Question

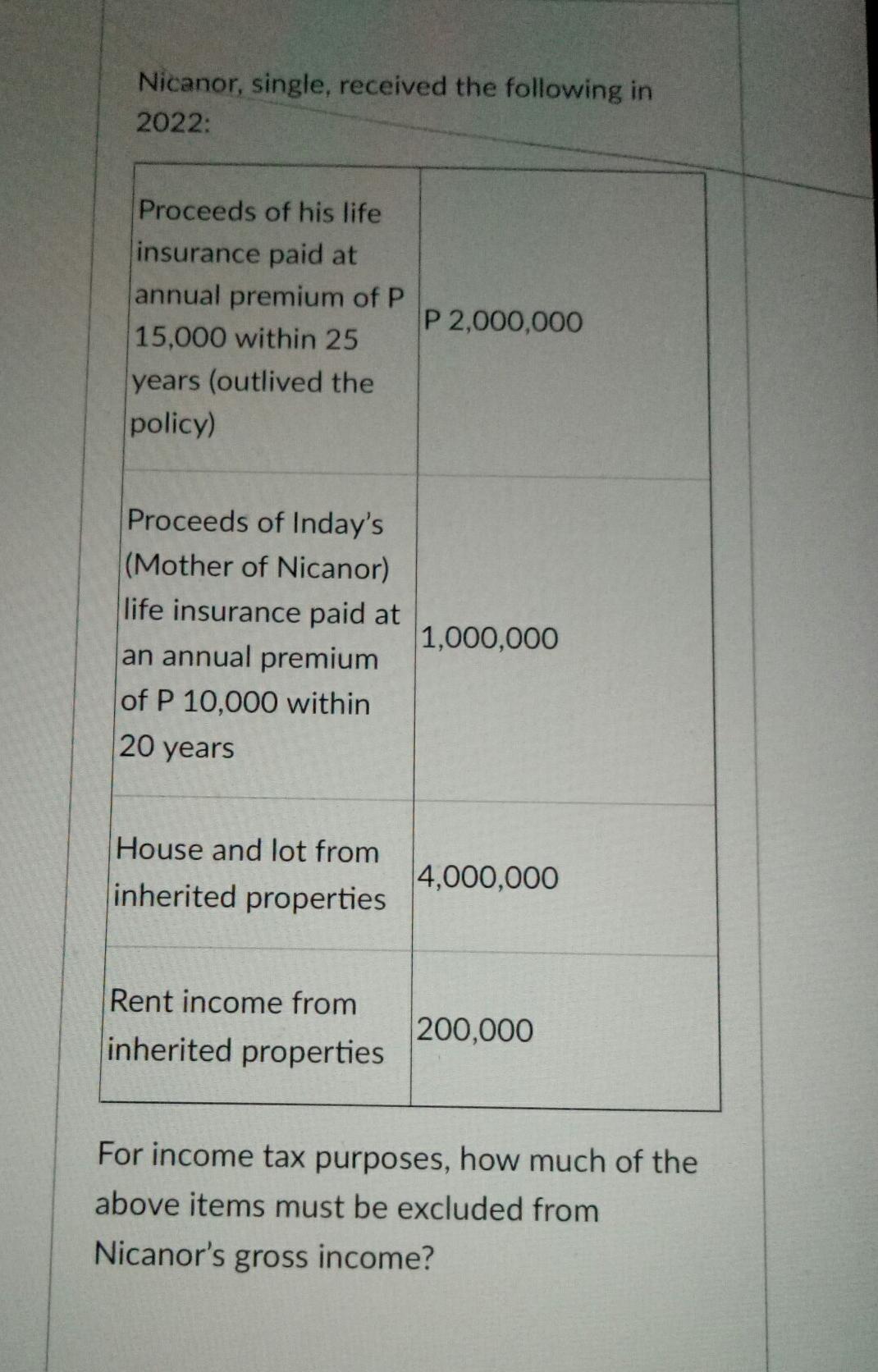

Nicanor, single, received the following in 2022: Proceeds of his life insurance paid at annual premium of P 15,000 within 25 years (outlived the

