Question

Nguni Limited is a medium-sized manufacturing company based in the East Rand, Johannesburg where it produces two main products, the Gunis and Unis respectively for

Nguni Limited is a medium-sized manufacturing company based in the East Rand, Johannesburg where it produces two main products, the Gunis and Unis respectively for local sales. Nguni Ltd successfully secured a contract for the supply of 15 000 Unis per quarter to Brazz Ltd, a Brazilian company, for a period of six months ending on 28 February 2023 Brazz Ltd are so impressed with the quality of Unis and have sent their purchasing director to South Africa to negotiate a three-year supply deal of 200 000 Unis to be delivered quarterly effectively from 1 March 2023. Having clinched a huge deal in India, they need Unis as a key part of the service that will be delivered from 1 May 2023.

Additional information

1. Forecast local sales of both Gunis and Unis are expected to remain at the current levels for the foreseeable future.

2. All variable costs are expected to increase by 7% per annum from 1 March 2023.

3. Inventory consists mainly of raw materials, split 60/40 between material TB used for Guni production and material HH used for Uni production. Careful monitoring of raw materials levels ensures that no undue fluctuations occur.

4. All sales are on credit and occur evenly throughout the year except for the special order.

5. The accounts receivable relates only to local sales as Brazz Ltd have so far paid on delivery of the products.

6. The company issued 5 million shares of R1 each. A private sale of a substantial package of Nguni shares recently took place at 990 cents per share.

7. Long term loans carry on average, interest rates of 10.25% per annum with redemption on 28 February 2028 at a premium of 5%. Similar loans currently trade at 11.75% per annum in the open market.

8. Nguni Ltd has a tax rate of 28% per annum and pays their taxes one year in arrears.

9. The management accountant has investigated local markets and found the following: o A public company like Nguni Ltd has a beta of 1.4. The auditors have expressed an opinion that Nguni’s risk profile warrants a premium of 25%. o The accepted market return for equity is currently 15% per annum.

o Government stock trade as follows –

▪ redemption in 5 years at 9.1% p.a.

▪ redemption in 10 years: 10.2% p.a.

o Research has shown that companies in South Africa prefer using the long-term government bonds yield as the risk-free rate than the Treasury Bills.

Special Order

• An annual order of 200 000 Unis at a unit price of US $9 which will increase by 4% annually on 1 March 2023

• The contract will run from 1 March 2023 for a three-year period with quarterly deliveries.

Nguni Ltd Management

• A decision was taken that local sales will not be sacrificed.

• The company will purchase a new machine with an annual capacity of 120 000 Unis at a cost of R12 million and installation costs of R800 000. The machine will start operating from 1 March 2023.

• When the project starts, inventory of material HH will increase by 40%.

• SARS will allow the machine to be written off over the three-year contract period.

• Additional tax allowance of R1 000 000 will be granted in the first year of operation.

• The new machine will cut other fixed manufacturing costs (related to the special order) by 20%. Labor costs will however remain the same.

• There will be spare capacity only for the existing production to minimize undue breakdowns and maintenance.

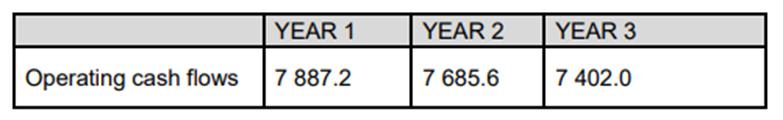

• These are the forecast operating cash flows from the special order:

Required:

Calculate Nguni Ltd’s current weighted average cost of capital. Communication – layout & logic. (10)

Based on the information presented and using a discount rate of 20%, determine whether Nguni Ltd should proceed with the Brazz Ltd contract. Note//cash flows are considered to occur at the end of the period unless specifically mentioned otherwise. (15)

Recommend, with detailed motivation, a financing structure for the acquisition of the new machine. You may assume that management of Nguni Ltd strives to attain a target D/E ratio of 60:40 using book values. (5)

