Answered step by step

Verified Expert Solution

Question

1 Approved Answer

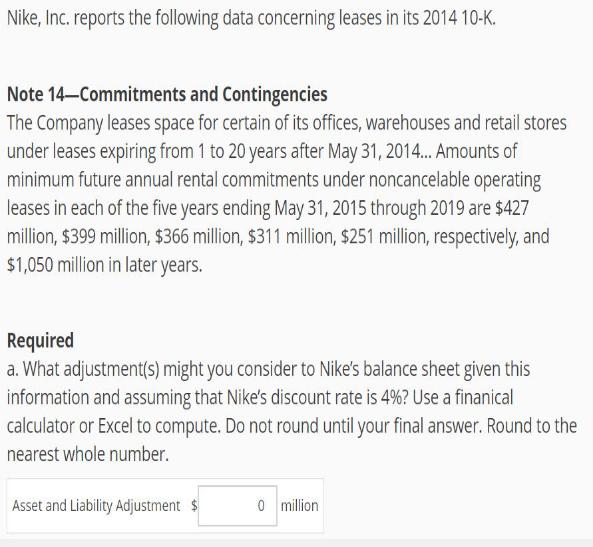

Nike, Inc. reports the following data concerning leases in its 2014 10-K. Note 14-Commitments and Contingencies The Company leases space for certain of its

