Answered step by step

Verified Expert Solution

Question

1 Approved Answer

New Model Z: Purchase cost is $650,000 and installation costs are $22,000. The same 5-year MACRS depreciation schedule will be used. At the end of

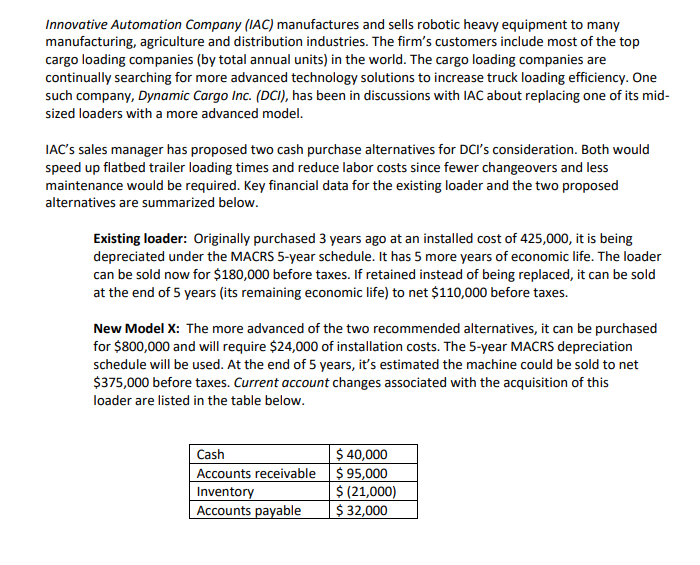

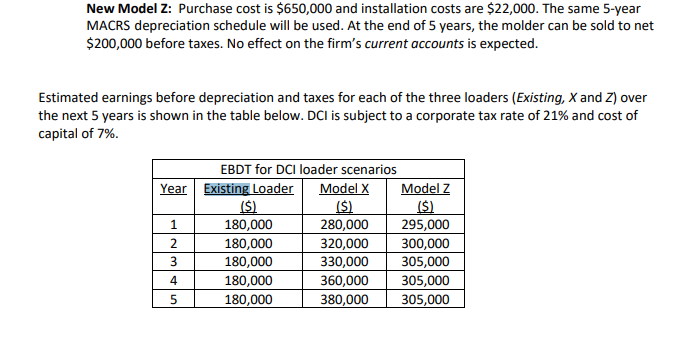

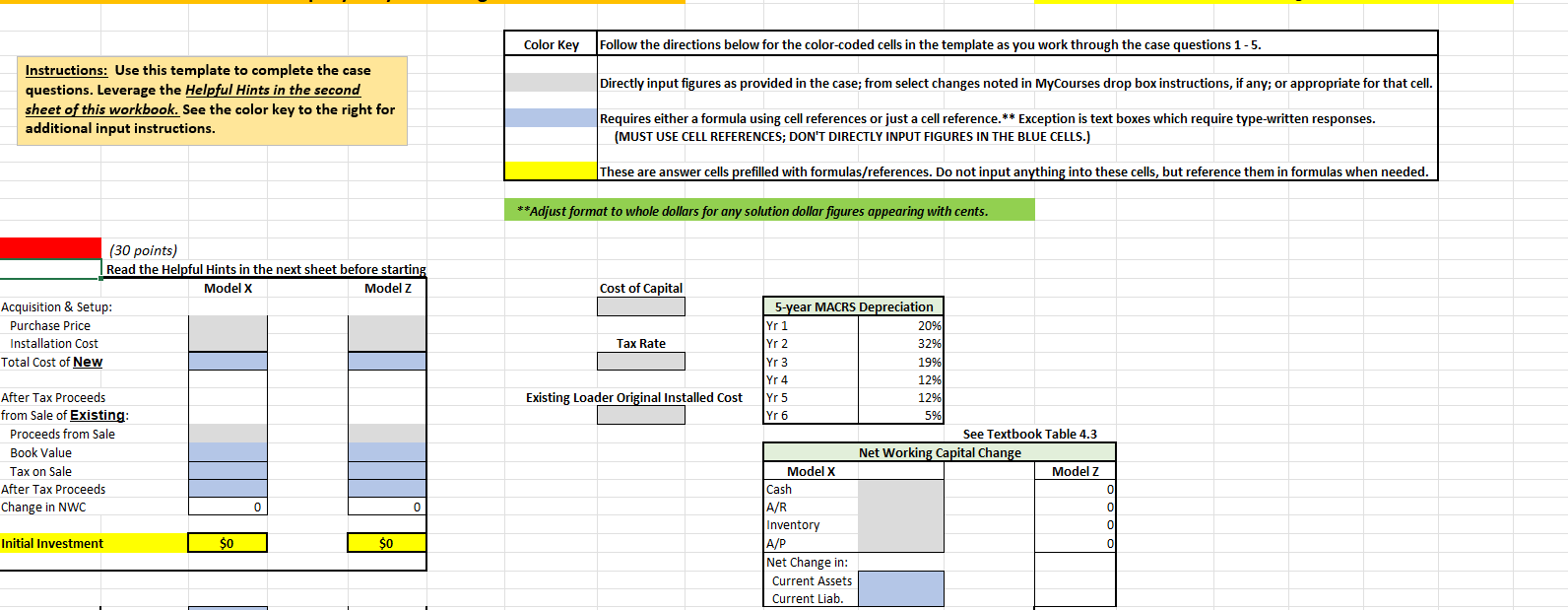

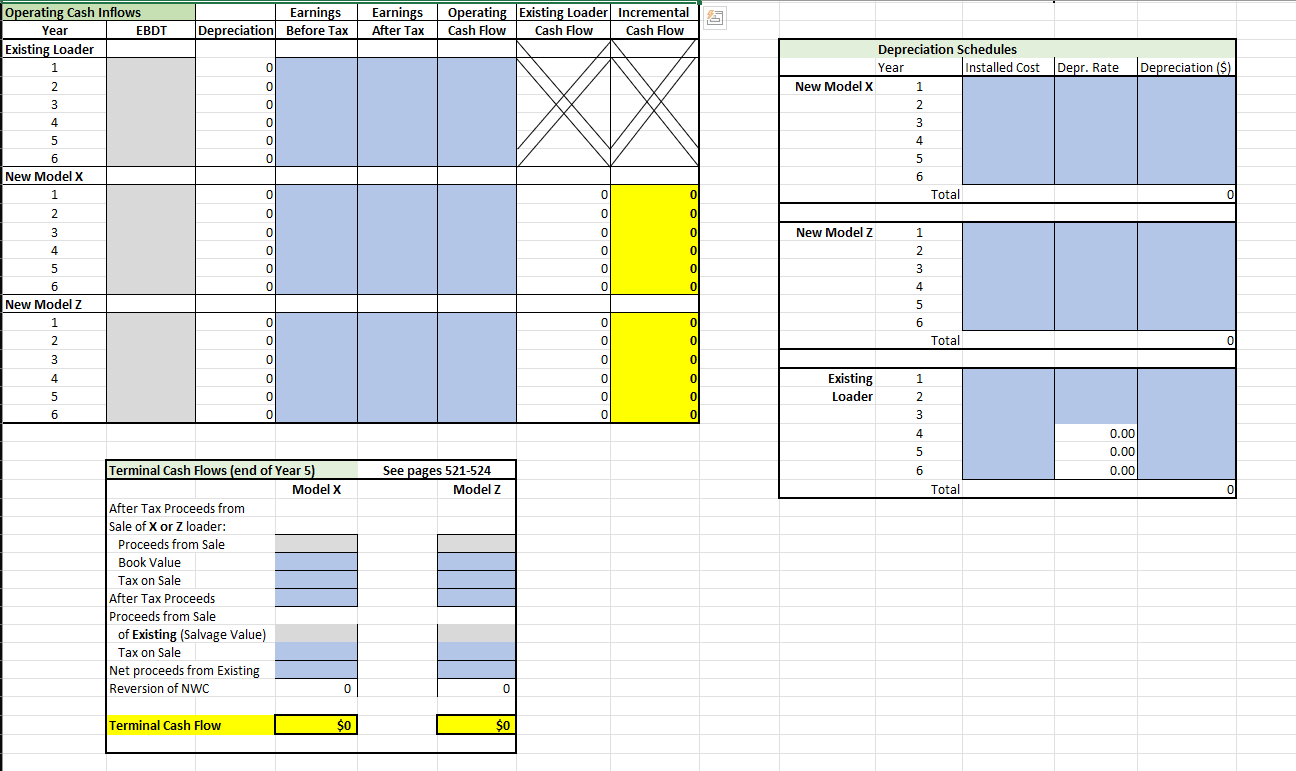

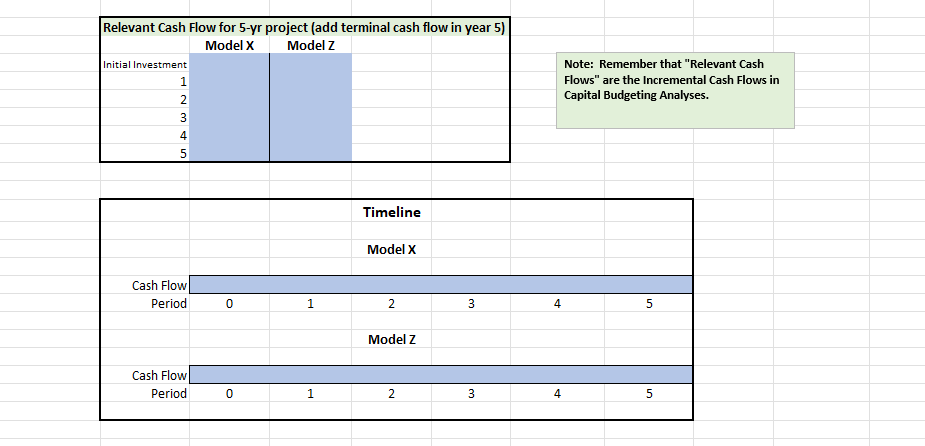

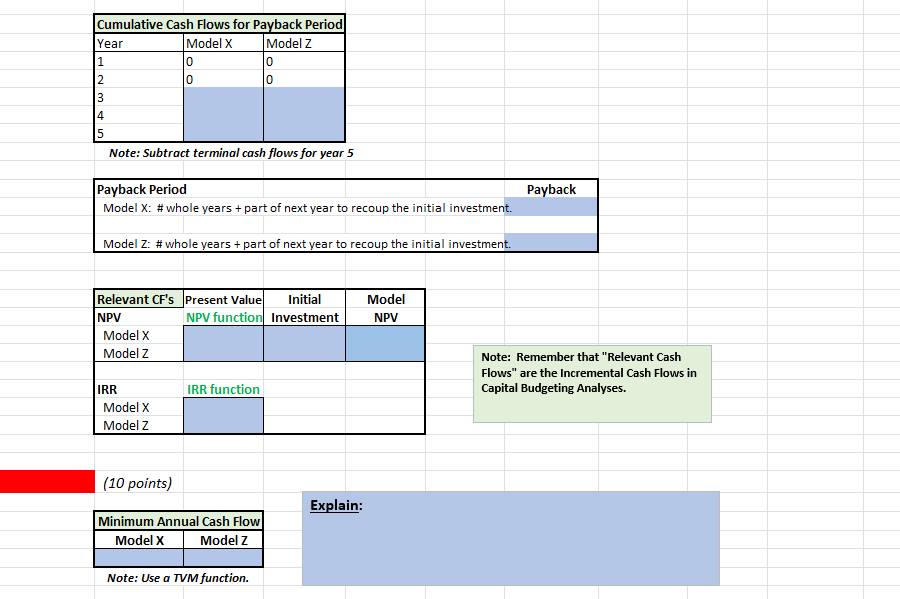

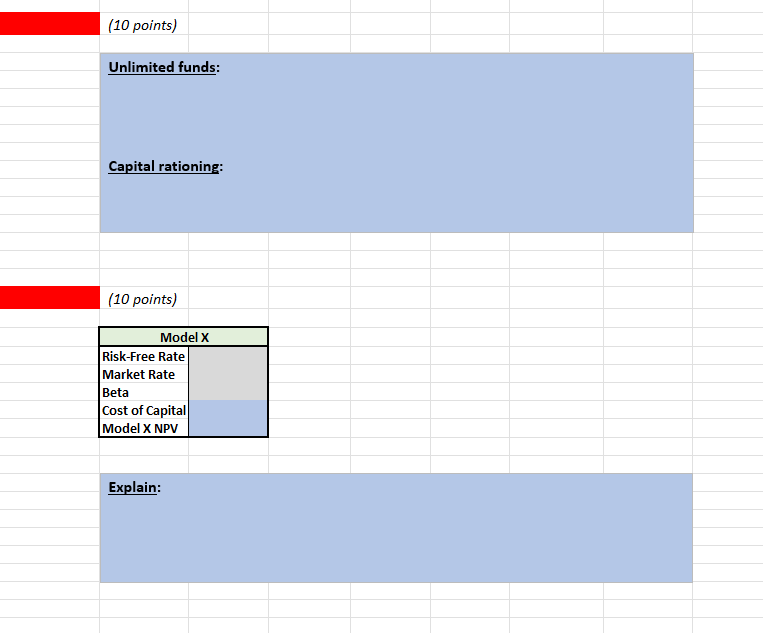

New Model Z: Purchase cost is $650,000 and installation costs are $22,000. The same 5-year MACRS depreciation schedule will be used. At the end of 5 years, the molder can be sold to net $200,000 before taxes. No effect on the firm's current accounts is expected. Estimated earnings before depreciation and taxes for each of the three loaders (Existing, X and Z ) over the next 5 years is shown in the table below. DCl is subject to a corporate tax rate of 21% and cost of capital of 7%. C's sales manager has proposed two cash purchase alternatives for DCl's consideration. Both would eed up flatbed trailer loading times and reduce labor costs since fewer changeovers and less aintenance would be required. Key financial data for the existing loader and the two proposed ternatives are summarized