Question

Nike has a new gear for Olympic Athletes. The problem is that Olympics are hard to predict with global uncertainty. For their gear, they know

Nike has a new gear for Olympic Athletes. The problem is that Olympics are hard to predict with global uncertainty. For their gear, they know it will be expensive to kick off the project and develop new strategic partners to make it. The upfront investment is $37.5 million. They see the following scenarios below. Nike has no idea what the probability of each scenario is. Would you recommend this at at 15% MARR for the 12 year life? See Excel Table

| Year | Best Case Sales (Millions) | Most Likely Case (Millions) | Worst Case (Millions) |

| 1 | $ 4.0 | $ 3.0 | $ 2.0 |

| 2 | $ 3.0 | $ 4.0 | $ 3.0 |

| 3 | $ 3.0 | $ 4.0 | $ 3.0 |

| 4 | $ 9.0 | $ 8.0 | $ 6.0 |

| 5 | $ 2.0 | $ 3.0 | $ 3.0 |

| 6 | $ 2.0 | $ 3.0 | $ 3.0 |

| 7 | $ 3.0 | $ 3.0 | $ 2.0 |

| 8 | $ 16.0 | $ 12.0 | $ 8.0 |

| 9 | $ 5.0 | $ 4.0 | $ 3.0 |

| 10 | $ 5.0 | $ 4.0 | $ 3.0 |

| 11 | $ 3.0 | $ 4.0 | $ 3.0 |

| 12 | $ 12.0 | $ 10.0 | $ 8.0 |

a) No, every scenario is bad

b) Yes, every scenario makes sense

c) Yes, the Best case seems like a good idea

d) No, some scenarios good and some bad

and

Answers Options:

$115,517, Yes

$-27,670, No

$-100,090, No

$100,090, Yes

$-140,470 No

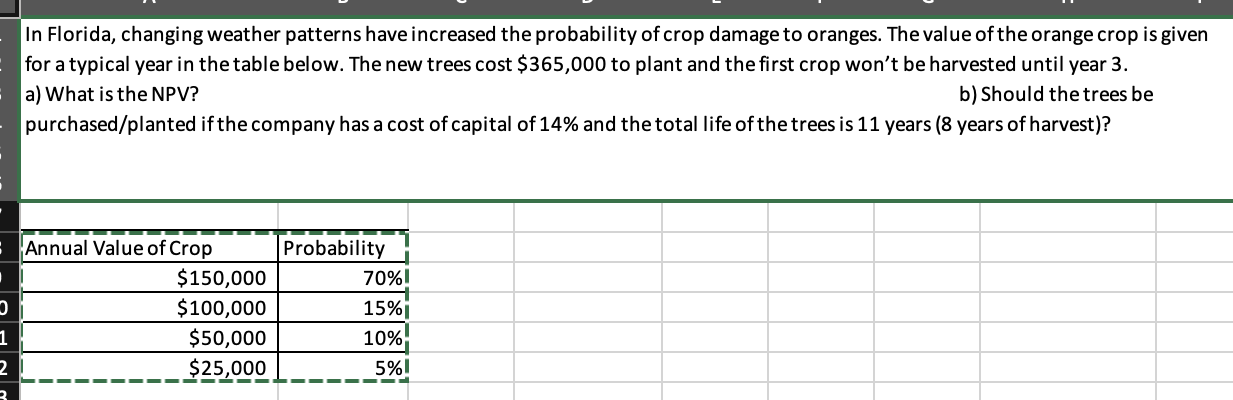

In Florida, changing weather patterns have increased the probability of crop damage to oranges. The value of the orange crop is given for a typical year in the table below. The new trees cost $365,000 to plant and the first crop won't be harvested until year 3. a) What is the NPV? b) Should the trees be purchased/planted if the company has a cost of capital of 14% and the total life of the trees is 11 years (8 years of harvest)? Annual Value of Crop $150,000 $100,000 1 $50,000 2 $25,000 Probability 70% 15% 10% 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started