Answered step by step

Verified Expert Solution

Question

1 Approved Answer

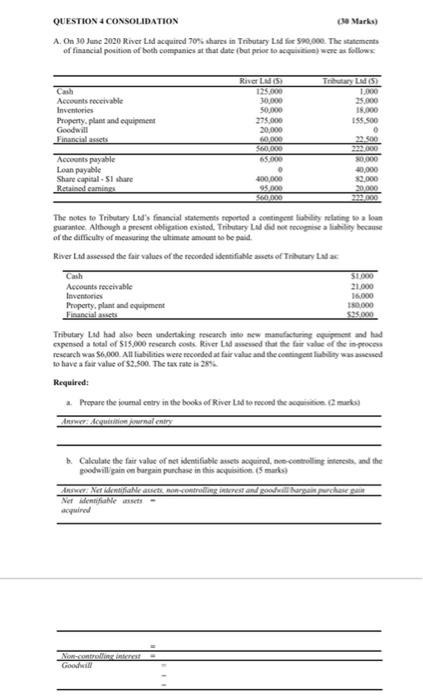

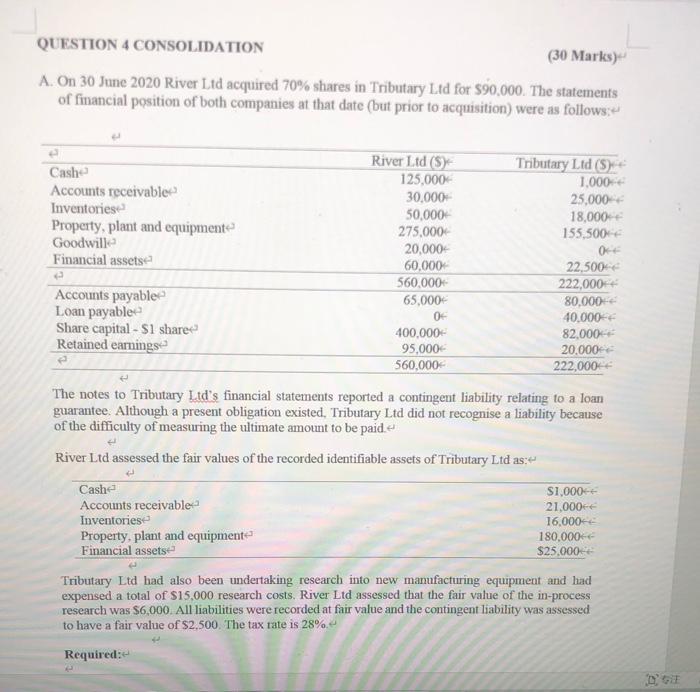

new photo available QUESTION 4 CONSOLIDATION 010 Marks) A. On 30 June 2020 River Lod acquired 70% shares an Tributary Lsd fe 590.00. The statements

