Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Nike, Inc.: Cost of Capital On July 5, 2001, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual fund management firm, pored over analysts'

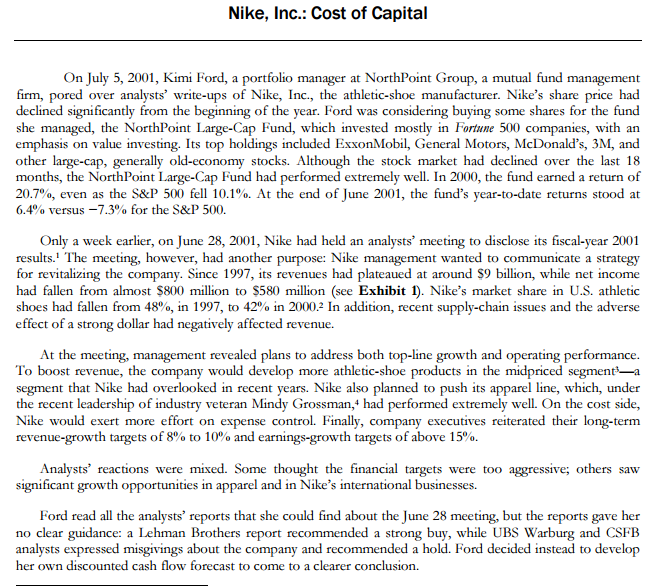

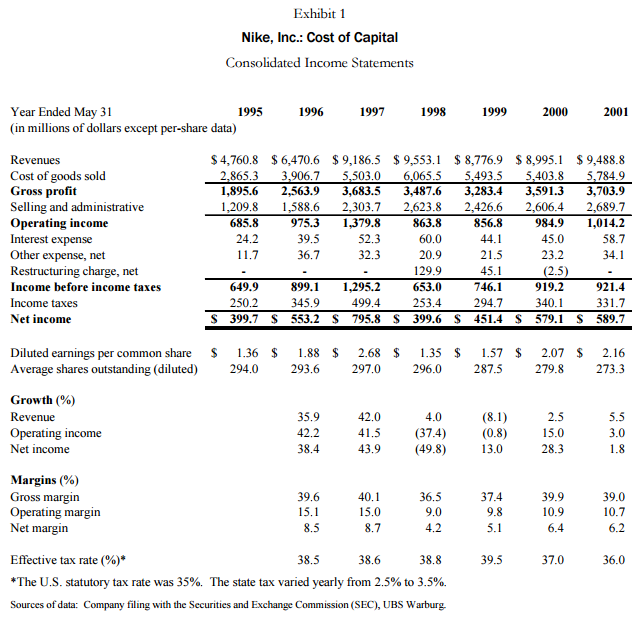

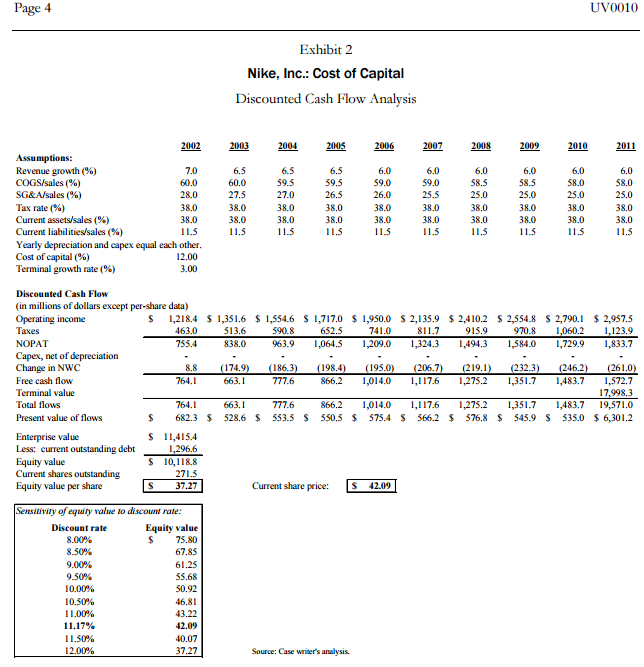

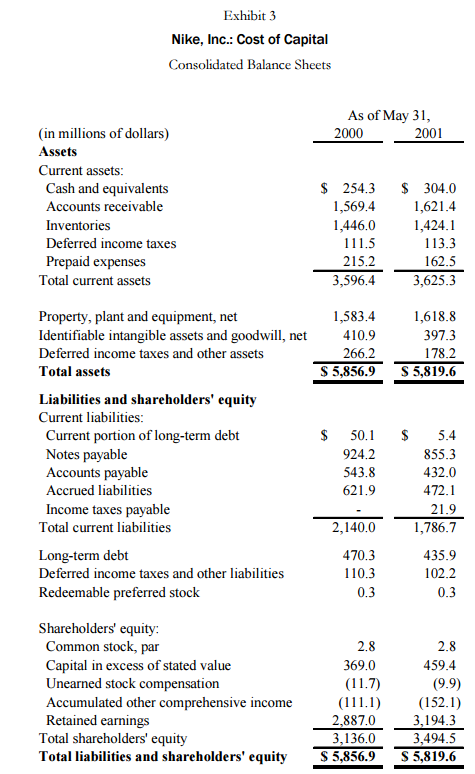

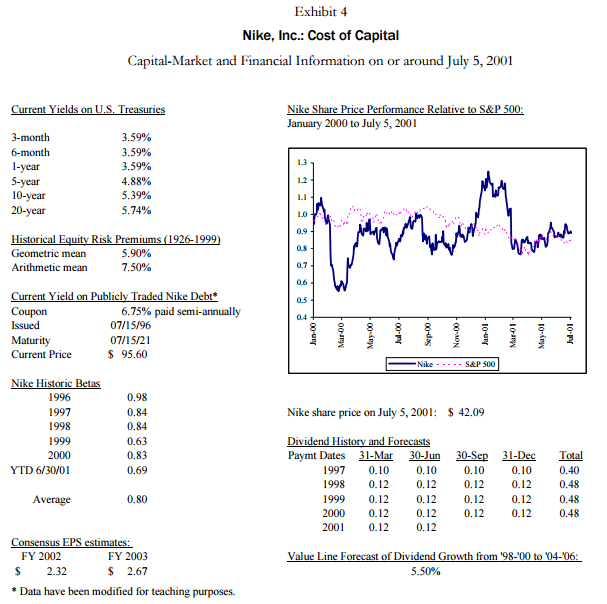

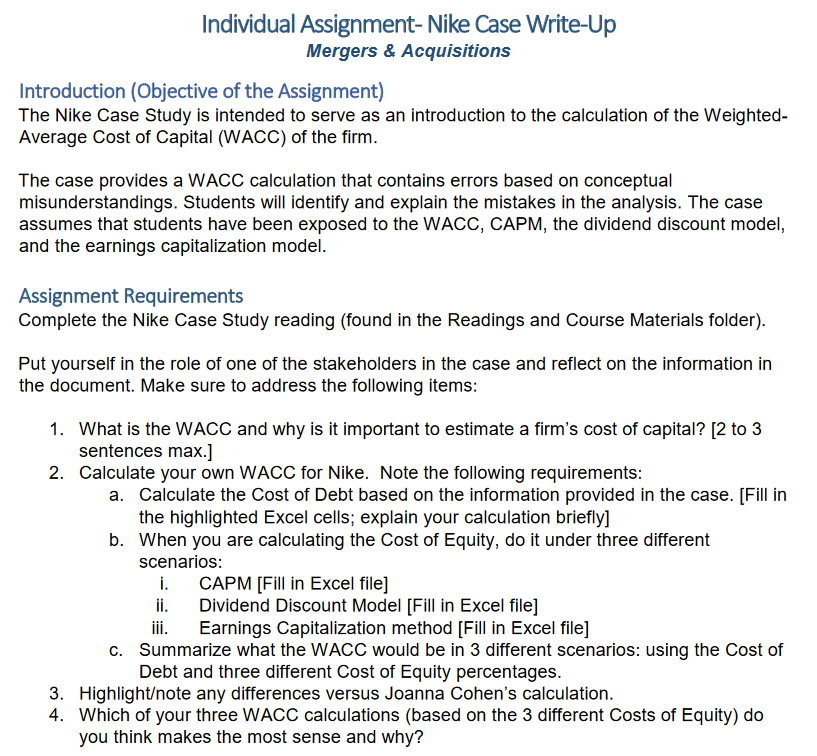

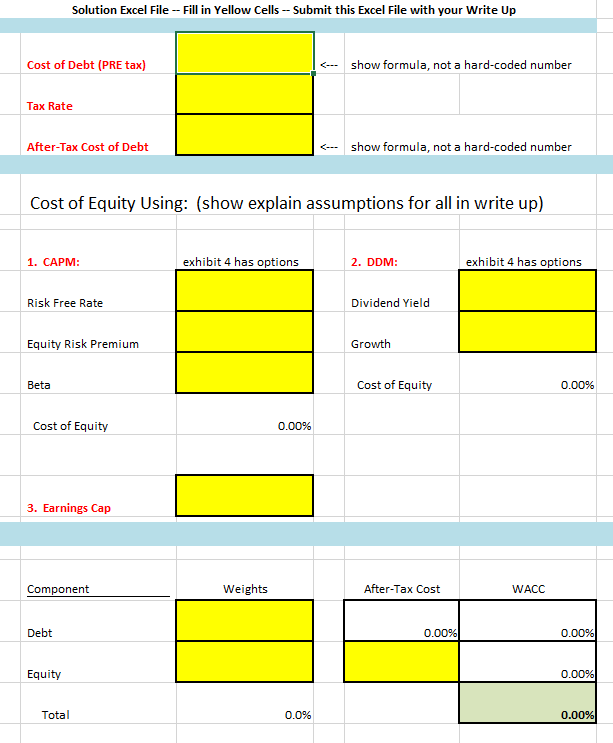

Nike, Inc.: Cost of Capital On July 5, 2001, Kimi Ford, a portfolio manager at NorthPoint Group, a mutual fund management firm, pored over analysts' write-ups of Nike, Inc., the athletic-shoe manufacturer. Nike's share price had declined significantly from the beginning of the year. Ford was considering buying some shares for the fund she managed, the NorthPoint Large-Cap Fund, which invested mostly in Fortune 500 companies, with an emphasis on value investing. Its top holdings included ExxonMobil, General Motors, McDonald's, 3M, and other large-cap, generally old-economy stocks. Although the stock market had declined over the last 18 months, the NorthPoint Large-Cap Fund had performed extremely well. In 2000, the fund earned a return of 20.7%, even as the S&P 500 fell 10.1%. At the end of June 2001, the fund's year-to-date returns stood at 6.4% versus -7.3% for the S&P 500. Only a week earlier, on June 28, 2001, Nike had held an analysts' meeting to disclose its fiscal-year 2001 results.' The meeting, however, had another purpose: Nike management wanted to communicate a strategy for revitalizing the company. Since 1997, its revenues had plateaued at around $9 billion, while net income had fallen from almost $800 million to $580 million (see Exhibit 1). Nike's market share in U.S. athletic shoes had fallen from 48%, in 1997, to 42% in 2000.2 In addition, recent supply-chain issues and the adverse effect of a strong dollar had negatively affected revenue. At the meeting, management revealed plans to address both top-line growth and operating performance. To boost revenue, the company would develop more athletic-shoe products in the midpriced segment-a segment that Nike had overlooked