Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nicholas Cash, the sole proprietor of Advantage Tennis Coaching (ATC), has met with his accountant to discuss the preparation of the ATC's financial statements

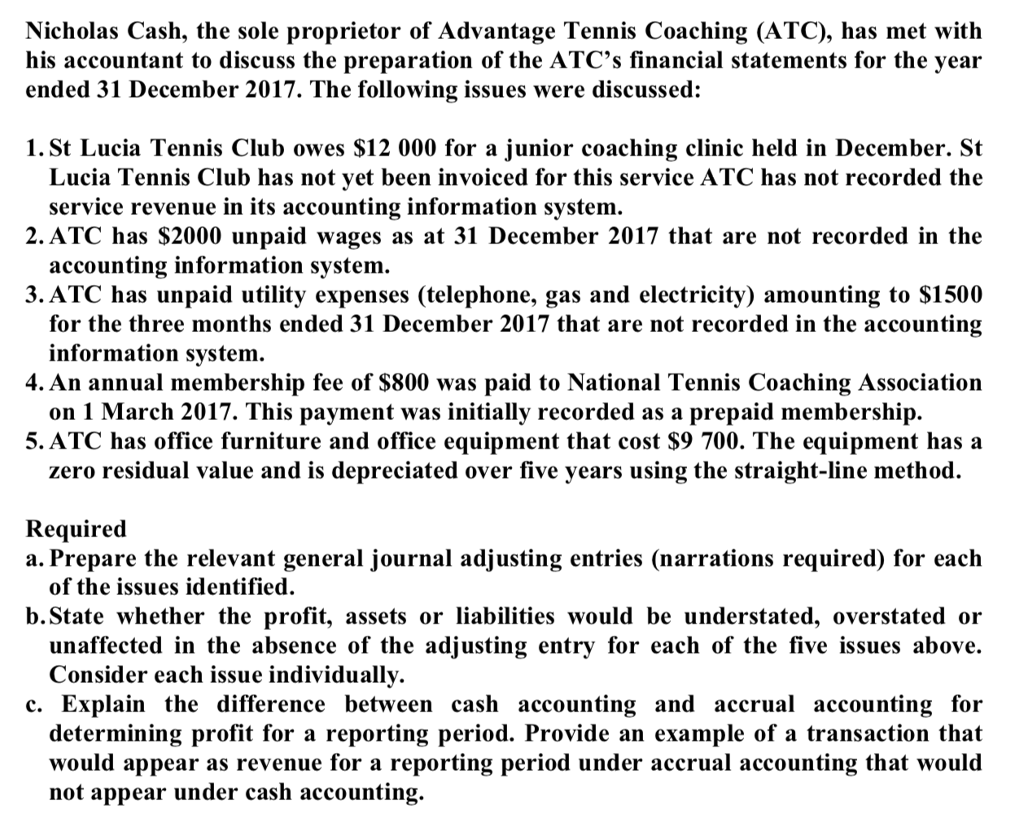

Nicholas Cash, the sole proprietor of Advantage Tennis Coaching (ATC), has met with his accountant to discuss the preparation of the ATC's financial statements for the year ended 31 December 2017. The following issues were discussed: 1. St Lucia Tennis Club owes $12 000 for a junior coaching clinic held in December. St Lucia Tennis Club has not yet been invoiced for this service ATC has not recorded the service revenue in its accounting information system. 2. ATC has $2000 unpaid wages as at 31 December 2017 that are not recorded in the accounting information system. 3. ATC has unpaid utility expenses (telephone, gas and electricity) amounting to $1500 for the three months ended 31 December 2017 that are not recorded in the accounting information system. 4. An annual membership fee of $800 was paid to National Tennis Coaching Association on 1 March 2017. This payment was initially recorded as a prepaid membership. 5. ATC has office furniture and office equipment that cost $9 700. The equipment has a zero residual value and is depreciated over five years using the straight-line method. Required a. Prepare the relevant general journal adjusting entries (narrations required) for each of the issues identified. b. State whether the profit, assets or liabilities would be understated, overstated or unaffected in the absence of the adjusting entry for each of the five issues above. Consider each issue individually. c. Explain the difference between cash accounting and accrual accounting for determining profit for a reporting period. Provide an example of a transaction that would appear as revenue for a reporting period under accrual accounting that would not appear under cash accounting.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Date Name of the account Debit Dr Credit Cr 31122017 Accounts receivableSt Lucia Tennis Club Coach...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started