Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nick lives in Denver and operates a small company selling bikes. On average, he receives $833,000 per year from selling bikes. Out of this

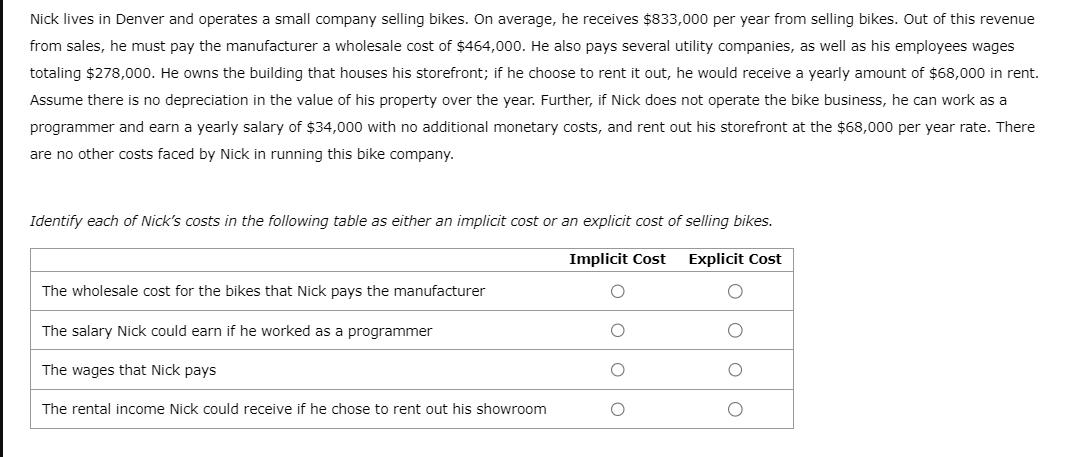

Nick lives in Denver and operates a small company selling bikes. On average, he receives $833,000 per year from selling bikes. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $464,000. He also pays several utility companies, as well as his employees wages totaling $278,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $68,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Nick does not operate the bike business, he can work as a programmer and earn a yearly salary of $34,000 with no additional monetary costs, and rent out his storefront at the $68,000 per year rate. There are no other costs faced by Nick in running this bike company. Identify each of Nick's costs in the following table as either an implicit cost or an explicit cost of selling bikes. Implicit Cost Explicit Cost O O The wholesale cost for the bikes that Nick pays the manufacturer The salary Nick could earn if he worked as a programmer The wages that Nick pays The rental income Nick could receive if he chose to rent out his showroom C OOO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Implicit Cost The salary Nick could earn if he worked as a programmer Explicit Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started