Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ng. 2. Colleen and Thomas bought a home for $100,000 for use as their residence. Colleen paid $70,000 of the $100,000 purchase price and

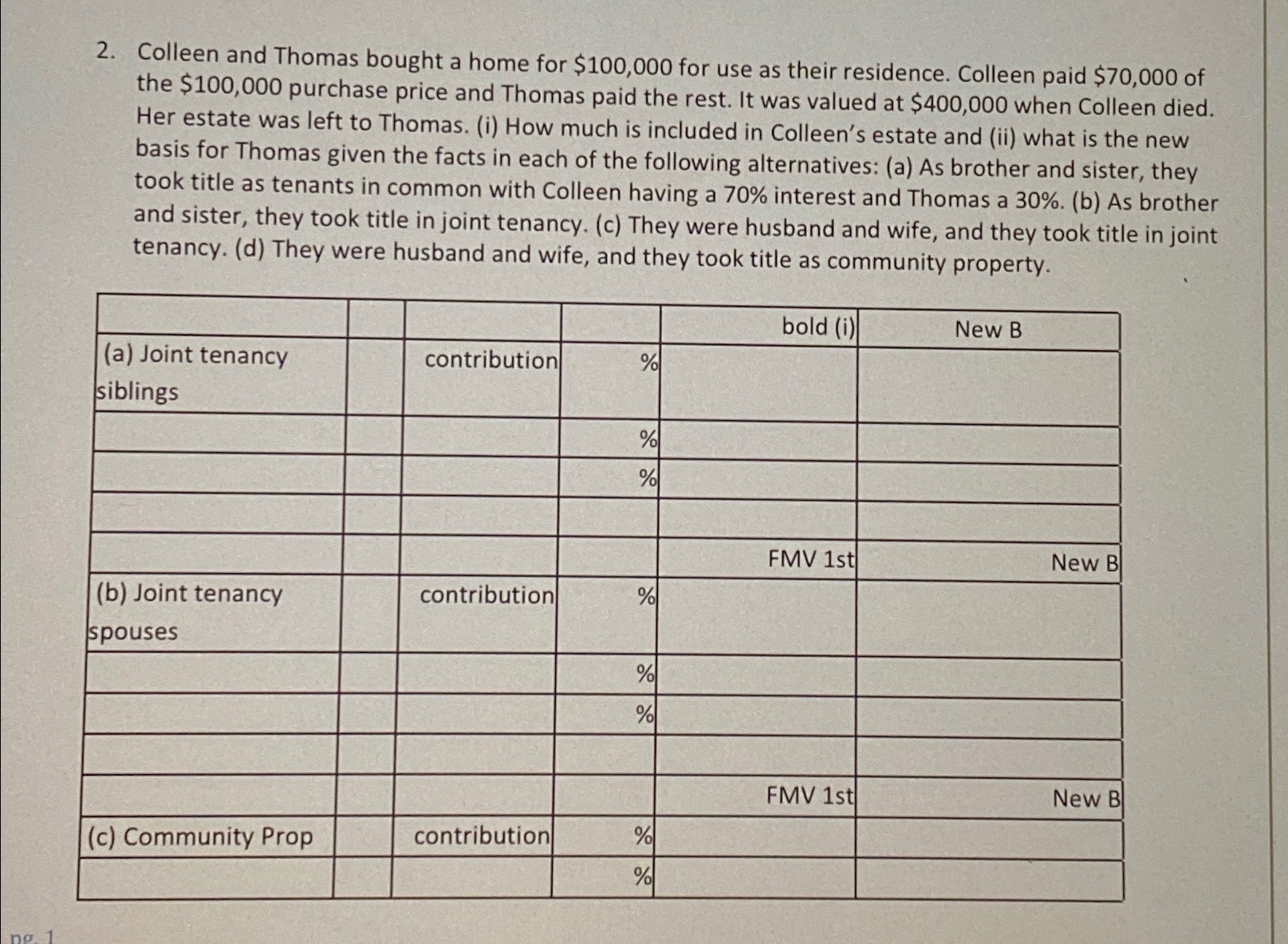

ng. 2. Colleen and Thomas bought a home for $100,000 for use as their residence. Colleen paid $70,000 of the $100,000 purchase price and Thomas paid the rest. It was valued at $400,000 when Colleen died. Her estate was left to Thomas. (i) How much is included in Colleen's estate and (ii) what is the new basis for Thomas given the facts in each of the following alternatives: (a) As brother and sister, they took title as tenants in common with Colleen having a 70% interest and Thomas a 30%. (b) As brother and sister, they took title in joint tenancy. (c) They were husband and wife, and they took title in joint tenancy. (d) They were husband and wife, and they took title as community property. (a) Joint tenancy siblings bold (i) New B contribution % % % FMV 1st New B (b) Joint tenancy spouses contribution % % % FMV 1st New B (c) Community Prop contribution % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

lets provide detailed explanations and solutions for each scenario i How much is included in Colleen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started