Question

Nick Turner is considering the purchase of a bond that was issued 4 years ago and has 11 years left till maturity. The bond

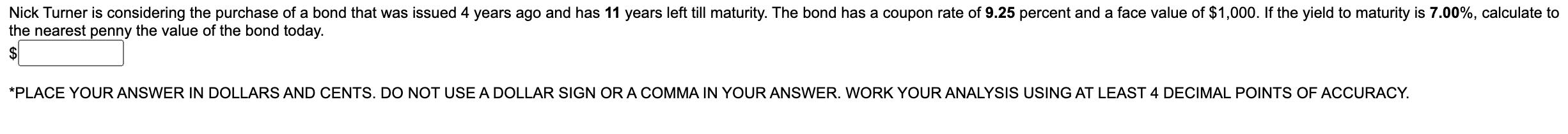

Nick Turner is considering the purchase of a bond that was issued 4 years ago and has 11 years left till maturity. The bond has a coupon rate of 9.25 percent and a face value of $1,000. If the yield to maturity is 7.00%, calculate to the nearest penny the value of the bond today. $ *PLACE YOUR ANSWER IN DOLLARS AND CENTS. DO NOT USEA DOLLAR SIGN OR A COMMA IN YOUR ANSWER. WORK YOUR ANALYSIS USING AT LEAST 4 DECIMAL POINTS OF ACCURACY.

Step by Step Solution

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution If Annual Coupon Nper 114 payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App