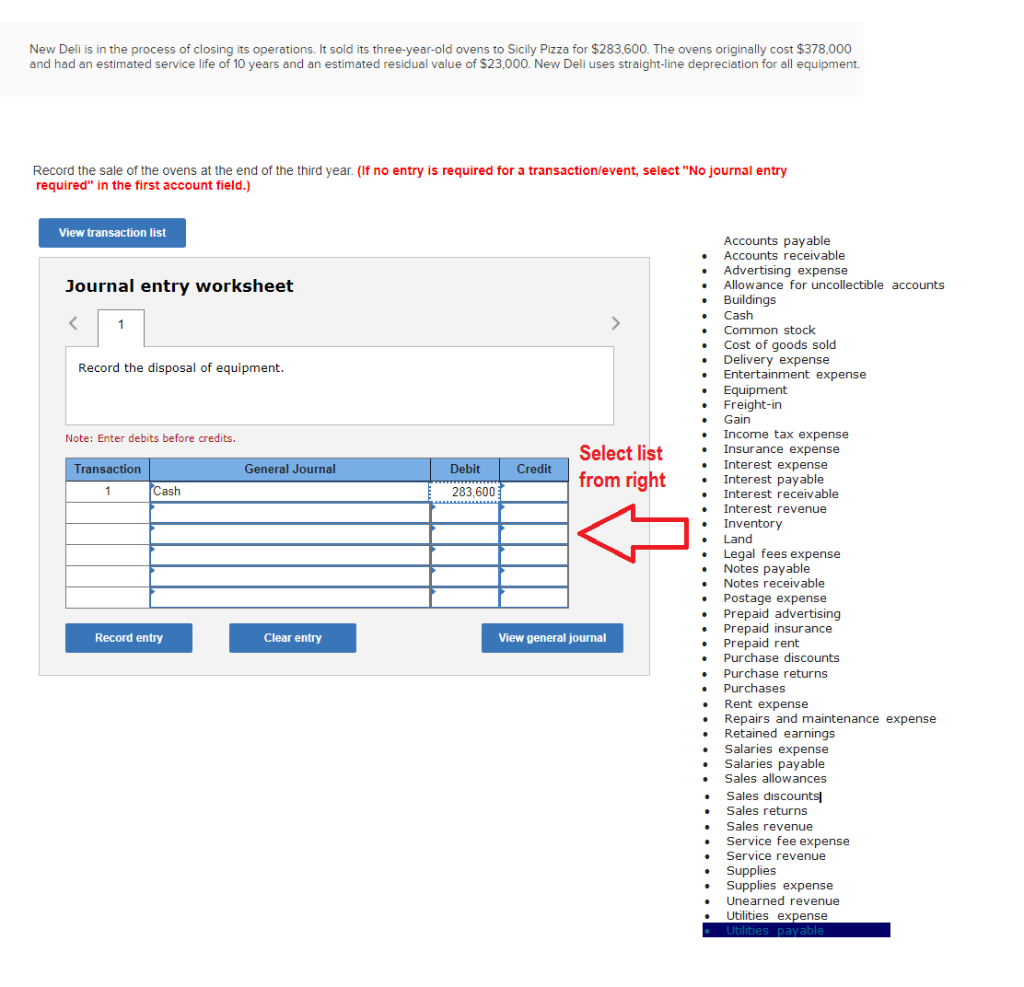

New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $283,600. The ovens originally cost $378,000 and had an estimated service life of 10 years and an estimated residual value of $23,000. New Deli uses straight-line depreciation for all equipment.

a) Record the sale of the ovens at the end of the third year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $283,600. The ovens originally cost $378,000 and had an estimated service life of 10 years and an estimated residual value of $23,000. New Deli uses straight-line depreciation for all equipment. Record the sale of the ovens at the end of the third year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Accounts payable Accounts receivable Advertising expense Allowance for uncollectible accounts Buildings Cash Common stock Cost of goods sold Journal entry worksheet . Delivery expense Record the disposal of equipment. Entertainment expense Equipment Freight-in Gain Note: Enter debits before credits Income tax expense Select listInsurance expense from right. Interest payable Transaction General Journal Debit Interest expense ash 283,600 Interest receivable Interest revenue Inventory Land Legal fees expense Notes payable Notes receivable Postage expense . Prepaid advertising Prepaid insurance Prepaid rent Purchase discounts Purchase returns Purchases Rent expense Repairs and maintenance expense Retained earnings Salaries expense Salaries payable Sales allowances Record entry Clear entry View general journal Sales discounts . Sales returns Sales revenue .Service fee expense Service revenue Supplies .Supplies expense Unearned revenue Utilities expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started