Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NGM Corporation's common stock is currently selling at $80, its volatility is estimated as 20%. Its investment bank encourages its customers to buy NGM

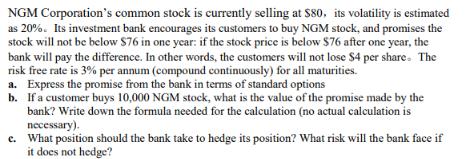

NGM Corporation's common stock is currently selling at $80, its volatility is estimated as 20%. Its investment bank encourages its customers to buy NGM stock, and promises the stock will not be below $76 in one year: if the stock price is below $76 after one year, the bank will pay the difference. In other words, the customers will not lose $4 per share. The risk free rate is 3% per annum (compound continuously) for all maturities. a. Express the promise from the bank in terms of standard options b. If a customer buys 10,000 NGM stock, what is the value of the promise made by the bank? Write down the formula needed for the calculation (no actual calculation is necessary). e. What position should the bank take to hedge its position? What risk will the bank face if it does not hedge?

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a The banks promise can be expressed as a put option with a strike price of 76 If the stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started