Question

A business received a delivery of goods on 29 June 20X6, which was included in inventory at 30 June 20X6. The invoice for the

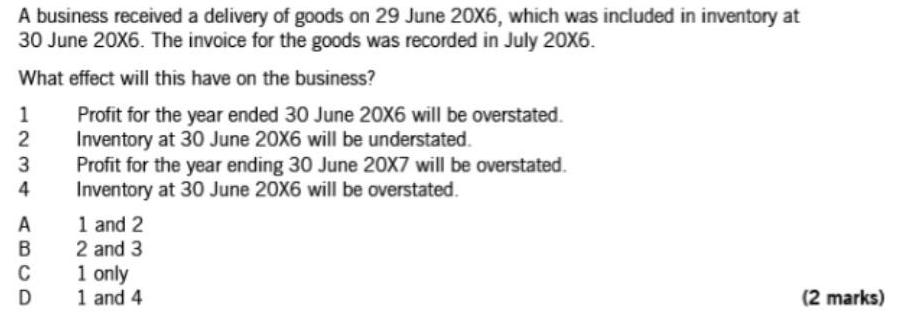

A business received a delivery of goods on 29 June 20X6, which was included in inventory at 30 June 20X6. The invoice for the goods was recorded in July 20X6. What effect will this have on the business? 1 2 3 4 A ABCD D Profit for the year ended 30 June 20X6 will be overstated. Inventory at 30 June 20X6 will be understated. Profit for the year ending 30 June 20X7 will be overstated. Inventory at 30 June 20X6 will be overstated. 1 and 2 2 and 3 1 only 1 and 4 (2 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

As Inventory received on 29 June 20X6 increase the value of inventory held ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Statistics

Authors: Robert R. Johnson, Patricia J. Kuby

11th Edition

978-053873350, 9781133169321, 538733500, 1133169325, 978-0538733502

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App