in recent years. Nike also planned to push its apparel line, which, under the recent leadership of industry veteran Mindy Grossman,t had performed extremely well. On the cost side, Nike would exert more effort on expense control. Finally, company executives reiterated their long-term revenue-growth targets of 8% to 10% and earnings-growth targets of above 15%. Analysts' reactions were mixed. Some thought the financial targets were too aggressive; others saw significant growth opportunities in apparel and in Nike's international businesses. Ford read all the analysts' reports that she could find about the June 28 meeting, but the reports gave her no clear guidance: a Lehman Brothers report recommended a strong buy, while UBS Warburg and CSFB analysts expressed misgivings about the company and recommended a hold. Ford decided instead to develop her own discounted cash flow forecast to come to a clearer conclusion. Exhibit 1 Nike, Inc.: Cost of Capital Consolidated Income Statements Year Ended May 31 1995 1996 1997 1998 1999 2000 2001 (in millions of dollars except per-share data) Revenues $4,760.8 $6,470.6 $9,186.5 $ 9,553.1 $8,776.9 $ 8,995.1 $ 9,488.8 Cost of goods sold 2,865.3 3.906.7 5,503.0 6,065.5 5,493.5 5.403.8 5,784.9 Gross profit 1,895.6 2,563.9 3,683.5 3,487.6 3,283.4 3,591.3 3,703.9 Selling and administrative 1,209.8 1,588.6 2,303.7 2,623.8 2,426.6 2,606.4 2,689.7 Operating income 685.8 975.3 1,379.8 863.8 856.8 984.9 1,014.2 Interest expense 24.2 39.5 52.3 60.0 44.1 45.0 58.7 Other expense, net 11.7 36.7 32.3 20.9 21.5 23.2 34.1 Restructuring charge, net 45.1 (2.5) Income before income taxes 649.9 899.1 1,295.2 653.0 746.1 919.2 921.4 Income taxes 250.2 345.9 499.4 253.4 294.7 340.1 331.7 Net income $ 399.7 $ 553.2 $ 795.8 $ 399.6 S 451.4 $ 579.1 S 589.7 129.9 Diluted earnings per common share $ Average shares outstanding (diluted) 1.36 $ 294.0 1.88 $ 293.6 2.68 $ 297.0 1.35 $ 296.0 1.57 $ 287.5 2.07 $ 279.8 2.16 273.3 Growth (%) Revenue Operating income Net income 35.9 42.2 38.4 42.0 41.5 43.9 4.0 (37.4) (49.8) (8.1) (0.8) 13.0 2.5 15.0 28.3 5.5 3.0 1.8 Margins (%) Gross margin Operating margin Net margin 39.6 15.1 40.1 15.0 8.7 36.5 9.0 4.2 37.4 