new photo available

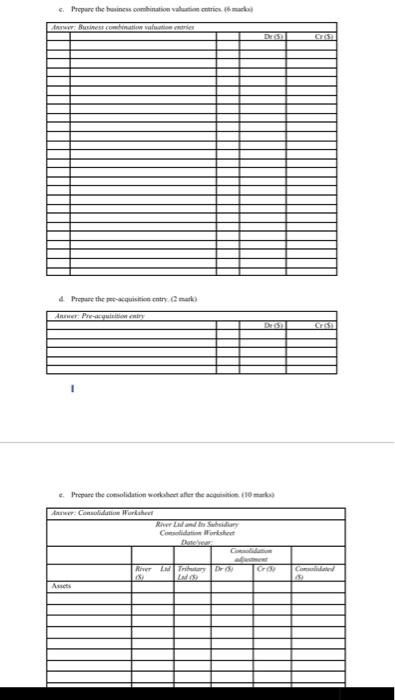

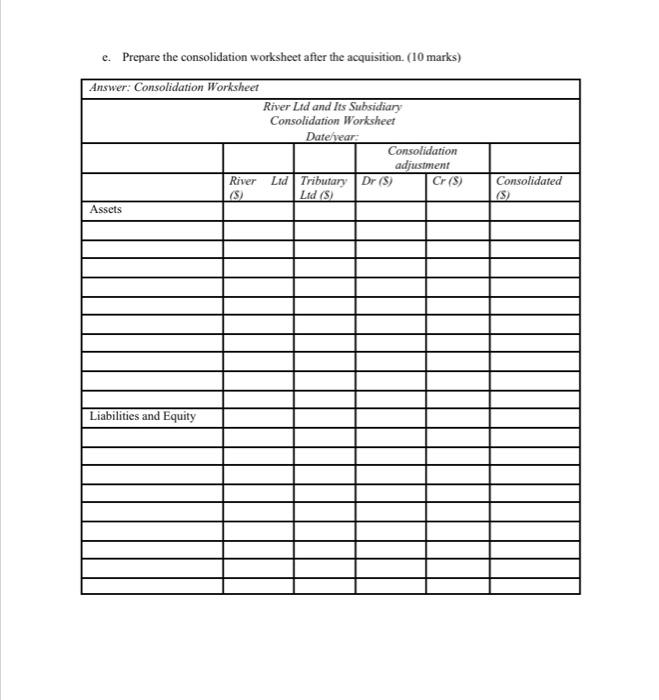

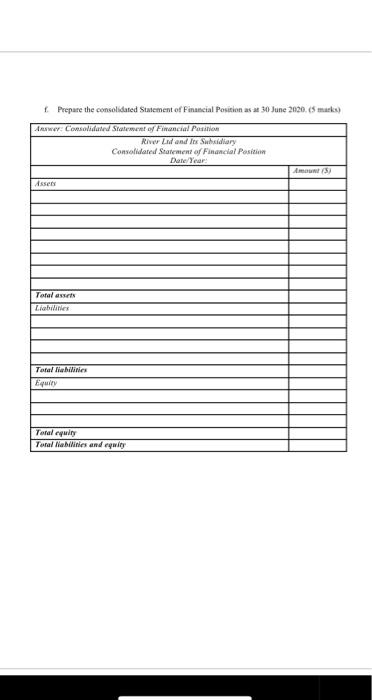

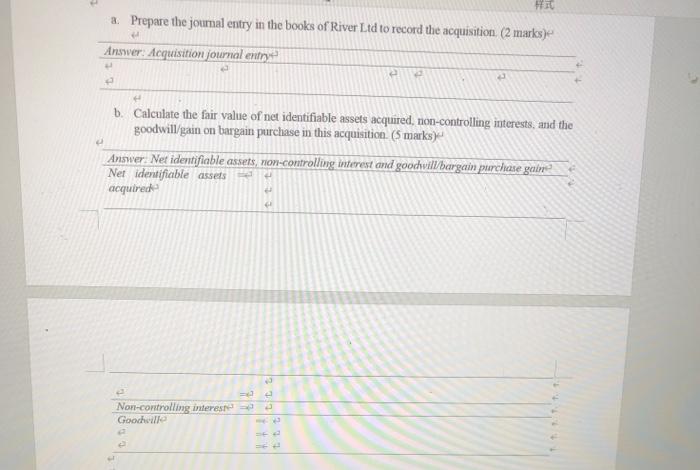

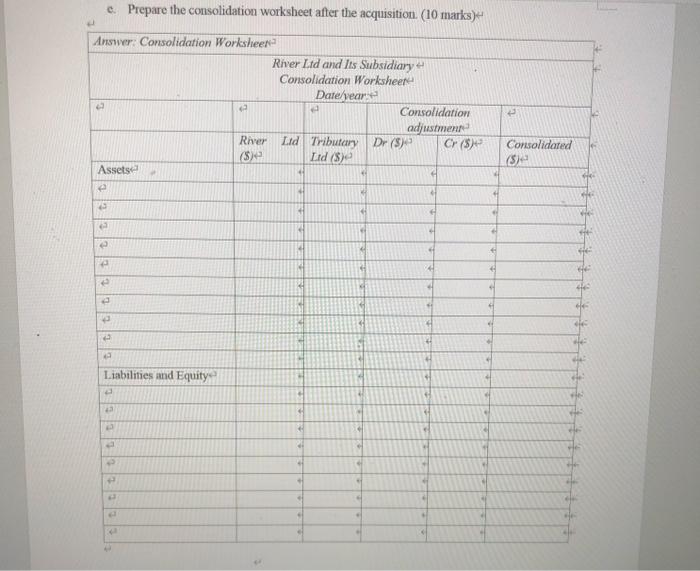

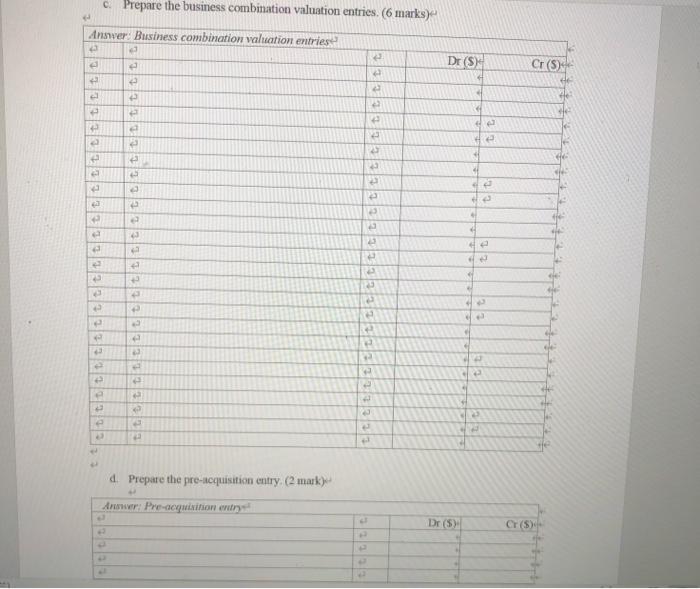

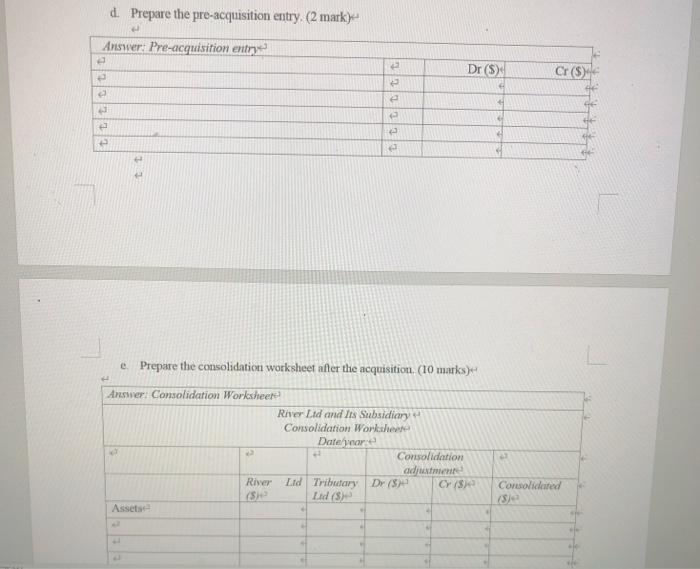

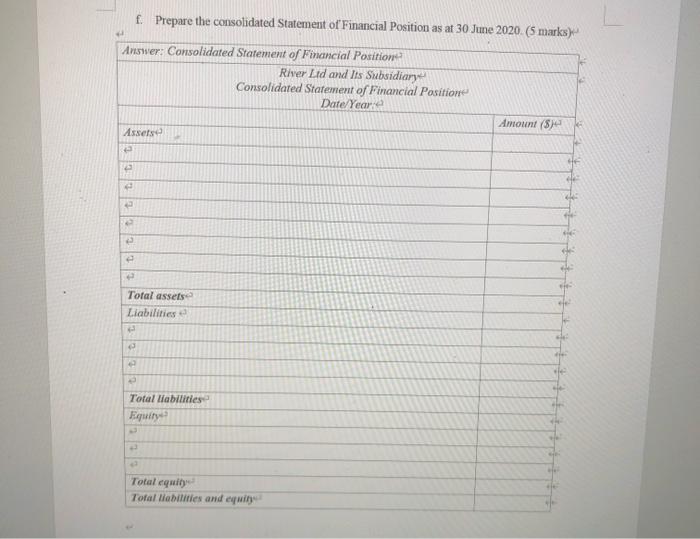

QUESTION 4 CONSOLIDATION 010 Marks) A. On 30 June 2020 River Lod acquired 70% shares an Tributary Lsd fe 590.00. The statements of financial position of both companies at that date but prior to acquit) were as follows Tribuy 100 Accounts receivable Inventories Property, plant and equipment Goodwill Financial assets 18.000 15.500 0 River 12.000 30,000 50,000 275.000 20.000 0.000 SEO,000 65.000 . 400,000 95.000 SC.000 Accounts payable Loan payable Share capital Share Retail.com 000 10,000 30,000 2000 2000 The notes to Tributary Lod's financial statements reported a contingenting a loan paranee. Although a present obligation exstod. Tributary Lad did not recoge because of the difficulty of measuring the ultimate amount to be said. Riverad assessed the fair values of the recorded identifiable anets of Tribayt 26 Cash SODO Accounts receivable 21.000 Inventories 16.000 Property, plant and equipment Finants 525.000 Tributary Lod had also been undertaking rocachinto new manufacturing met and had expensed a total of $15.000 research costs River Laded that the fair value of the in proces research was $6,000. All lubilities were recorded at fair value and the contingentbility was to have a fair value of $2.500. The tax rate 25% Required: Prepare the foumal cetry in the books of River Lad to record the tears were lagu ini walay Calculate the fair value of net identifiable acquired, necrolling in and the podwill gain on bargain purchase in this works Aww Na Mafia Barallongest and March Ne identifiable assets acquired Net Gold 6. Prepare the business einston va com www Business combination valtion tres DE 5 d. Prepare the action catrymat APY CU Prepare the comioiden och fler the action (10 Arr: Cinderel The Swary Condorchest lorar Com Assets e. Prepare the consolidation worksheet after the acquisition. (10 marks) Answer: Consolidation Worksheet River Lid and Its Subsidiary Consolidation