Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Newtrend Ltd is a new business which has been formed to buy standard radio units and modify them to the specific needs of customers.

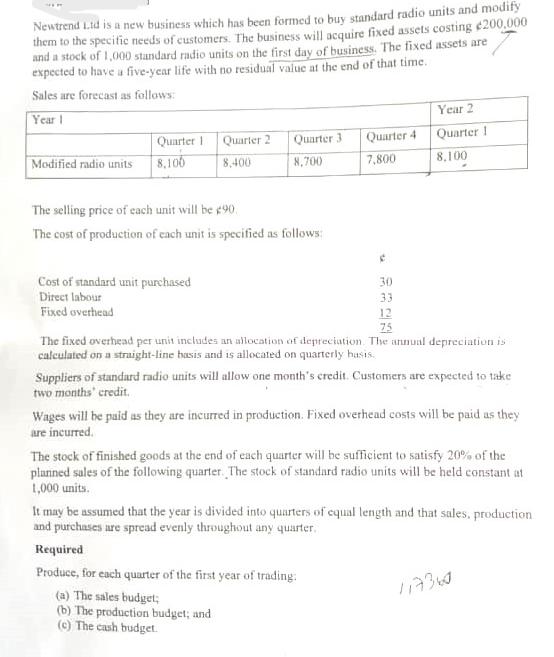

Newtrend Ltd is a new business which has been formed to buy standard radio units and modify them to the specific needs of customers. The business will acquire fixed assets costing 200,000 and a stock of 1,000 standard radio units on the first day of business. The fixed assets are expected to have a five-year life with no residual value at the end of that time. Sales are forecast as follows: Year 1 Year 2 Modified radio units Quarter 1 8,100 Quarter 2 Quarter 3 Quarter 4 Quarter ! 8,400 8,700 7,800 8,100 The selling price of each unit will be e90 The cost of production of each unit is specified as follows: Cost of standard unit purchased Direct labour Fixed overhead 30 33 12 75 The fixed overhead per unit includes an allocation of depreciation. The annual depreciation is calculated on a straight-line basis and is allocated on quarterly basis. Suppliers of standard radio units will allow one month's credit. Customers are expected to take two months' credit. Wages will be paid as they are incurred in production. Fixed overhead costs will be paid as they are incurred. The stock of finished goods at the end of each quarter will be sufficient to satisfy 20% of the planned sales of the following quarter. The stock of standard radio units will be held constant at 1,000 units. It may be assumed that the year is divided into quarters of equal length and that sales, production and purchases are spread evenly throughout any quarter. Required Produce, for each quarter of the first year of trading: (a) The sales budget; (b) The production budget; and (c) The cash budget. 117360

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started