9.8 5.1 39.9 10.9 6.4 39.0 10.7 6.2 8.5 39.5 37.0 36.0 Effective tax rate (%)* 38.5 38.6 38.8 *The U.S. statutory tax rate was 35%. The state tax varied yearly from 2.5% to 3.5%. Sources of data: Company filing with the Securities and Exchange Commission (SEC), UBS Warburg Page 4 UV0010 Exhibit 2 Nike, Inc.: Cost of Capital Discounted Cash Flow Analysis 38.0 38.0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Assumptions: Revenue growth (%) 7.0 6.5 6.5 6.5 6.0 6.0 6.0 6.0 6.0 6.0 COGS/sales (%) 60.0 60.0 59.5 59,5 59.0 39.0 58.5 58.5 58.0 58.0 SG&A/sales (%) 28.0 27.5 27.0 26,5 26.0 25.5 25.0 25.0 25.0 25.0 Tax rate(%) 38.0 38.0 38.0 38.0 38.0 38,0 38.0 38.0 38.0 Current assets/sales (%) 38.0 38.0 38,0 38.0 38.0 38.0 38.0 38.0 38.0 Current liabilities/sales (%) 11.5 11.5 11.5 11.5 11.5 11.5 11.5 11.5 11.3 11.5 Yearly depreciation and capex equal each other. Cost of capital (%) 12.00 Terminal growth rate (%) 3.00 Discounted Cash Flow (in millions of dollars except per-share data) Operating income $ 1,218.4 $ 1,351.6 $ 1,554.6 $ 1,717,0 $ 1,950.0 $2,135.9 $ 2,410.2 $ 2,554.8 $ 2,790.1 $ 2,957.5 Taxes 463.0 $13.6 590.8 652.5 741.0 811.7 915.9 970.8 1,060.2 1,123.9 NOPAT 755.4 838.0 963.9 1,064.5 1,209.0 1,324.3 1,494.3 1,584.0 1,729.9 1,833.7 Capex, net of depreciation Change in NWC 8.8 (174.9) (186.3) (198.4) (195.0) (206.7) (219.1) (232.3) (246.2) (261.0) Free cash flow 764.1 663.1 777.6 866.2 1,014.0 1,117.6 1,275.2 1,351.7 1,483.7 1,572.7 Terminal value 17,998.3 Total flows 764.1 663.1 777.6 866.2 1,014.0 1,117.6 1,275.2 1,351.7 1,483.7 19,571.0 Present value of flows $ 682.3 $ 528.6 $ 553.5 S SS0S $ 575.4 $ 566.2 $ 576.8 $ 545.9 $ 535.0 $ 6,301,2 Enterprise value $ 11,415.4 Less: current outstanding debt 1,296.6 Equity value $ 10,118.8 Current shares outstanding 271.5 Equity value per share s 37.27 Current share price: 42.09 Sensitivity of equity value to discount rate: Discount rate Equity value 8.00% $ 75.80 8.50% 67.85 9.00% 61.25 9.50% 10.00% $0.92 10.50% 46.81 11.00% 43.22 11.17% 42.09 11.50% 40.07 12.00% 37.27 55.68 Source: Case writer's analysis, Exhibit 3 Nike, Inc.: Cost of Capital Consolidated Balance Sheets As of May 31, 2000 2001 (in millions