Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Newly formed S&J Iron Corporation has 186,000 shares of $5 par common stock authorized. On March 1, Year 1, S&J Iron issued 10,500 shares

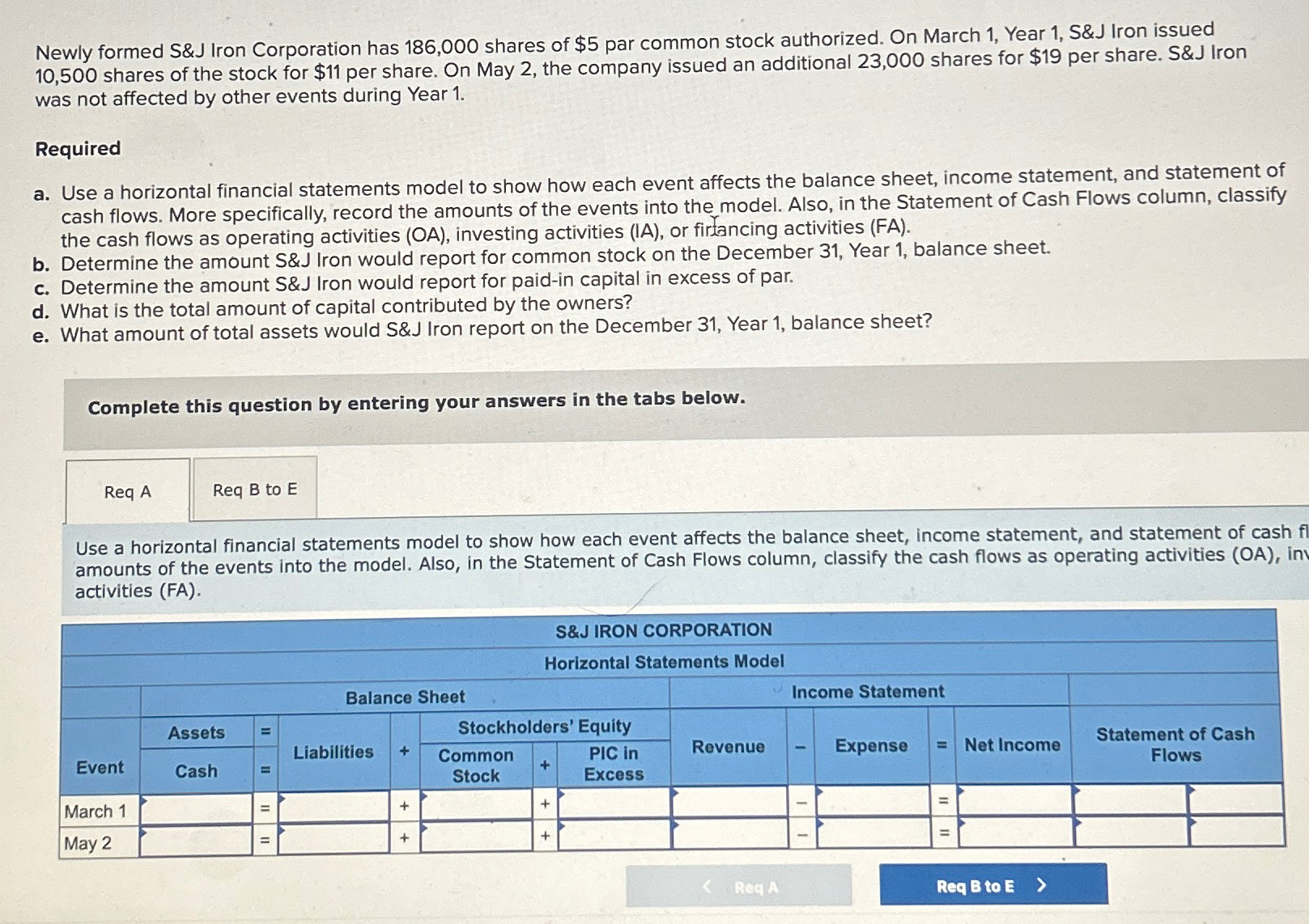

Newly formed S&J Iron Corporation has 186,000 shares of $5 par common stock authorized. On March 1, Year 1, S&J Iron issued 10,500 shares of the stock for $11 per share. On May 2, the company issued an additional 23,000 shares for $19 per share. S&J Iron was not affected by other events during Year 1. Required a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. More specifically, record the amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or firlancing activities (FA). b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. Req A Req B to E Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash fl amounts of the events into the model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), inv activities (FA). S&J IRON CORPORATION Horizontal Statements Model Income Statement Balance Sheet Assets Stockholders' Equity Liabilities + Common Event Cash + Stock PIC in Excess Revenue March 1 May 2 ++ + Expense = Net Income Statement of Cash Flows Req A Req B to E >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Heres how each event affects the financial statements for SJ Iron Corporation using a horizon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started