Worksheet Date/vear: Consolidation adjustment River Ltd Tributary Dr (8) Cr (5) Lid (5) Consolidated (S) Assets Liabilities and Equity Prepare the consolidated Statement of Financial Position as a 30 June 2020.marks) Answer: Consolidated Statement of Financial Position Riwandle Shidary Consolidated Statement of Financial Position Date/Year Am Asses Tonala Liabilities Total Mines Equity Total city Total abilities and equity QUESTION 4 CONSOLIDATION (30 Marks) A. On 30 June 2020 River Ltd acquired 70% shares in Tributary Ltd for $90,000. The statements of financial position of both companies at that date (but prior to acquisition) were as follows: Cashe Accounts receivable Inventoriese Property, plant and equipment Goodwille Financial assetse River Ltd (5) 125,000 30,000 50,000 275,000 20,000- 60.000- 560.000 65,000- Tributary Ltd (5) 1.000- 25,000 18,000+ 155,500 Accounts payable Loan payable Share capital - S1 share Retained earnings 22.500 222,000 80,000 40.000 82,000- 20.000 222,000+ 400,000+ 95,000 560,000+ The notes to Tributary Ltd's financial statements reported a contingent liability relating to a loan guarantee. Although a present obligation existed, Tributary Ltd did not recognise a liability because of the difficulty of measuring the ultimate amount to be paid. River Ltd assessed the fair values of the recorded identifiable assets of Tributary Ltd as: Cash Accounts receivable Inventoriese Property, plant and equipment Financial assetse $1,000- 21,000- 16,000+ 180.000- $25.000 Tributary Ltd had also been undertaking research into new mamfacturing equipment and had expensed a total of $15.000 research costs, River Ltd assessed that the fair value of the in-process research was $6,000. All liabilities were recorded at fair value and the contingent liability was assessed to have a fair value of $2.500. The tax rate is 28% Required: FER 2. Prepare the journal entry in the books of River Ltd to record the acquisition. (2 marks) Answer: Acquisition journal entry b. Calculate the fair value of net identifiable assets acquired, non-controlling interests, and the goodwill/gain on bargain purchase in this acquisition (5 marks) Answer. Net identifiable assets, non-controlling interest and goodwill bargain purchase galerie Net