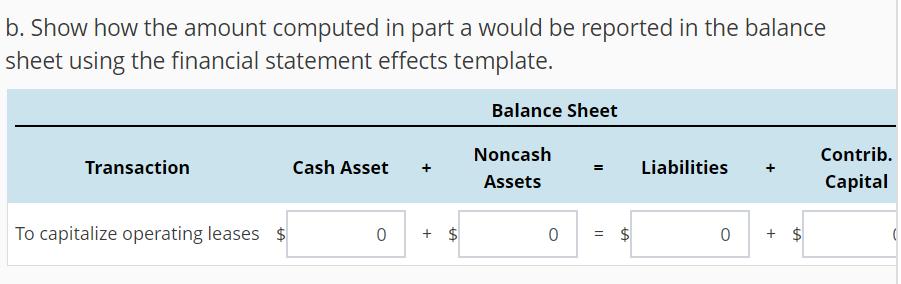

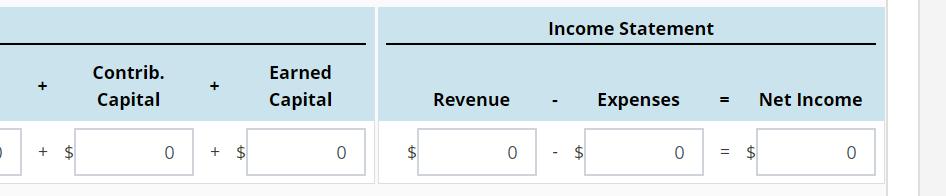

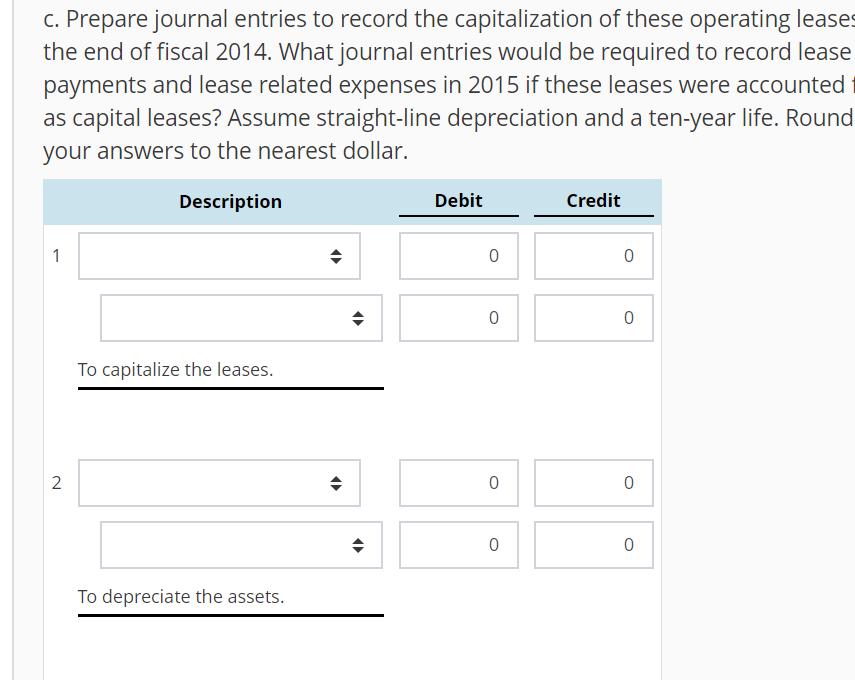

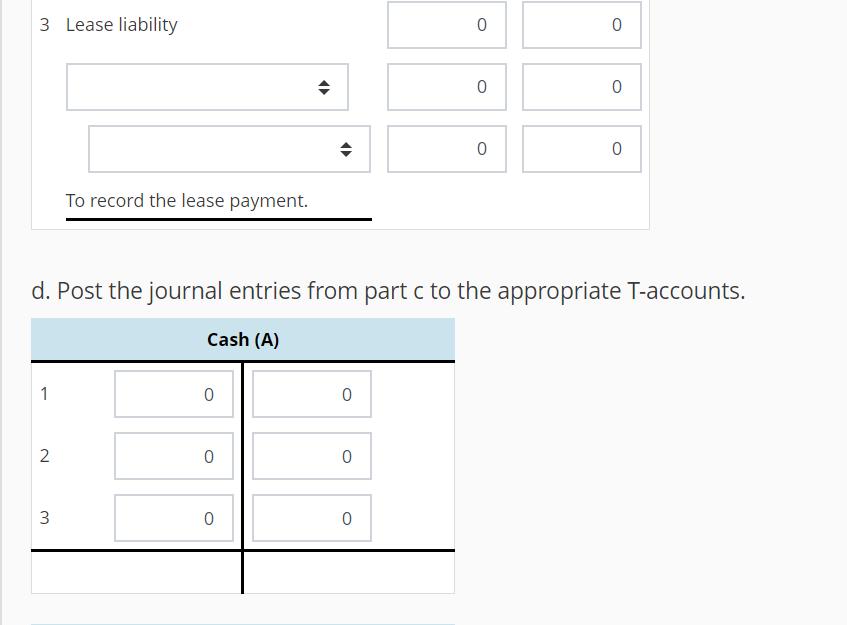

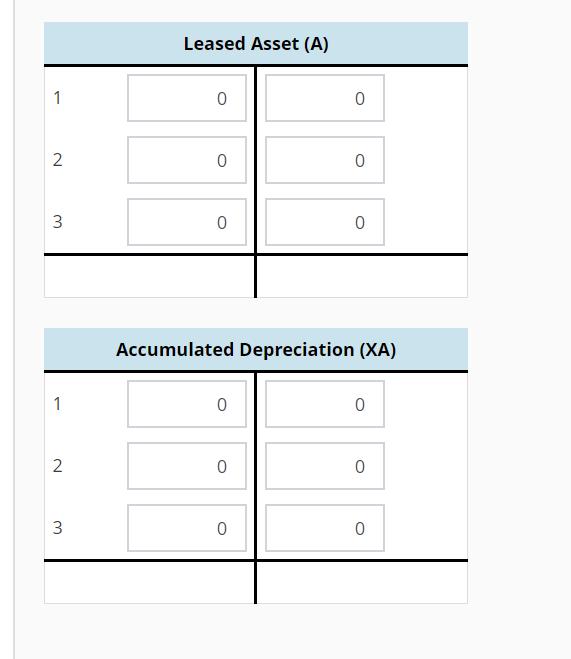

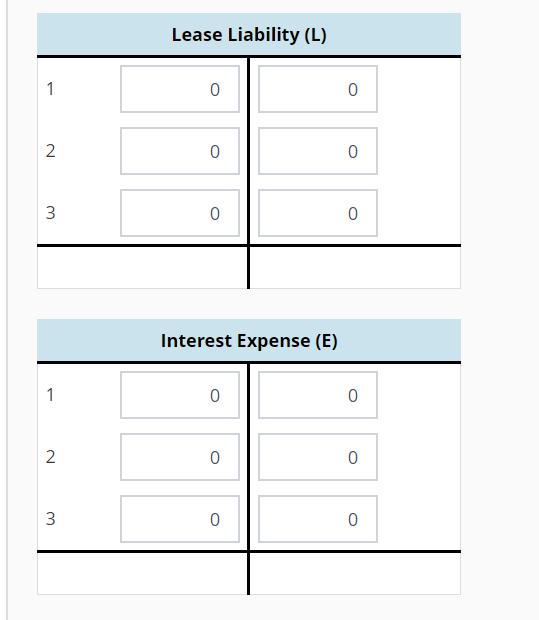

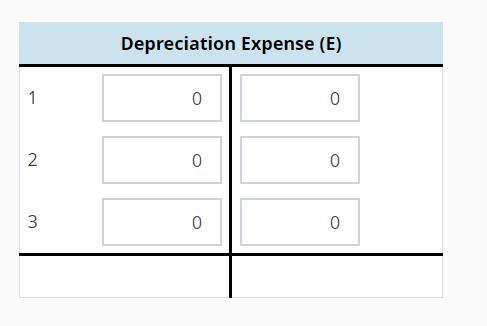

Nike, Inc. reports the following data concerning leases in its 2014 10-K. Note 14-Commitments and Contingencies The Company leases space for certain of its offices, warehouses and retail stores under leases expiring from 1 to 20 years after May 31, 2014... Amounts of minimum future annual rental commitments under noncancelable operating leases in each of the five years ending May 31, 2015 through 2019 are $427 million, $399 million, $366 million, $311 million, $251 million, respectively, and $1,050 million in later years. Required a. What adjustment(s) might you consider to Nike's balance sheet given this information and assuming that Nike's discount rate is 4%? Use a finanical calculator or Excel to compute. Do not round until your final answer. Round to the nearest whole number. Asset and Liability Adjustment $ 0 million b. Show how the amount computed in part a would be reported in the balance sheet using the financial statement