Question

New Tech (NT) is looking to expand its business. The new business would generate $600,000 per year in sales over the next 5 years.

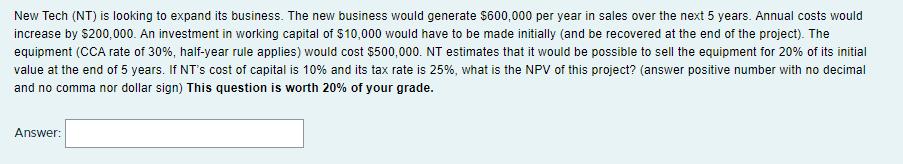

New Tech (NT) is looking to expand its business. The new business would generate $600,000 per year in sales over the next 5 years. Annual costs would increase by $200,000. An investment in working capital of $10,000 would have to be made initially (and be recovered at the end of the project). The equipment (CCA rate of 30%, half-year rule applies) would cost $500,000. NT estimates that it would be possible to sell the equipment for 20% of its initial value at the end of 5 years. If NT's cost of capital is 10% and its tax rate is 25%, what is the NPV of this project? (answer positive number with no decimal and no comma nor dollar sign) This question is worth 20% of your grade. Answer:

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution To calculate the NPV of the project we need to calculate the annual cash inflows and outflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

2nd Canadian edition

176517308, 978-0176517304

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App