Nicky just graduated from engineering at Concordia and landed her first job paying an annual gross salary of $84,000. On the first day of

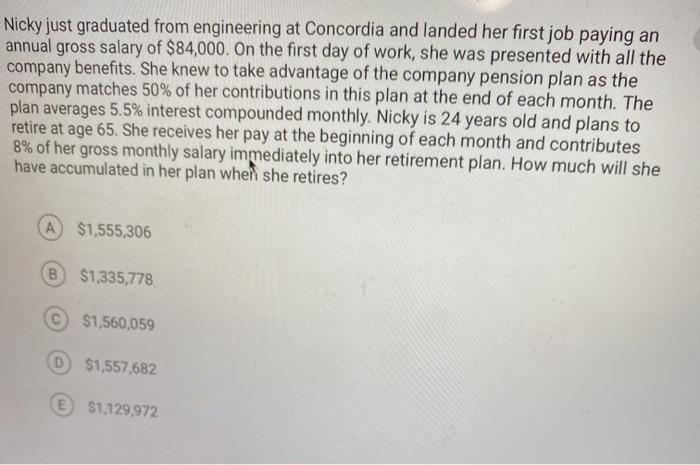

Nicky just graduated from engineering at Concordia and landed her first job paying an annual gross salary of $84,000. On the first day of work, she was presented with all the company benefits. She knew to take advantage of the company pension plan as the company matches 50% of her contributions in this plan at the end of each month. The plan averages 5.5% interest compounded monthly. Nicky is 24 years old and plans to retire at age 65. She receives her pay at the beginning of each month and contributes 8% of her gross monthly salary immediately into her retirement plan. How much will she have accumulated in her plan when she retires? A $1,555,306 B $1,335,778 $1,560,059 D $1,557,682 $1,129,972

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 Total Contribution per Month Monthly salary Contribution 1 Company Matching 7000 8 150 840 2 Accum...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started