below. Existing loader: Originally purchased 3 years ago at an installed cost of 425,000 , it is being depreciated under the MACRS 5-year schedule. It has 5 more years of economic life. The loader can be sold now for $180,000 before taxes. If retained instead of being replaced, it can be sold at the end of 5 years (its remaining economic life) to net $110,000 before taxes. New Model X: The more advanced of the two recommended alternatives, it can be purchased for $800,000 and will require $24,000 of installation costs. The 5-year MACRS depreciation schedule will be used. At the end of 5 years, it's estimated the machine could be sold to net $375,000 before taxes. Current account changes associated with the acquisition of this loader are listed in the table below. Instructions: Use this template to complete the case questions. Leverage the Helpful Hints in the second sheet of this workbook. See the color key to the right for additional input instructions. (30 points) Read the Helpful Hints in the next sheet before starting \begin{tabular}{|c|c|c|} \hline \multirow{2}{*}{\multicolumn{3}{|c|}{ Acquisition \& Setup: }} \\ \hline & & \\ \hline \multirow{2}{*}{\multicolumn{3}{|c|}{\begin{tabular}{l} Purchase Price \\ Installation Cost \end{tabular}}} \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Total Cost of New } \\ \hline \multicolumn{3}{|l|}{ After Tax Proceeds } \\ \hline \multicolumn{3}{|c|}{ from Sale of Existing: } \\ \hline \multicolumn{3}{|l|}{ Proceeds from Sale } \\ \hline \multicolumn{3}{|l|}{ Book Value } \\ \hline \multicolumn{3}{|l|}{ Tax on Sale } \\ \hline \multicolumn{3}{|l|}{ After Tax Proceeds } \\ \hline Change in NWC & 0 & 0 \\ \hline Initial Investment & $0 & $0 \\ \hline \end{tabular} \begin{tabular}{|c|l|} \hline Color Key & Follow the directions below for the color-coded cells in the template as you work through the case questions 1 - 5. \\ & \begin{tabular}{r} Directly input figures as provided in the case; from select changes noted in MyCourses drop box instructions, if any; or appropriate for that cell. \\ Requires either a formula using cell references or just a cell reference.** Exception is text boxes which require type-written responses. \\ (MUST USE CELL REFERENCES; DON'T DIRECTLY INPUT FIGURES IN THE BLUE CELLS.) \\ These are answer cells prefilled with formulas/references. Do not input anything into these cells, but reference them in formulas when needed. \end{tabular} \\ \hline \end{tabular} **Adjust format to whole dollars for any solution dollar figures appearing with cents. (10 points) Unlimited funds: Capital rationing: (10 