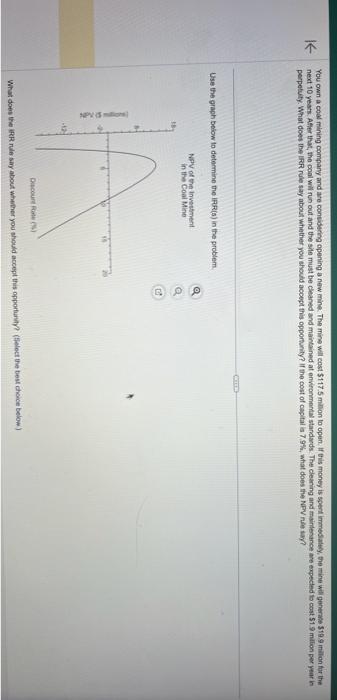

next 10 years. Aleer that, the conl will run out and the sile must be cleaned and maintained at environmental stardards. The clearing and mainlesance ave expected bo cost 51.9 mallon per year in perpetuly. What does the IRRR rule say about whather you ehould accept this opportunity? If the cost of capital is 7.9 th, what does the NPV rile iah? Use the graph beiow to determine the ifre(s) in the problem Nipy of the invetwent What does the iRR rule say about whether you thould accept this opporturnty? (ffelect the best chacke beiow ) What does the IRR nule say aboul whether you should acoegt this opportunig? [Belect the best cheice beloin. .) A. Roject the cpportunity becasse the IRR is lower thas the 7.9 fh cest of capital B. There are two IRPs; so you cannot use the IRR as a cilenion for accepting the opportunty. C. The IRR is r=9.34%, so accept the opportunity. D. Accept the opportenity because the IRR is greater than the cost of capial A. If the coportanity cost of castal is less than r=2.64\%, the investrent thoult be indertaken. B. Feject the project because the Nipy is negative. C. If the oppotunty cost of capilal is between r=264% and r=9.34%, the imvestmont shoudd be undertakn D. It the opportunty coed of capital i greater than r=9.34%, the imvitment should be undertaked next 10 years. Aleer that, the conl will run out and the sile must be cleaned and maintained at environmental stardards. The clearing and mainlesance ave expected bo cost 51.9 mallon per year in perpetuly. What does the IRRR rule say about whather you ehould accept this opportunity? If the cost of capital is 7.9 th, what does the NPV rile iah? Use the graph beiow to determine the ifre(s) in the problem Nipy of the invetwent What does the iRR rule say about whether you thould accept this opporturnty? (ffelect the best chacke beiow ) What does the IRR nule say aboul whether you should acoegt this opportunig? [Belect the best cheice beloin. .) A. Roject the cpportunity becasse the IRR is lower thas the 7.9 fh cest of capital B. There are two IRPs; so you cannot use the IRR as a cilenion for accepting the opportunty. C. The IRR is r=9.34%, so accept the opportunity. D. Accept the opportenity because the IRR is greater than the cost of capial A. If the coportanity cost of castal is less than r=2.64\%, the investrent thoult be indertaken. B. Feject the project because the Nipy is negative. C. If the oppotunty cost of capilal is between r=264% and r=9.34%, the imvestmont shoudd be undertakn D. It the opportunty coed of capital i greater than r=9.34%, the imvitment should be undertaked