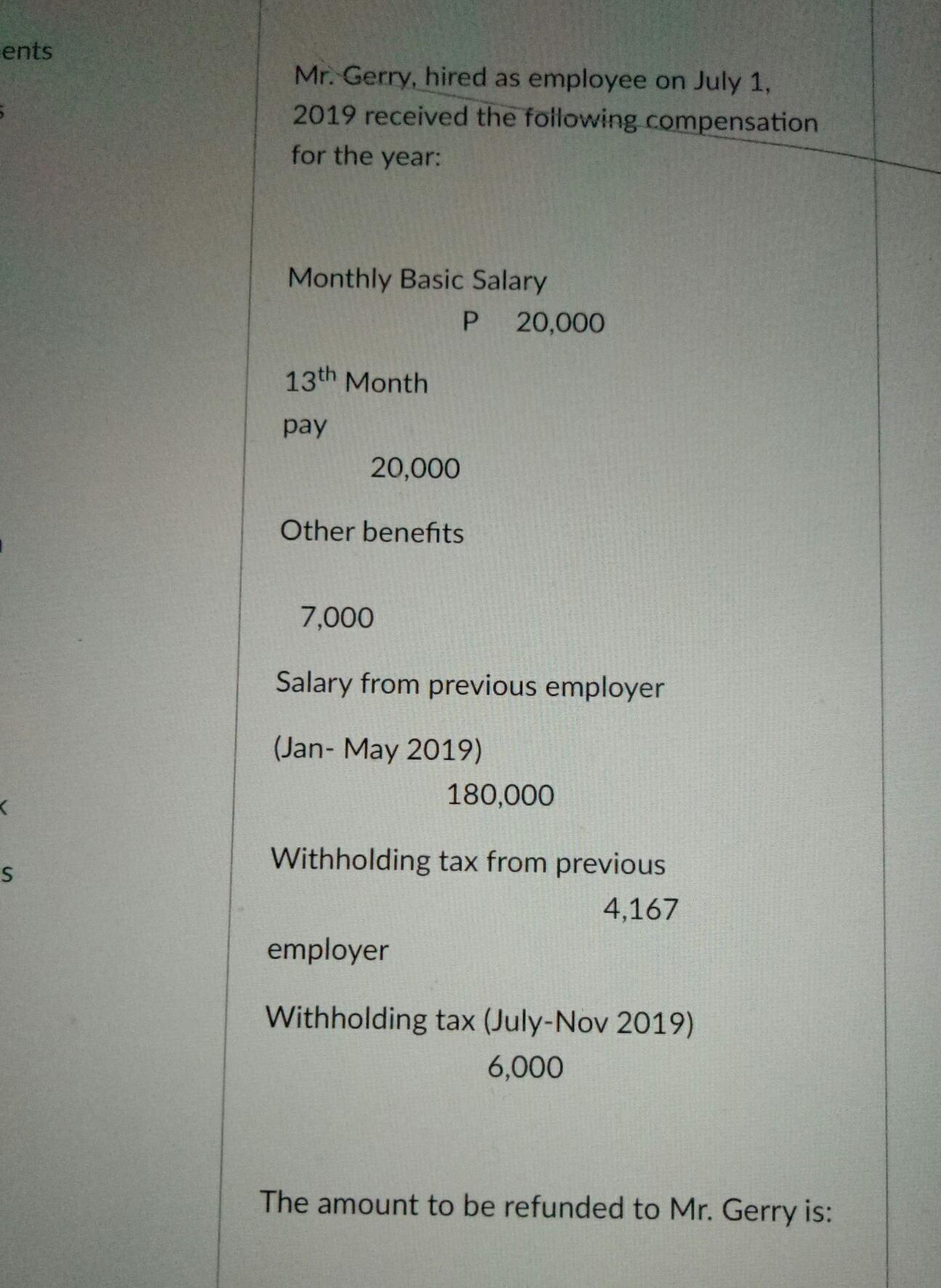

Nicanor, single, received the following in 2022: Proceeds of his life insurance paid at annual premium of P 15,000 within 25 years (outlived the policy) Proceeds of Inday's (Mother of Nicanor) life insurance paid at an annual premium of P 10,000 within 20 years House and lot from inherited properties Rent income from inherited properties P 2,000,000 1,000,000 4,000,000 200,000 For income tax purposes, how much of the above items must be excluded from Nicanor's gross income? ents S Mr. Gerry, hired as employee on July 1, 2019 received the following compensation for the year: Monthly Basic Salary 13th Month pay 20,000 P 20,000 Other benefits 7,000 Salary from previous employer (Jan-May 2019) 180,000 Withholding tax from previous 4,167 employer Withholding tax (July-Nov 2019) 6,000 The amount to be refunded to Mr. Gerry is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law Principles for Today's Commercial Environment

Authors: David P. Twomey, Marianne M. Jennings, Stephanie M Greene

5th edition

1305575156, 978-1305887657, 1305887654, 978-1305575158

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App