points) \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Model X } \\ \hline Risk-Free Rate & \\ Market Rate & \\ Beta & \\ Cost of Capital & \\ \hline Model X NPV & \\ \hline \end{tabular} Explain: \begin{tabular}{|l|l|l|} \hline \multicolumn{3}{|l|}{ Cumulative Cash Flows for Payback Period } \\ \hline Year & Model X & Model Z \\ \hline 1 & 0 & 0 \\ 2 & 0 & 0 \\ 3 & & \\ 4 & & \\ 5 & & \\ \hline \end{tabular} Note: Subtract terminal cash flows for year 5 Payback Period Payback Model X: \# whole years + part of next year to recoup the initial investment. Model Z: \# whole years + part of next year to recoup the initial investment. \begin{tabular}{|c|c|c|c|} \hline Relevant CF's & Present Value & Initial & Model \\ \hline NPV & NPV function & Investment & NPV \\ \hline \multicolumn{4}{|l|}{ Model X } \\ \hline \multicolumn{4}{|l|}{ Model Z } \\ \hline IRR & IRR function & & \\ \hline Model X & & & \\ \hline Model Z & & & \\ \hline \end{tabular} (10 points) Explain: \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ Minimum Annual Cash Flow } \\ \hline Model X & Model Z \\ \hline & \\ \hline \end{tabular} Note: Remember that "Relevant Cash Flows" are the Incremental Cash Flows in Capital Budgeting Analyses. Note: Use a TVM function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started