Question

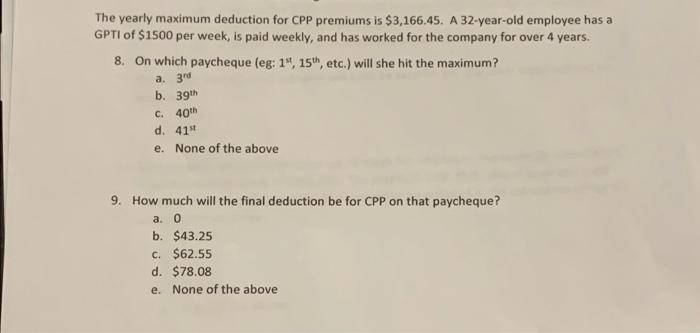

The yearly maximum deduction for CPP premiums is $3,166.45. A 32-year-old employee has a GPTI of $1500 per week, is paid weekly, and has

The yearly maximum deduction for CPP premiums is $3,166.45. A 32-year-old employee has a GPTI of $1500 per week, is paid weekly, and has worked for the company for over 4 years. 8. On which paycheque (eg: 1st, 15th, etc.) will she hit the maximum? a. 3rd b. 39th C. 40th d. 41st e. None of the above 9. How much will the final deduction be for CPP on that paycheque? a. 0 b. $43.25 C. $62.55 d. $78.08 e. None of the above

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

WN 1 Calculation of Interest on Capital 5 Interest on Anita 100 000 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Financial Accounting

Authors: Charles Horngren, Gary Sundem, John Elliott, Donna Philbrick

11th edition

978-0133251111, 013325111X, 0133251039, 978-0133251036

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App