Nicolette is a self-employed consultant who uses 25% of her residence as an office. The office is used exclusively for business and is frequented by

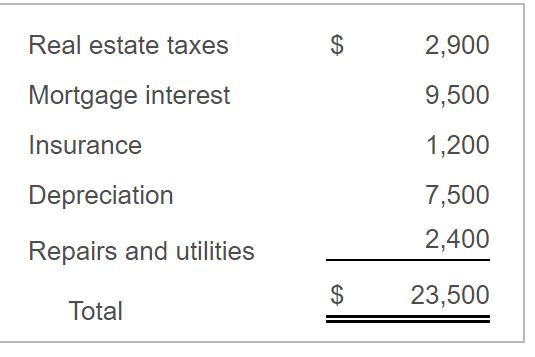

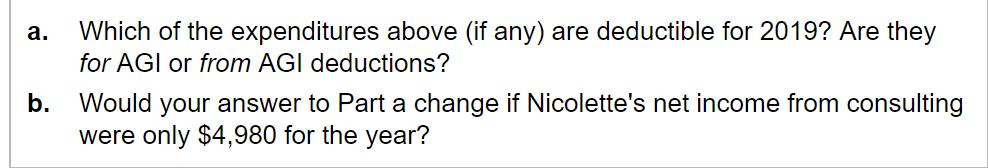

Nicolette is a self-employed consultant who uses 25% of her residence as an office. The office is used exclusively for business and is frequented by customers on a regular basis. Nicolette also uses her den as an office (7% of the total floor space of her home) to prepare bills and keep records. However, the den is also used by her children as a TV room. In 2019, Nicolette's net income from the consulting business (other than her home office expenses) amounts to $120,000. She also incurs $1,300 of expenses directly related to the office (e.g., painting of the office, window blinds). Nicolette incurs the following expenses in 2019 related to her residence:

Real estate taxes $ 2,900 Mortgage interest 9,500 Insurance 1,200 Depreciation 7,500 2,400 Repairs and utilities 23,500 Total %24

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Deduction Exp Amount Of of Deduction Deduction Direct home office exp 1300 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started