Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NHP invested $100 million in a new production line which will generate after-tax operating cash flow of $40 million at the end of each

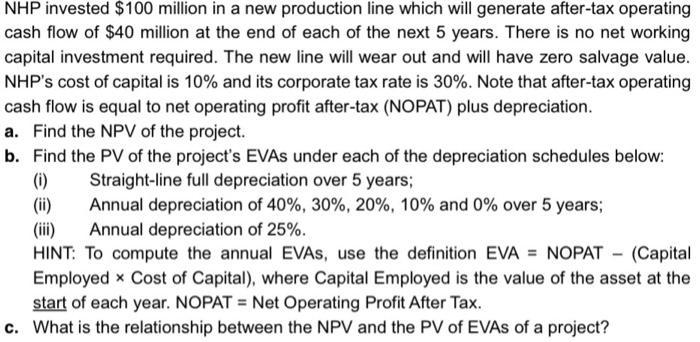

NHP invested $100 million in a new production line which will generate after-tax operating cash flow of $40 million at the end of each of the next 5 years. There is no net working capital investment required. The new line will wear out and will have zero salvage value. NHP's cost of capital is 10% and its corporate tax rate is 30%. Note that after-tax operating cash flow is equal to net operating profit after-tax (NOPAT) plus depreciation. a. Find the NPV of the project. b. Find the PV of the project's EVAS under each of the depreciation schedules below: Straight-line full depreciation over 5 years; (i) (ii) Annual depreciation of 40%, 30%, 20%, 10% and 0% over 5 years; Annual depreciation of 25%. (iii) HINT: To compute the annual EVAS, use the definition EVA = NOPAT - (Capital Employed x Cost of Capital), where Capital Employed is the value of the asset at the start of each year. NOPAT = Net Operating Profit After Tax. c. What is the relationship between the NPV and the PV of EVAs of a project?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem well calculate the NPV of the project and the present value PV of the projects Economic Value Added EVA under different depreciation schedules a NPV Calculation To find the NPV o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started