Newlyweds Jamie Lee and Ross have had several milestones in the past year. They are newly married, recently purchased their first home, and now have twins on the way!

Jamie Lee and Ross have to seriously consider their insurance needs. With a family, a home, and now babies on the way, they are working on developing a risk management plan to help them should an unexpected event arise.

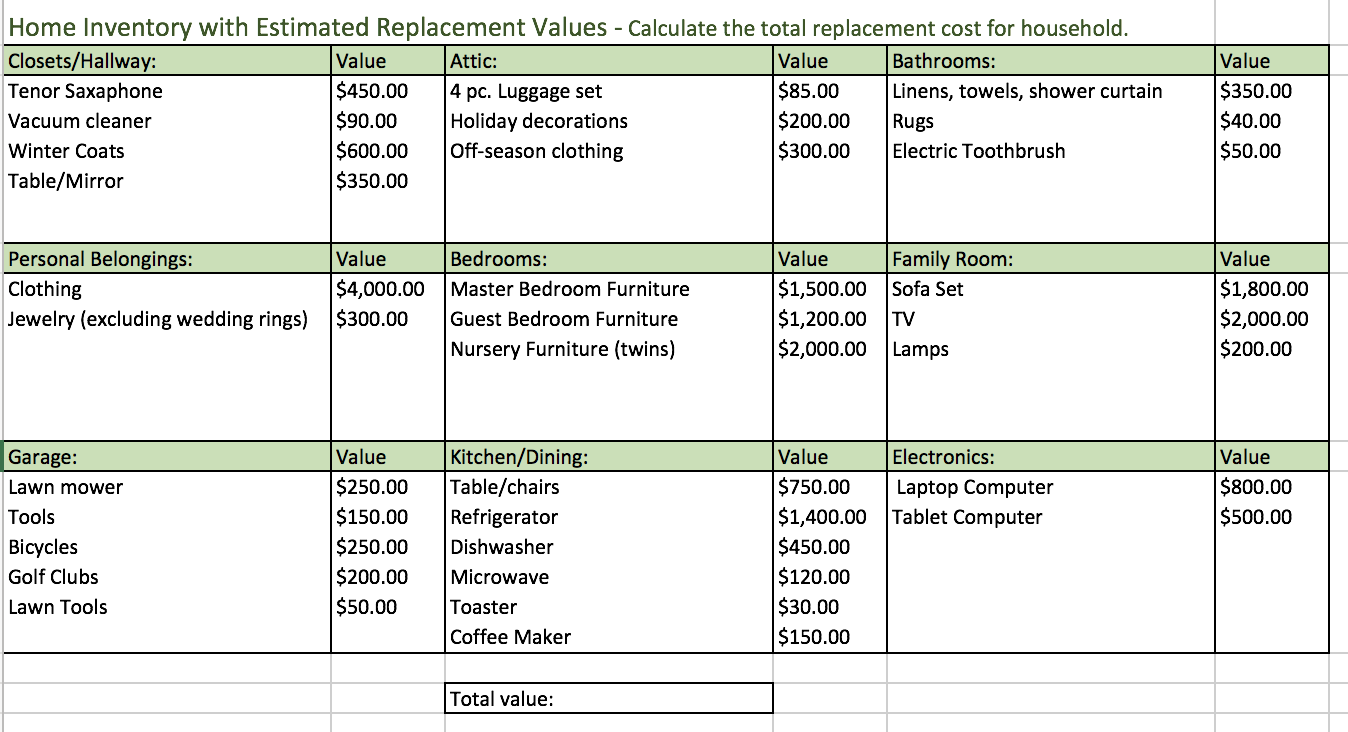

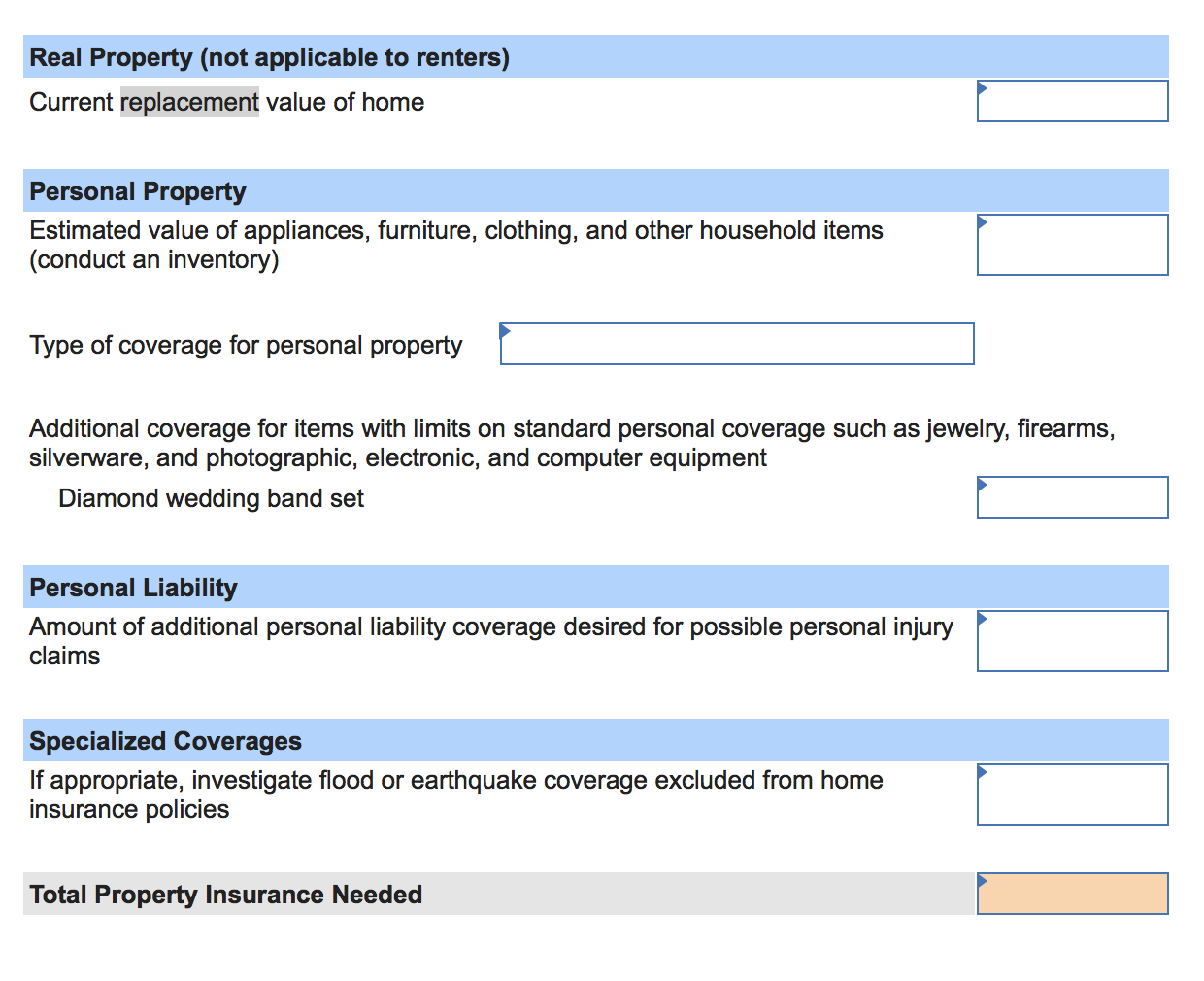

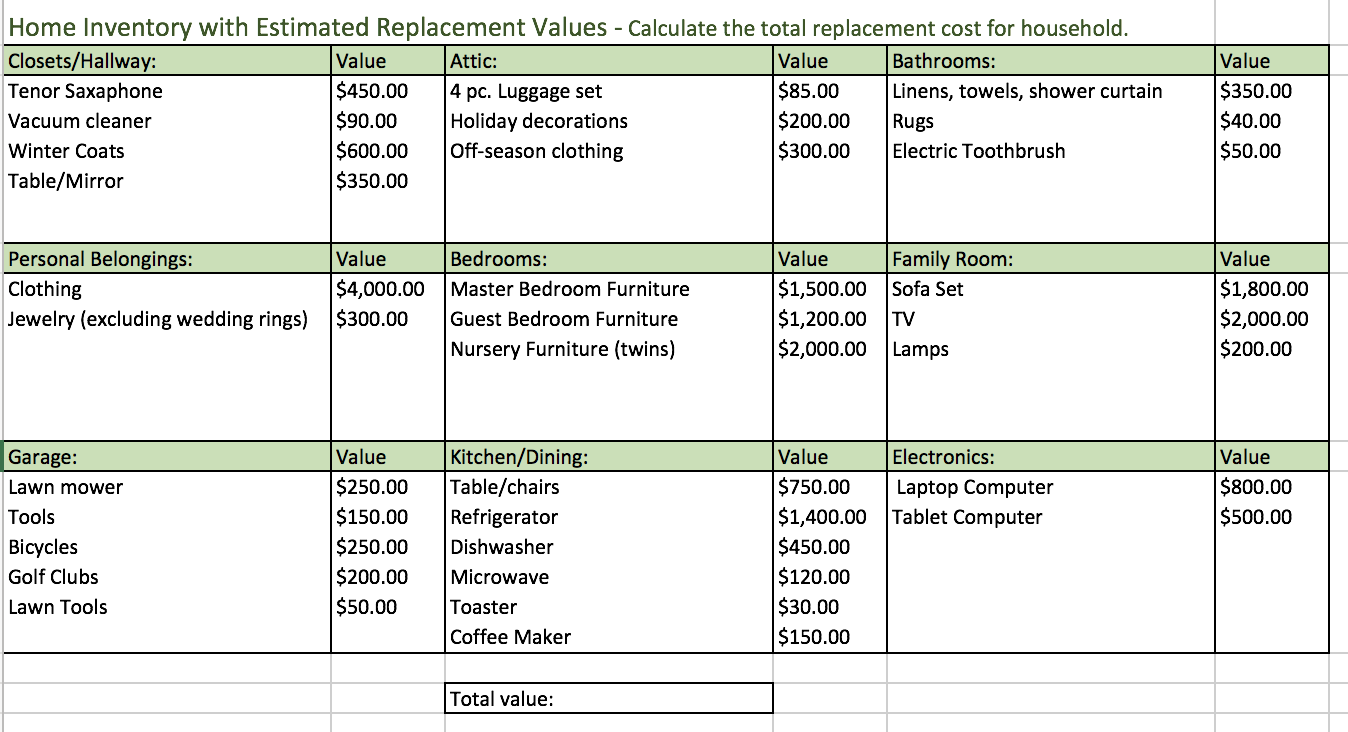

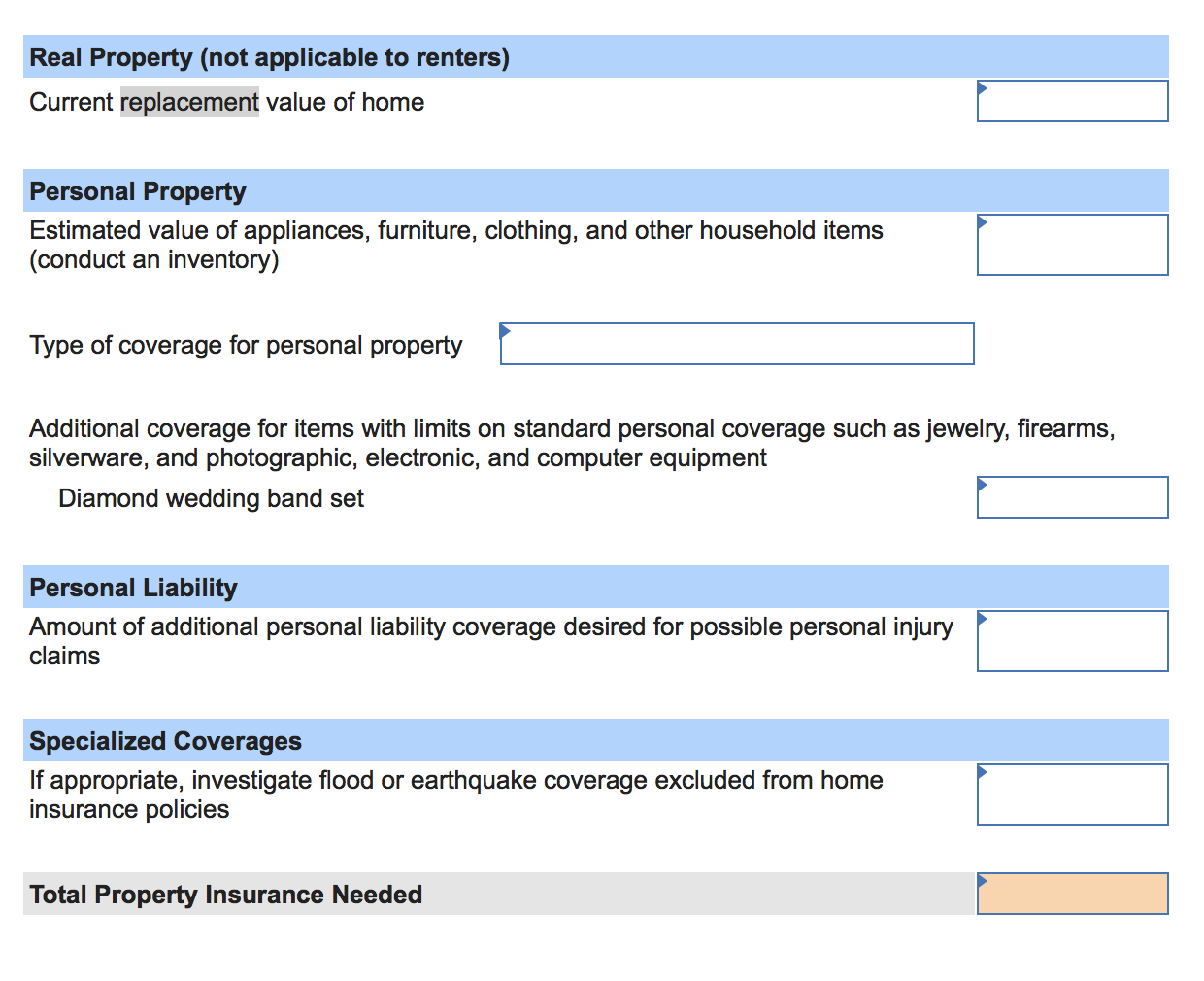

Jamie Lee and Ross created a Household Inventory (see Addendum C), excluding the $2,000 diamond wedding band set. They have elected not to get any further liability or other specialized coverage at this time. Currently, their home has increased in value by $15,000 since they purchased it five years ago. If something unfortunate should happen, they want to ensure that they are able to rebuild their home using the most current costs.

Use this information to complete the table below and determine the total amount of property insurance coverage they will need. Each answer must have a value for the assignment to be complete. Enter "0" for any unused categories.