effects template. Transaction To capitalize operating leases $ Cash Asset + 0 + $ Balance Sheet Noncash Assets 0 = = $ Liabilities 0 + + $ Contrib. Capital D + Contrib. Capital 0 + Earned Capital 0 Revenue 0 Income Statement Expenses 0 = Net Income = 0 c. Prepare journal entries to record the capitalization of these operating leases the end of fiscal 2014. What journal entries would be required to record lease payments and lease related expenses in 2015 if these leases were accounted as capital leases? Assume straight-line depreciation and a ten-year life. Round your answers to the nearest dollar. Description 1 2 To capitalize the leases. To depreciate the assets. 3 Lease liability 1 2 To record the lease payment. 3 0 0 < 0 + d. Post the journal entries from part c to the appropriate T-accounts. Cash (A) 0 0 O 0 0 0 0 0 0 1 2 3 1 2 3 Leased Asset (A) 0 0 0 0 0 0 Accumulated Depreciation (XA) 0 0 0 0 0 0 1 2 3 1 2 3 Lease Liability (L) 0 0 0 Interest Expense (E) 0 0 0 0 0 0 0 0 0 1 2 3 Depreciation Expense (E) 0 0 0 0 0 0

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

You might adjust Nikes balance sheet by recording an operating lease liability of 427 million a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started