Question

Nicanor, a Filipino residing in the United States, earned P 20,000 dividend income from his investment in ABC Corporation, a corporation established under the

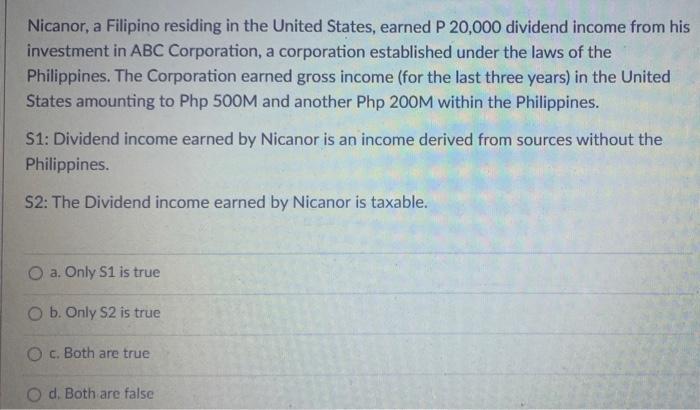

Nicanor, a Filipino residing in the United States, earned P 20,000 dividend income from his investment in ABC Corporation, a corporation established under the laws of the Philippines. The Corporation earned gross income (for the last three years) in the United States amounting to Php 500M and another Php 20OM within the Philippines. S1: Dividend income earned by Nicanor is an income derived from sources without the Philippines. S2: The Dividend income earned by Nicanor is taxable. O a. Only S1 is true O b. Only S2 is true O c. Both are true d. Both are false

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

b Only S2 is true The Dividend income earned by Nicanor is taxab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Supply Chain Focused Manufacturing Planning and Control

Authors: W. C. Benton

1st edition

2901133586714 , 1133586716, 978-1133586715

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App