Current Financial Situation

| Assets: | | | Income: | |

| Checking account | $5,600 | | Gross income (Jamie Lee) | $63,000 |

| Savings account | $23,500 | | Net income after taxes (Jamie Lee) | $47,250 |

| Emergency fund savings account | $21,800 | | Gross income (Ross) | $88,000 |

| IRA balance | $27,300 | | Net income after taxes (Ross) | $74,800 |

| Car (Jamie Lee) | $11,300 | | Monthly Expenses: | |

| Car (Ross) | $19,300 | | Mortgage | $1,420 |

| Liabilities: | | | Property taxes and insurance | $630 |

| Student loan balance | $0 | | Utilities | $110 |

| Credit card balance | $2,000 | | Food | $465 |

| Car loans | $7,300 | | Gas/maintenance | $340 |

| | | | Credit card payment | $315 |

| Original purchase price of home | $301,000 | | Car loan payment | $302 |

| | | | Entertainment | $365 |

Home Inventory with Estimated Replacement Values - Calculate the total replacement cost for household. Closets/Hallway: Value Attic: Value Bathrooms: Tenor Saxaphone $450.00 4 pc. Luggage set $85.00 Linens, towels, shower curtain Vacuum cleaner $90.00 Holiday decorations $200.00 Rugs Winter Coats $600.00 Off-season clothing $300.00 Electric Toothbrush Table/Mirror $350.00 Value $350.00 $40.00 $50.00 Personal Belongings: Clothing Jewelry (excluding wedding rings) Value Bedrooms: $4,000.00 Master Bedroom Furniture $300.00 Guest Bedroom Furniture Nursery Furniture (twins) Value $1,500.00 $1,200.00 $2,000.00 Family Room: Sofa Set TV Value $1,800.00 $2,000.00 $200.00 Lamps Electronics: Laptop Computer Tablet Computer Value $800.00 $500.00 Garage: Lawn mower Tools Bicycles Golf Clubs Lawn Tools Value $250.00 $150.00 $250.00 $200.00 $50.00 Kitchen/Dining: Table/chairs Refrigerator Dishwasher Microwave Toaster Coffee Maker Value $750.00 $1,400.00 $450.00 $120.00 $30.00 $150.00 Total value: Real Property (not applicable to renters) Current replacement value of home Personal Property Estimated value of appliances, furniture, clothing, and other household items (conduct an inventory) r Type of coverage for personal property Additional coverage for items with limits on standard personal coverage such as jewelry, firearms, silverware, and photographic, electronic, and computer equipment Diamond wedding band set Personal Liability Amount of additional personal liability coverage desired for possible personal injury claims Specialized Coverages If appropriate, investigate flood or earthquake coverage excluded from home insurance policies Total Property Insurance Needed Home Inventory with Estimated Replacement Values - Calculate the total replacement cost for household. Closets/Hallway: Value Attic: Value Bathrooms: Tenor Saxaphone $450.00 4 pc. Luggage set $85.00 Linens, towels, shower curtain Vacuum cleaner $90.00 Holiday decorations $200.00 Rugs Winter Coats $600.00 Off-season clothing $300.00 Electric Toothbrush Table/Mirror $350.00 Value $350.00 $40.00 $50.00 Personal Belongings: Clothing Jewelry (excluding wedding rings) Value Bedrooms: $4,000.00 Master Bedroom Furniture $300.00 Guest Bedroom Furniture Nursery Furniture (twins) Value $1,500.00 $1,200.00 $2,000.00 Family Room: Sofa Set TV Value $1,800.00 $2,000.00 $200.00 Lamps Electronics: Laptop Computer Tablet Computer Value $800.00 $500.00 Garage: Lawn mower Tools Bicycles Golf Clubs Lawn Tools Value $250.00 $150.00 $250.00 $200.00 $50.00 Kitchen/Dining: Table/chairs Refrigerator Dishwasher Microwave Toaster Coffee Maker Value $750.00 $1,400.00 $450.00 $120.00 $30.00 $150.00 Total value: Real Property (not applicable to renters) Current replacement value of home Personal Property Estimated value of appliances, furniture, clothing, and other household items (conduct an inventory) r Type of coverage for personal property Additional coverage for items with limits on standard personal coverage such as jewelry, firearms, silverware, and photographic, electronic, and computer equipment Diamond wedding band set Personal Liability Amount of additional personal liability coverage desired for possible personal injury claims Specialized Coverages If appropriate, investigate flood or earthquake coverage excluded from home insurance policies Total Property Insurance Needed