identifiable assets acquired Non-controlling interest Goochelle tut tot c. Prepare the consolidation worksheet after the acquisition (10 marks) Answer: Consolidation Worksheen River Ltd and Its Subsidiary Consolidation Worksheet Date/vear Consolidation adjustment River Ltd Tributary Dr (5) Cr(s) (8) Lid) Assets Consolidated ) 4 4 4 4 Liabilities and Equity c. Prepare the business combination valuation entries. (6 marks) Ansver: Business combination valuation entries C e Dr (S) Cr () C ch ele 4 2 5 e 4 45 C 5 67 C . d. Prepare the pre-requisition entry (2 mark) Arower: Pre-acquisitionery Dr(s) CT(S) d. Prepare the pre-acquisition entry. (2 mark) Answer: Pre-acquisition entry e Dr (S) Cr ($) a e e. Prepare the consolidation worksheet after the acquisition. (10 marks) Answer: Consolidation Worksheet River Lid and Its Subsidiary Consolidation Worksheet Date/year Consolidation adiume River Lid Tributary Dr (8) Cr(se Lid (3) Assets Consolidated f. Prepare the consolidated Statement of Financial Position as at 30 June 2020 (5 marks) Answer: Consolidated Statement of Financial Position River Lid and Its Subsidiary Consolidated Statement of Financial Positione Date/Year Amount (3) Assets SI Total assets Liabilities Total liabilities Total equity Total liabilities and equity QUESTION 4 CONSOLIDATION 010 Marks) A. On 30 June 2020 River Lod acquired 70% shares an Tributary Lsd fe 590.00. The statements of financial position of both companies at that date but prior to acquit) were as follows Tribuy 100 Accounts receivable Inventories Property, plant and equipment Goodwill Financial assets 18.000 15.500 0 River 12.000 30,000 50,000 275.000 20.000 0.000 SEO,000 65.000 . 400,000 95.000 SC.000 Accounts payable Loan payable Share capital Share Retail.com 000 10,000 30,000 2000 2000 The notes to Tributary Lod's financial statements reported a contingenting a loan paranee. Although a present obligation exstod. Tributary Lad did not recoge because of the difficulty of measuring the ultimate amount to be said. Riverad assessed the fair values of the recorded identifiable anets of Tribayt 26 Cash SODO Accounts receivable 21.000 Inventories 16.000 Property, plant and equipment Finants 525.000 Tributary Lod had also been undertaking rocachinto new