Question

Next year, a share of stock will pay an annual dividend of $2.50 (D1), and that this dividend is expected to grow by $0.16

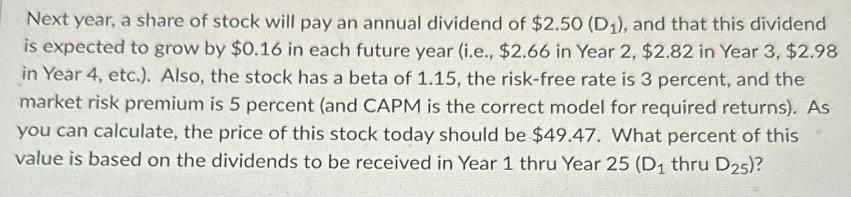

Next year, a share of stock will pay an annual dividend of $2.50 (D1), and that this dividend is expected to grow by $0.16 in each future year (i.e., $2.66 in Year 2, $2.82 in Year 3, $2.98 in Year 4, etc.). Also, the stock has a beta of 1.15, the risk-free rate is 3 percent, and the market risk premium is 5 percent (and CAPM is the correct model for required returns). As you can calculate, the price of this stock today should be $49.47. What percent of this value is based on the dividends to be received in Year 1 thru Year 25 (D thru D25)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of the dividends received in Year 1 through Year 25 D to D and determ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford, David A. Stangeland, Andras Marosi

1st canadian edition

978-0133400694

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App