Nguni Ltd’s dividend policy is a stable cover of 4 times. Explain the meaning and implication of a stable cover and then determine the expected dividend per share for the financial year ending 28 February 2023. (5)

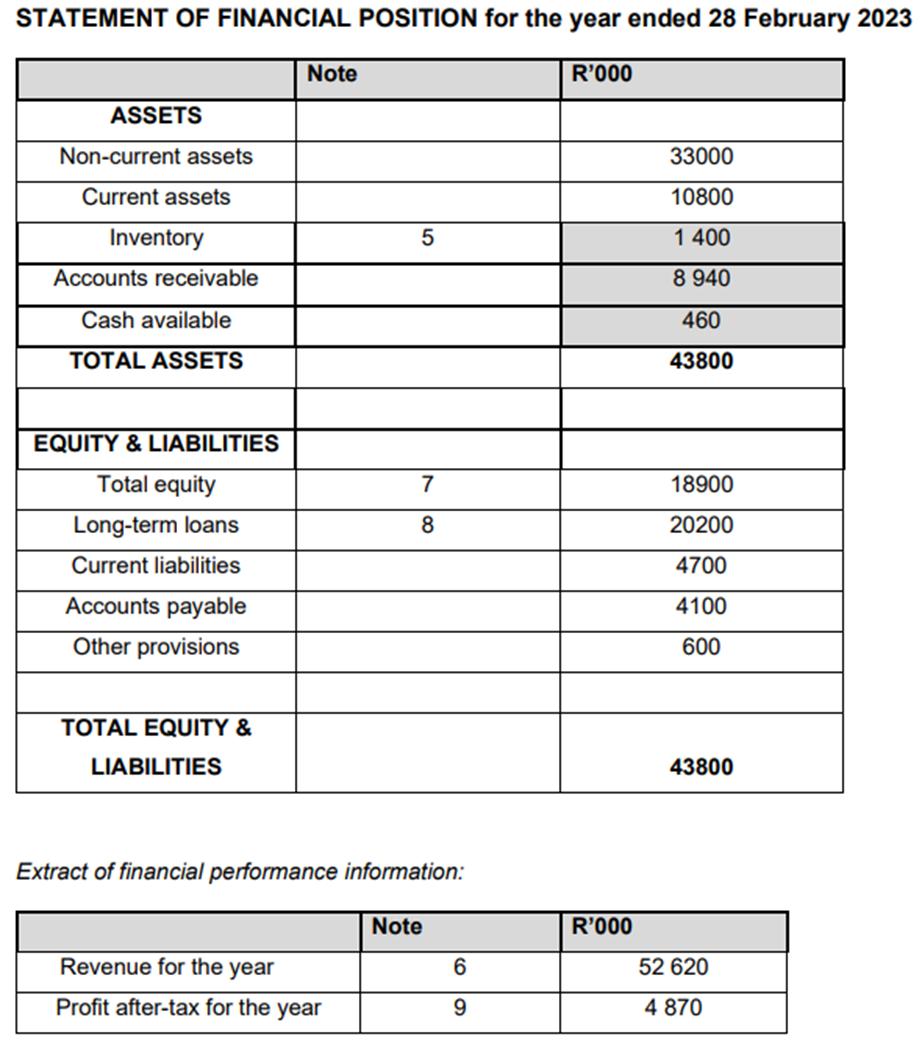

STATEMENT OF FINANCIAL POSITION for the year ended 28 February 2023 ASSETS Non-current assets Current assets Inventory Accounts receivable Cash available TOTAL ASSETS EQUITY & LIABILITIES Total equity Long-term loans Current liabilities Accounts payable Other provisions TOTAL EQUITY & LIABILITIES Note 5 Revenue for the year Profit after-tax for the year 7 8 Extract of financial performance information: Note 6 9 R'000 R'000 33000 10800 1 400 8 940 460 43800 18900 20200 4700 4100 600 43800 52 620 4 870

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculate Nguni Ltds current weighted average cost of capital WACC The weighted average cost of capital WACC is the average rate of return a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started