Answered step by step

Verified Expert Solution

Question

1 Approved Answer

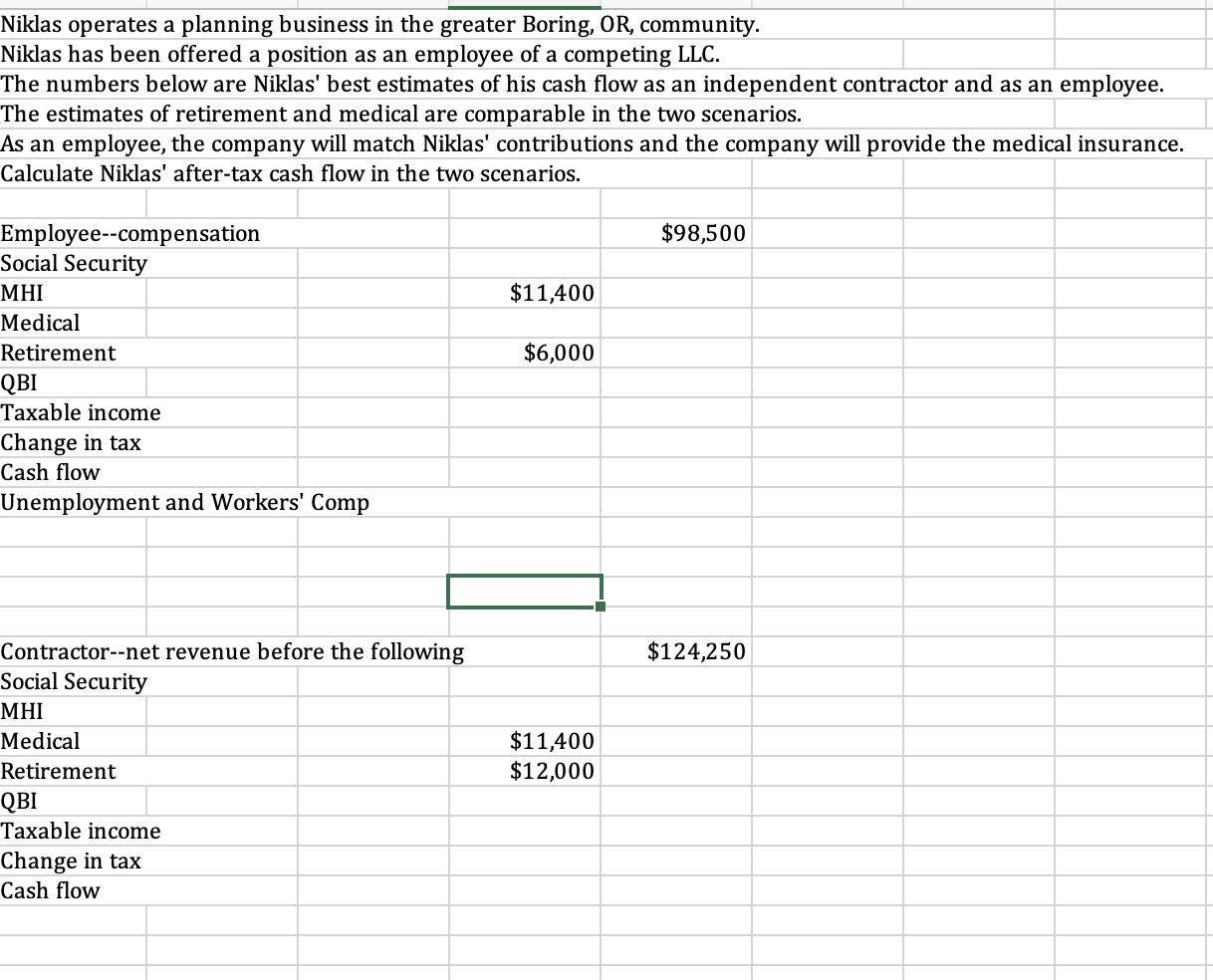

Niklas operates a planning business in the greater Boring, OR, community. Niklas has been offered a position as an employee of a competing LLC.

Niklas operates a planning business in the greater Boring, OR, community. Niklas has been offered a position as an employee of a competing LLC. The numbers below are Niklas' best estimates of his cash flow as an independent contractor and as an employee. The estimates of retirement and medical are comparable in the two scenarios. As an employee, the company will match Niklas' contributions and the company will provide the medical insurance. Calculate Niklas' after-tax cash flow in the two scenarios. Employee--compensation Social Security MHI Medical Retirement QBI Taxable income Change in tax Cash flow Unemployment and Workers' Comp Contractor--net revenue before the following Social Security MHI Medical Retirement QBI Taxable income Change in tax Cash flow $11,400 $6,000 $11,400 $12,000 $98,500 $124,250

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Employee Scenario Compensation 98500 Social Security 62 98500 62 6097 M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started