of dollars) Assets Current assets: Cash and equivalents Accounts receivable Inventories Deferred income taxes Prepaid expenses Total current assets $ 254.3 1,569.4 1,446.0 111.5 215.2 3,596.4 $ 304.0 1,621.4 1,424.1 113.3 162.5 3,625.3 1,583.4 410.9 266.2 $ 5,856.9 1,618.8 397.3 178.2 S 5,819.6 $ Property, plant and equipment, net Identifiable intangible assets and goodwill, net Deferred income taxes and other assets Total assets Liabilities and shareholders' equity Current liabilities: Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable Total current liabilities Long-term debt Deferred income taxes and other liabilities Redeemable preferred stock 50.1 924.2 543.8 621.9 $ 5.4 855.3 432.0 472.1 21.9 1,786.7 2,140.0 470.3 110.3 435.9 102.2 0.3 0.3 Shareholders' equity: Common stock, par Capital in excess of stated value Unearned stock compensation Accumulated other comprehensive income Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2.8 369.0 (11.7) (111.1) 2,887.0 3,136.0 $ 5,856.9 2.8 459.4 (9.9) (152.1) 3,194.3 3,494.5 S 5,819.6 Exhibit 4 Nike, Inc.: Cost of Capital Capital Market and Financial Information on or around July 5, 2001 Current Yields on U.S. Treasuries Nike Share Price Performance Relative to S&P 500: January 2000 to July 5, 2001 3.59% 1.3 3-month 6-month 1-year 5-year 10-year 20-year 3.59% 3.59% 4.88% 5.39% 5.74% 1.2 1.1 1.0 Historical Equity Risk Premiums (1926-1999) Geometric mean 5.90% Arithmetic mean 7.50% foran OS hran 0.7 0.6 05 0.4 Current Yield on Publicly Traded Nike Debt* Coupon 6.75% paid semi-annually Issued 07/15/96 Maturity 07/15/21 Current Price $ 95.60 Jan-00- Mar-00- 00-PY May.00 10. May 01 - Nike S&P 500 Nike share price on July 5, 2001: $42.09 Nike Historic Betas 1996 1997 1998 1999 2000 YTD 6/30/01 0.98 0.84 0.84 0.63 0.83 0.69 Dividend History and Forecasts Paymt Dates 31-Mar 30-Jun 1997 0.10 0.10 1998 0.12 0.12 1999 0.12 0.12 2000 0.12 0.12 2001 0.12 0.12 30-Sep 31-Dec 0.10 0.10 0.12 0.12 0.12 0.12 0.12 0.12 Total 0.40 0.48 0.48 0.48 Average 0.80 Consensus EPS estimates: FY 2002 FY 2003 $ 2.32 $ 2.67 * Data have been modified for teaching purposes. Value Line Forecast of Dividend Growth from '98-'00 to '04-06: 