manufacturing met and had expensed a total of $15.000 research costs River Laded that the fair value of the in proces research was $6,000. All lubilities were recorded at fair value and the contingentbility was to have a fair value of $2.500. The tax rate 25% Required: Prepare the foumal cetry in the books of River Lad to record the tears were lagu ini walay Calculate the fair value of net identifiable acquired, necrolling in and the podwill gain on bargain purchase in this works Aww Na Mafia Barallongest and March Ne identifiable assets acquired Net Gold 6. Prepare the business einston va com www Business combination valtion tres DE 5 d. Prepare the action catrymat APY CU Prepare the comioiden och fler the action (10 Arr: Cinderel The Swary Condorchest lorar Com Assets e. Prepare the consolidation worksheet after the acquisition. (10 marks) Answer: Consolidation Worksheet River Lid and Its Subsidiary Consolidation Worksheet Date/vear: Consolidation adjustment River Ltd Tributary Dr (8) Cr (5) Lid (5) Consolidated (S) Assets Liabilities and Equity Prepare the consolidated Statement of Financial Position as a 30 June 2020.marks) Answer: Consolidated Statement of Financial Position Riwandle Shidary Consolidated Statement of Financial Position Date/Year Am Asses Tonala Liabilities Total Mines Equity Total city Total abilities and equity QUESTION 4 CONSOLIDATION (30 Marks) A. On 30 June 2020 River Ltd acquired 70% shares in Tributary Ltd for $90,000. The statements of financial position of both companies at that date (but prior to acquisition) were as follows: Cashe Accounts receivable Inventoriese Property, plant and equipment Goodwille Financial assetse River Ltd (5) 125,000 30,000 50,000 275,000 20,000- 60.000- 560.000 65,000- Tributary Ltd (5) 1.000- 25,000 18,000+ 155,500 Accounts payable Loan payable Share capital - S1 share Retained earnings 22.500 222,000 80,000 40.000 82,000- 20.000 222,000+ 400,000+ 95,000 560,000+ The notes to Tributary Ltd's financial statements reported a contingent liability relating to a loan guarantee. Although a present obligation existed, Tributary Ltd did not recognise a liability because of the difficulty of measuring the ultimate amount to be paid. River Ltd assessed the fair values of the recorded identifiable assets of Tributary Ltd as: Cash Accounts receivable Inventoriese Property, plant and equipment Financial assetse $1,000- 21,000- 16,000+ 180.000- $25.000 Tributary Ltd had also been undertaking research into new mamfacturing equipment and had expensed a total of $15.000 research costs, River Ltd assessed that the fair value of the in-process research was $6,000. All liabilities were recorded at fair value and the contingent liability was assessed to have a fair value of $2.500. The tax rate is 28% Required: FER 2. Prepare the journal entry in the books of River Ltd to record the acquisition. (2 marks) Answer: Acquisition journal entry b. Calculate the fair value of net identifiable assets acquired, non-controlling interests, and the goodwill/gain on bargain purchase in this acquisition (5 marks) Answer. Net identifiable assets, non-controlling interest and goodwill bargain purchase galerie Net identifiable assets acquired Non-controlling interest Goochelle tut tot c. Prepare the consolidation worksheet after the acquisition (10 marks) Answer: Consolidation Worksheen River Ltd and Its Subsidiary Consolidation Worksheet Date/vear Consolidation adjustment River Ltd Tributary Dr (5) Cr(s) (8) Lid) Assets Consolidated ) 4 4 4 4 Liabilities and Equity c. Prepare the business combination valuation entries. (6 marks) Ansver: Business combination valuation entries C e Dr (S) Cr () C ch ele 4 2 5 e 4 45 C 5 67 C . d. Prepare the pre-requisition entry (2 mark) Arower: Pre-acquisitionery Dr(s) CT(S) d. Prepare the pre-acquisition entry. (2 mark) Answer: Pre-acquisition entry e Dr (S) Cr ($) a e e. Prepare the consolidation worksheet after the acquisition. (10 marks) Answer: Consolidation Worksheet River Lid and Its Subsidiary Consolidation Worksheet Date/year Consolidation adiume River Lid Tributary Dr (8) Cr(se Lid (3) Assets Consolidated f. Prepare the consolidated Statement of Financial Position as at 30 June 2020 (5 marks) Answer: Consolidated Statement of Financial Position River Lid and Its Subsidiary Consolidated Statement of Financial Positione Date/Year Amount (3) Assets SI Total assets Liabilities Total liabilities Total equity Total liabilities and equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started