5.50% Individual Assignment-Nike Case Write-Up Mergers & Acquisitions Introduction (Objective of the Assignment) The Nike Case Study is intended to serve as an introduction to the calculation of the Weighted- Average Cost of Capital (WACC) of the firm. The case provides a WACC calculation that contains errors based on conceptual misunderstandings. Students will identify and explain the mistakes in the analysis. The case assumes that students have been exposed to the WACC, CAPM, the dividend discount model, and the earnings capitalization model. Assignment Requirements Complete the Nike Case Study reading (found in the Readings and Course Materials folder). Put yourself in the role of one of the stakeholders in the case and reflect on the information in the document. Make sure to address the following items: 1. What is the WACC and why is it important to estimate a firm's cost of capital? [2 to 3 sentences max.] 2. Calculate your own WACC for Nike. Note the following requirements: a. Calculate the cost of Debt based on the information provided in the case. [Fill in the highlighted Excel cells; explain your calculation briefly] b. When you are calculating the Cost of Equity, do it under three different scenarios: I. CAPM [Fill in Excel file] ii. Dividend Discount Model [Fill in Excel file] Earnings Capitalization method [Fill in Excel file] C. Summarize what the WACC would be in 3 different scenarios: using the Cost of Debt and three different Cost of Equity percentages. 3. Highlightote any differences versus Joanna Cohen's calculation. 4. Which of your three WACC calculations (based on the 3 different Costs of Equity) do you think makes the most sense and why? iii. You should have the following section in your final submission. They should look something like this: 1. What is your WACC and Why is it Important? Your answer... 2. WACC Calculations A Summary of your findings. You will submit the Excel file separately. 3. Differences vs. Joanna Cohen Your answer... 4. WACC Recommendation Your answer.... Solution Excel File -- Fill in Yellow Cells -- Submit this Excel file with your Write Up Cost of Debt (PRE tax)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started